Ethereum’s Speculative Action Goes through the Roof as the Merge Edges Closer

Since the merge of Ethereum (ETH) has been awaited with bated breath by the crypto community, the network’s speculative action has skyrocketed.

Market insight provider Glassnode explained:

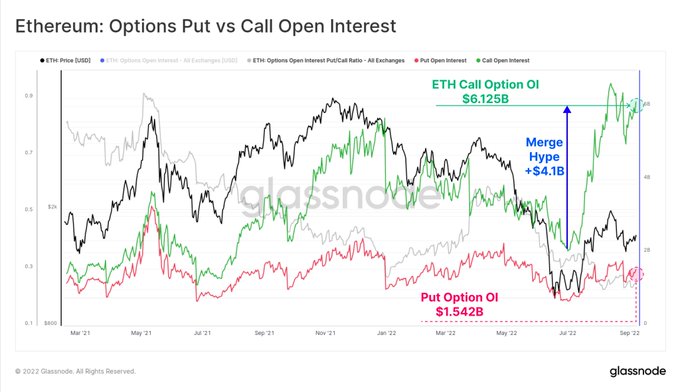

“Ethereum speculative action continues, with over $6.12B in outstanding Open Interest for Call Options. Put options account for a much smaller $1.5B, making for a Put/Call Ratio of 0.25.”

Source: Glassnode

Call options entail buying, whereas put options signify selling. Therefore, based on open interest being depicted in the ETH network, buying pressure outways selling, thanks to the much-anticipated merge event slated for September 15.

Despite the merge being elusive for a couple of years, it is anticipated to be the largest software upgrade in the Ethereum ecosystem because it will change the consensus mechanism from proof-of-work (PoW) to proof-of-stake (PoS).

Therefore, various experts and institutions believe this event will heighten Ethereum’s quest to be a deflationary asset.

For instance, American multinational investment bank Citigroup or Citi recently pointed out that the merge would slash the overall Ether issuance by 4.2% annually, making it deflationary, Blockchain.News reported.

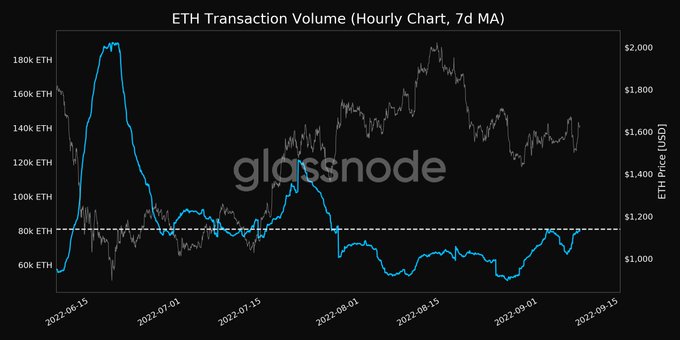

Therefore, the merge seems to have made Ethereum be watched with a keen eye, given that transaction volume hit a monthly high. Glassnode stated:

“Ethereum Transaction Volume (7d MA) just reached a 1-month high of 80,910.738 ETH. Previous 1-month high of 80,814.148 ETH was observed on 02 September 2022.”

Source: Glassnode

Furthermore, Ethereum address activity has been scaling heights, with the number of addresses holding more than 100 ETH, recording an 18-month high.

Source: Glassnode

ETH was up by 6.7% in the last 24 hours to hit $1,622 during intraday trading, according to CoinMarketCap.

With the Bellatrix upgrade having already set the ball rolling for the merge, it remains to be seen how the second-largest cryptocurrency plays out after this event.

Image source: Shutterstock

Hiccups Surface as Bellatrix Upgrade Sets Stage for Ethereum Merge