Bitcoin Needs Momentum to Hit $43,000 For Recapturing the 200-Day Moving Average

Bitcoin (BTC) regained momentum, pushing its price above the psychological price of $40k. The leading cryptocurrency was trading at $40,200 during intraday trading, according to CoinMarketCap.

Market analyst Lark Davis noted that BTC needs to push to the $43,000 level to regain the 200-day moving average (MA) level. He explained:

“This is the line to beat for Bitcoin right now! We must retake the 200 day MA, which means we need a daily close above the blue line, around $43,000.”

BTC suffered from a sharp correction on May 19 as the price fell to around $30,000, resulting in the biggest single-day drop of the price up to 30%. Furthermore, this price drop indicated the first time that BTC had dropped below the 200-day moving average (MA).

The 200-day MA is a key technical indicator used to determine the general market trend. It is a line that shows the average closing price for the last 200 days or roughly 40 weeks of trading. Therefore, a surge above it represents the start of an uptrend.

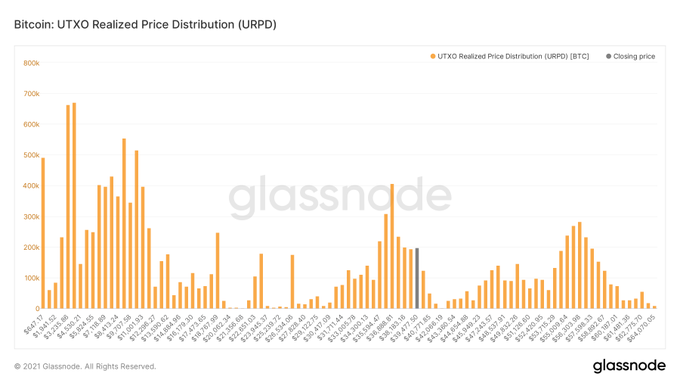

On-chain analyst William Clemente III believes that if Bitcoin breaks the level above $41k, it will lead to an upward push to $47k based on on-chain volume.

Funding rates on perpetual BTC futures turn positive

According to crypto data provider Dilution-proof:

“Funding rates on perpetual Bitcoin futures flipped positive after the latest price bump across $39k.”

This turn of events was triggered after Bitcoin hit a 3-week high of $40.8k as a healthy flow of funds were being moved from crypto exchanges.

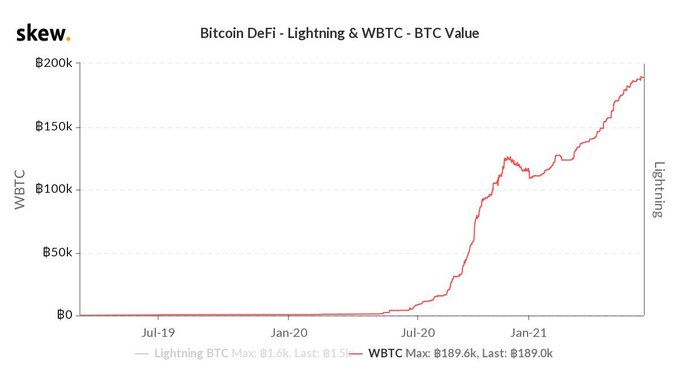

Research firm Bloqport noted that more than 1% of all Bitcoin in circulation is wrapped on Ethereum.

It, therefore, remains to be observed whether BTC will reclaim and surge above the 200-day MA level.

Meanwhile, a leading American business intelligence firm, MicroStrategy, announced plans to sell $1 billion in stock to add more Bitcoins to its 92,079 BTC portfolio.

Image source: Shutterstock