Ethereum Whales Continue Buying from Weak Hands, Ramping up their Position by 200,000 ETH

In the past few days, Ethereum (ETH) whales have been on a buying spree as their accumulation continues.

Market insight provider Santiment confirmed:

“Whale addresses holding 10K or more ETH have added 200K ETH from weak hands since January 20, worth ~$497.2M.”

This huge accumulation has not been seen in the last two months, suggesting that whales are back to their buying game.

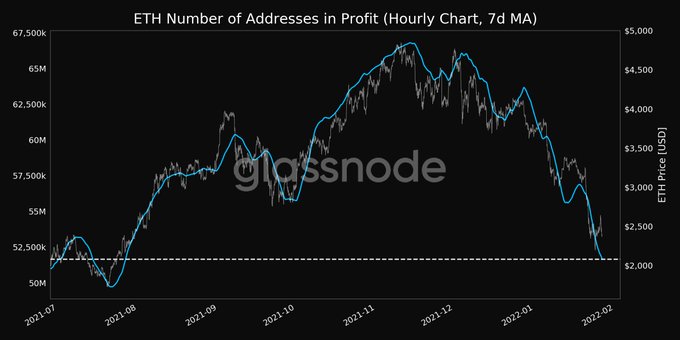

The crypto market has been dented by massive liquidations, which made Ethereum hit a 6-month low. As a result, the number of ETH addresses in profit reached a 5-month low, alluded to by crypto analytic firm Glassnode.

Source: Glassnode

Nevertheless, developments like huge whale accumulation offer bullish sentiments. Ethereum was down by 2.32% in the last 24 hours to hit $2,435 during intraday trading, according to CoinMarketCap.

The second-largest cryptocurrency faces notable resistance at the $2,500 level, which it has to overcome for a rebound, according to crypto analyst Ali Martinez.

On the other hand, significant support lies at the $2,200 zone because approximately 360,000 addresses hold 9.6 million ETH.

Options trader John Wick believes that Ethereum was consolidating a bottoming pattern attempting to break out. He stated:

“Ethereum showing the same bottoming pattern trying to break out of the resistance zone. Needs to see more upside from Bitcoin to breakout.”

Source: TradingView

Market analysts aired similar sentiments under the pseudonym TheCryptoCactus that Ethereum’s journey towards $3,000 would be reached if resistance at the $2,850 level would be flipped to support.

“If you longed the bottom, it’s easy to hedge here. Need to get a valid S/R flip of $2850. Personally, would rather wait till we flip $3000 into support again and then just ape a huge position,” TheCryptoCactus pointed out.

Image source: Shutterstock