Total Value Locked in DeFi on Ethereum Crosses $100 Billion as ETH Address Profitability Clocks 100%

Ethereum (ETH) recently breached the psychological price of $4,000, bringing it a stone’s throw away from its all-time high (ATH) level of $4,350.

The second-largest cryptocurrency based on market capitalization has been experiencing an uptick in activities, given that it is in high demand from sectors like decentralized finance (DeFi) and non-fungible tokens (NFTs).

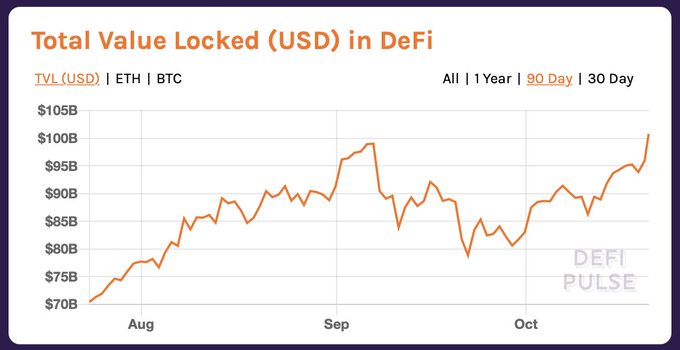

Reportedly, the total value locked (TVL) in DeFi on the Ethereum network breached the $100 billion mark as demand continues to soar.

DeFi is founded on blockchain-based smart contracts that fulfil certain financial functions based on the underlying code.

This sector took the world by storm in 2020 after its value grew by fourteen times. Its presence in the crypto space continues to be felt because it has become a billion-dollar industry based on growing demand.

According to a recent study by blockchain analytic firm Chainalysis, the United States had the highest DeFi adoption rate, followed by Vietnam, Thailand, China, and the United Kingdom.

Ethereum address profitability hits 100%

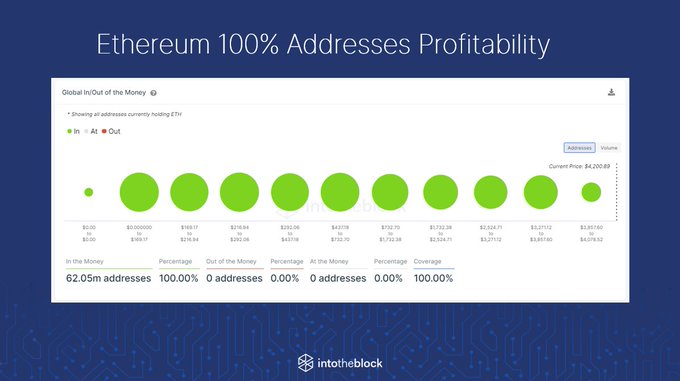

According to data analytic firm IntoTheBlock:

“For any address with a positive balance, IntoTheBlock identifies avg price at which tokens were acquired, indicating if the address is at profit or loss. Addresses at profit: BTC 99%, ETH 100%, ADA 75%, DOGE 68%, LTC 85%, LINK 71%, SHIB 76%, MATIC 70%, FTT 86%, and AXS 99%.”

“Billionaire” Ethereum addresses continue accumulating

Holding is a favoured strategy on the Ethereum network, and top addresses have been setting the ball rolling. On-chain metrics provider Santiment acknowledged:

“Ethereum's top addresses have accumulated ETH steadily since early August, and it's no surprise to see the number tw0 asset approaching an AllTimeHigh of its own. In the past 10 weeks, addresses with 1M to 10M ETH have accumulated 13.9% more to their bags.”

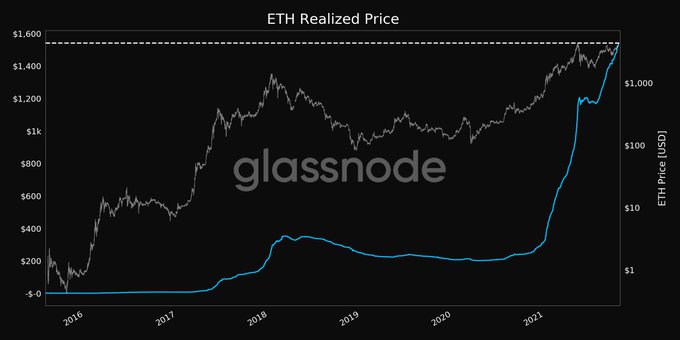

Meanwhile, the value stored in the Ethereum network is at a record-high, given that the realized price reached an ATH of $1,541.56.

Realized price is the capitalization of Ethereum based on the last time a coin moved.

Image source: Shutterstock