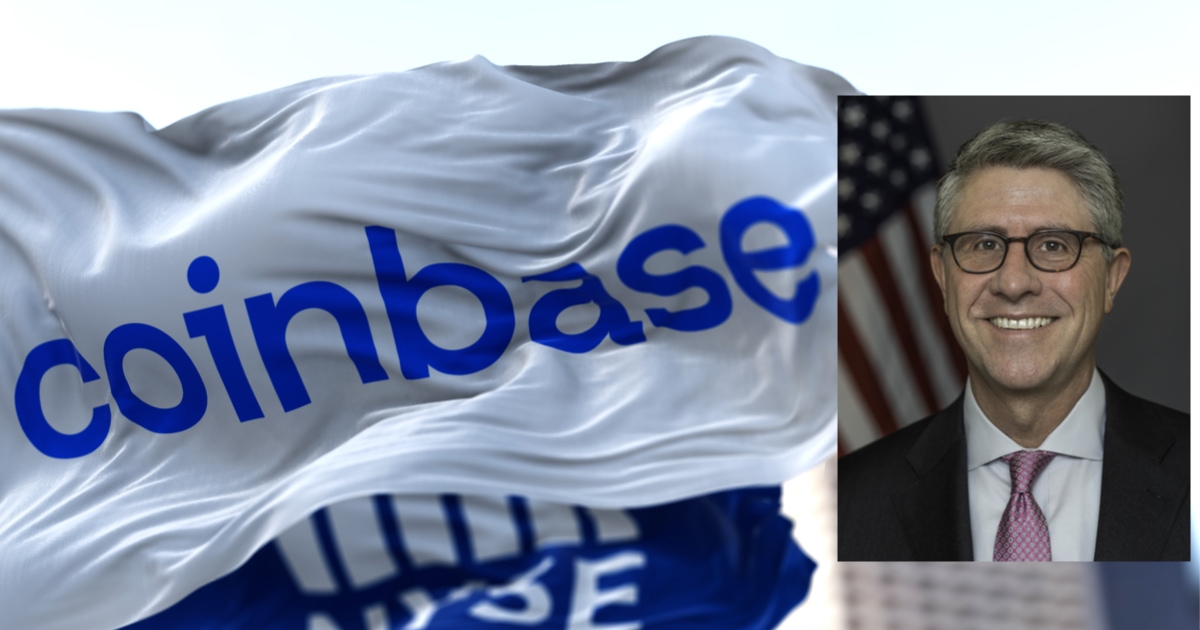

US SEC Former Director Brett Redfearn Leaves Coinbase after Four Months on Leadership Role

Brett Redfearn, the Head of Capital Markets at Coinbase Global, has resigned from his duties just four months after taking the job. Redfearn, one of Coinbase’s highest-profile hires this year, stepped down from the position at the end of July.

A Coinbase spokesperson confirmed the report and said: "We appreciate his contributions and wish him the best in his future endeavours."

Redfearn, the former executive of the US Securities and Exchange Commission, left Coinbase after the cryptocurrency exchange decided to shift its priority away from digital assets securities, people familiar with the sources said.

During his term in Coinbase, Redfearn was responsible for the cryptocurrency exchange’s strategy for crypto capital markets, including digital assets securities.

Persons familiar with the knowledge said Coinbase has deprioritised the digital-asset securities area as the exchange prioritises the DeFi market. Persons familiar with sources stated that Coinbase’s priority shift reflects the rising consumer demand for access to DeFi (decentralised finance).

Digital assets securities are crypto tokens included in the legal definitions of securities under US law, like traditional stocks and bonds, unlike Bitcoin, which regulators consider commodities.

Coinbase hired Redfearn on March 30, weeks before the firm went public in a hotly concluded debut on the Nasdaq Stock Exchange.

Redfearn spent three years at the US Securities and Exchange Commission (SEC) between 2017 and 2020, leading the agency's trading division and markets. Before joining the SEC, Redfearn held senior trading positions at JPMorgan and Bear Stearns.

DeFi Access as Coinbase Priorities

In late June, Coinbase CEO Brian Armstrong stated that decentralised finance (DeFi) is the future of the crypto industry. Armstrong explained how his crypto exchange would serve the growing demand for DeFi services and products during that time.

The Coinbase CEO stated that the firm has been seeing cryptocurrency maturing quickly, including trading thousands of new assets and adopting new use cases like DeFi and NFTs (non-fungible tokens).

Armstrong acknowledged that Coinbase has helped people access Bitcoin for the first time and admitted that the company needs to do the same for the decentralised crypto-economy.

The Coinbase CEO promised that the exchange will offer more products, including decentralised crypto products, to new international markets while still working with regulators in more established markets.

Image source: Shutterstock

Coinbase Supports Apple Pay to Purchase Cryptos and to Integrate with Google Pay