Bitcoin Supply is Moving to Strong Hands amid BTC On-Chain Analysis Going Mainstream

Ever since Bitcoin (BTC) hit an all-time high (ATH) price of $69,000 earlier this month, the leading cryptocurrency has retraced, even falling below the psychological price of $60K. Bitcoin was hovering around $57,636 during intraday trading, according to CoinMarketCap.

Nevertheless, this correction has not dampened the spirits of strong hands, investors who hold for future purposes, because they are accumulating more coins. Market analyst Will Clemente confirmed:

“Over the last two weeks, clear bullish divergence between BTC supply moving to strong hands and price.”

Bitcoin whales have also been on a buying spree based on the opportunity presented by the price grind down. On-chain insight provider Santiment noted:

“If you've been waiting for Bitcoin whales to show signs of accumulation, our data indicates it's happening once again. In the past week, a total 59K BTC has been added to addresses that hold between 100 to 10K BTC. This is 0.29% of the total supply.”

Crypto analyst Ali Martinez echoed these sentiments and said:

“Whales are buying your Bitcoin. Roughly 30,000 BTC have left exchanges since the correction began on Nov. 8. That's $1,710,000,000 worth of BTC.”

The demand for Bitcoin on-chain analysis is increasing

Bitcoin on-chain analytics was recently featured on CNBC, showing the growing demand for deeper crypto research.

The on-chain analysis takes a different approach because it incorporates metrics created using cutting edge technologies like machine learning (ML) and artificial intelligence (AI) to get a clear picture of what is happening in the market.

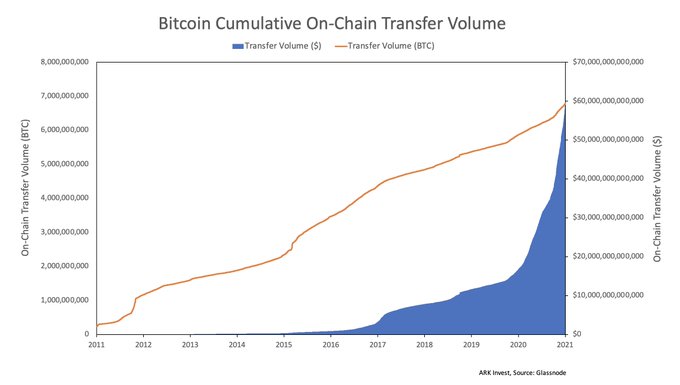

For instance, based on the Bitcoin cumulative on-chain transfer volume, approximately 6.9 billion BTC have been moved on-chain. Yassine Elmandjra, a crypto analyst at ARK Invest, stated:

“Since inception, 6.9 billion BTC have been transferred on-chain, settling ~$60 trillion dollars of cumulative value at the price of each transfer and ~$400 trillion of cumulative value at today’s prices.”

Nevertheless, it remains to be seen how Bitcoin ends the year because $100,000 is forecasted as the largest strike price for Bitcoin options in 2021.

Image source: Shutterstock