Bitcoin Funding Flips Negative as BTC Records 10% Daily Loss as Over-Leverage Factor Dominates

Days after Bitcoin (BTC) breached the psychological price of $50K and scaled to the $52,000 level. The leading cryptocurrency experienced a significant pullback that prompted a $10K loss.

BTC was down by 10.83% in the last 24 hours to hit $45,834 during intraday trading, according to CoinMarketCap.

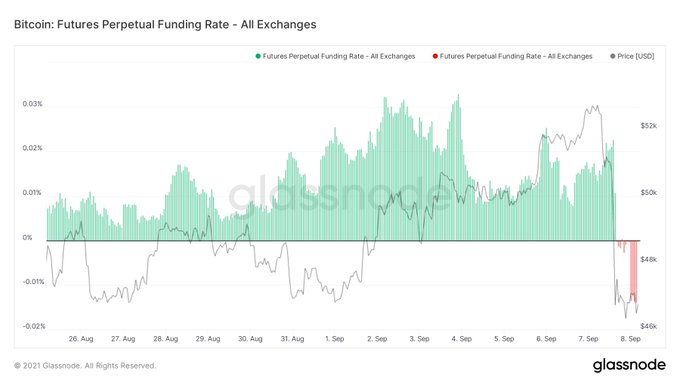

As a result, the Bitcoin futures perpetual funding rate turned negative. On-chain data provider Dilution-proof explained:

“Funding flipped negative, illustrating that there is currently a tendency to short Bitcoin. Now that over-leveraged longs have been flushed out of the market, could this be fertile ground for a nice little recovery bounce? Or is this perhaps a bit too soon?”

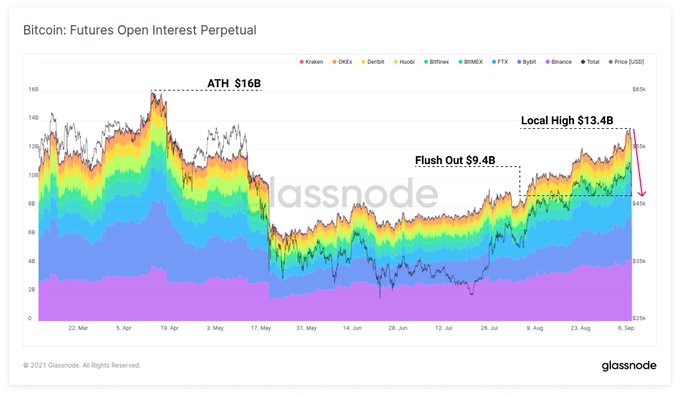

The funding rate turning negative was witnessed just hours after BTC perpetual swaps open interest recorded the highest point since mid-April after topping $16 billion.

Crypto analytic firm Glassnode acknowledged:

“Over $4 Billion in Bitcoin open interest has been cleared during this sell-off. This is the most significant leverage flush out since the sell-off in mid-May.”

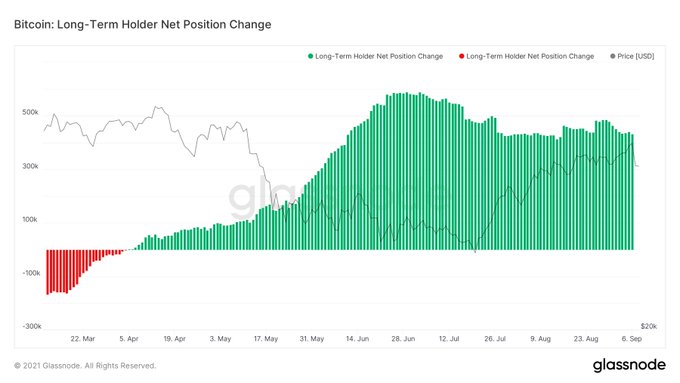

Long-term holders are showing a strong grip on their investment

According to the Bitcoin long-term holder net position change indicator, these investors still have a strong grip on their investments despite the latest drop in the market.

Dilution-proof added:

“While overexposed futures traders were liquidated, more risk-averse hodlers bought the dip, resulting in a decline in exchange balances of -4.6k BTC to a >3y low.”

The plunge in the BTC market occurred just after the leading cryptocurrency officially became a legal tender in El Salvador. Moreover, the nation’s president Nayib Bukele confirmed to purchase 150 Bitcoin amid the crypto market crash.

Meanwhile, McDonald’s, a major US fast-food company, started accepting Bitcoin as a payment option in El Salvador on the Lightning Network powered by OpenNode.

Image source: Shutterstock