Ethereum’s Top 10 Non-Exchange Whale Addresses Surge, NFT's Google Search Volume Up Exponentially

Ethereum (ETH) was down by 1.7% in the last 24 hours to hit $3,459 during intraday trading, according to CoinMarketCap. Nevertheless, Ethereum non-exchange whales have been accumulating more coins, which signifies a holding culture.

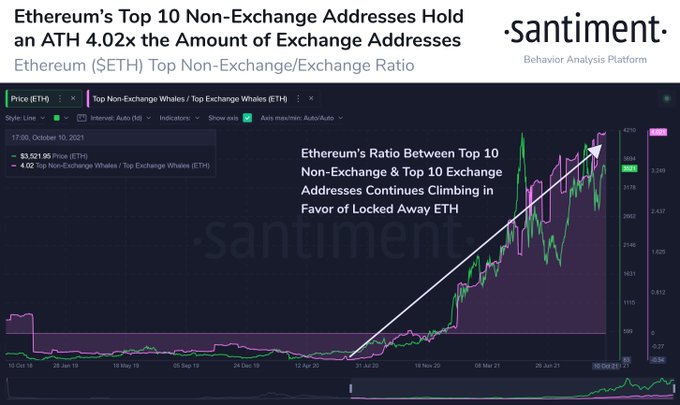

On-chain metrics provider Santiment explained:

“Ethereum's top 10 non-exchange whale addresses keep climbing, while the top 10 exchange addresses are falling. The ratio between the two has shown evidence of being tied closely to price, and this rise in ratio continues to be a good sign for bulls.”

Therefore, it shows more Ethereum is being transferred from crypto exchanges to cold storage and digital wallets.

Meanwhile, the ETH network has experienced an uptick in activities based on its diverse usage. For instance, Ethereum usage was recently fifty-four times that of Bitcoin.

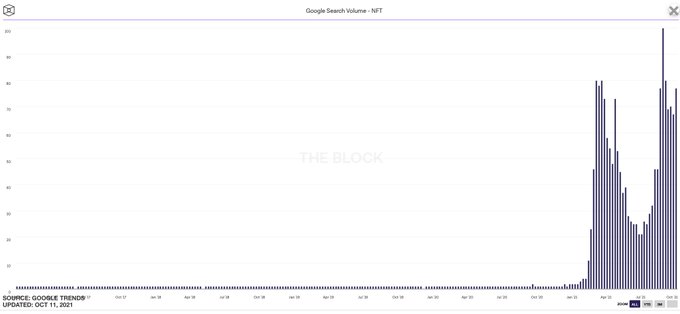

NFT in Google search skyrockets

According to crypto analytic firm Documenting Ethereum, the volume search on Google for NFTs has been on an uptrend.

Ethereum has emerged as the growth engine behind the non-fungible token (NFT) sector. This sector recently topped $10 billion in secondary sales, with ETH taking the lion’s share with more than $6 billion.

The NFT sector has experienced an uptick in activities, given that the tokens offered are different from the typical ones because of fungibility.

NFTs are blockchain-based ownership digital assets, and their value is pegged on their uniqueness, given that the tokens are non-divisible and have to be bought in their entirety.

As a result, these traits create intrinsic value for NFTs because of their limited supply.

On the other hand, the total value locked in decentralized finance (DeFi) recently jumped to $208 billion. Ethereum led the pack with a value of 141.92 billion, representing 68.2%.

DeFi is founded on blockchain-based smart contracts that fulfil certain financial functions based on the underlying code.

Image source: Shutterstock