Bitcoin’s Hashrate Rebounding after Engaging a 50% Drop

The hashrate of Bitcoin seems to be on an upward trajectory after nosediving by 50% amid intensified crackdowns on crypto mining by Chinese authorities recently.

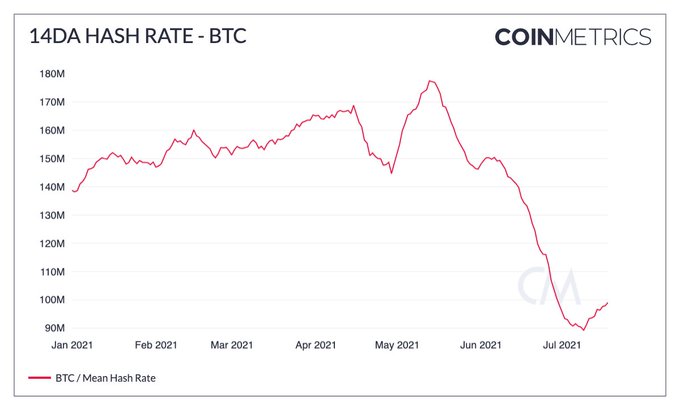

Crypto data provider CoinMetrics explained:

“China’s sudden crackdown on mining in Q2 2021 left miners with no choice but to shut down operations and move elsewhere. Bitcoin’s hash rate fell by ~50% as a result, but appears to be rebounding (2-wk ma).”

The function of hashrate mainly measures the processing power of the BTC network. It allows computers to process and solve problems that would enable transactions to be approved and confirmed across the network.

Chinese authorities' unfriendly stand against Bitcoin mining

BTC mining continues to be rejected and unwelcome on Chinese soil. For example, Anhui, an eastern Chinese province, became the latest region to shut down all crypto mining activities mid this month, citing an acute power shortage.

In June, Chinese authorities disconnected BTC mining sites in Sichuan. As a result, more than 90% of China’s crypto mining capacity was hampered.

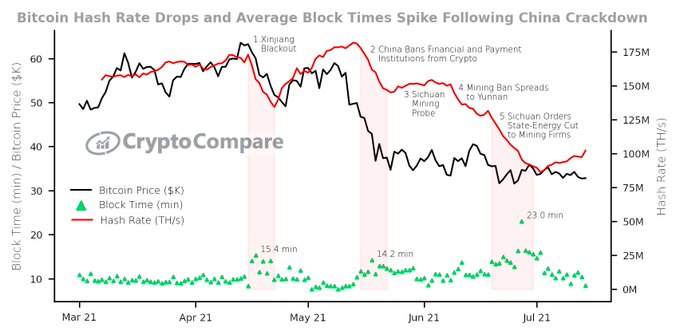

On-chain metrics provider Cryptocompare acknowledged:

“How much impact did China’s BTC mining crackdown really have on hash rate and block times? The short answer - A lot! Hash rate fell 45% from an avg of 163.93TH/s to 89.52TH/s in July. Bitcoin block times also passed the 20 min mark for the first time - peaking at 23 mins!”

Bitcoin’s hashrate seems to rebound as Bitcoin mining is shifting from the East to the West, while the U.S. is emerging as the biggest beneficiary.

For instance, the US share of hashrate skyrocketed to 16.8% from just over 4%. On the other hand, Kazakhstan, Russia, and Iran are also getting a share of the Bitcoin mining cake.

BTC is moving to strong hands, given that its supply shock is standing at levels around the $50-$60K range. The leading cryptocurrency remains to be observed whether a rebound in the hashrate continues a positive trend.

Image source: Shutterstock