Bitcoin Eyes $60,000 Based On the Formation of an Inverse Head & Shoulder Pattern

In the last 24 hours, Bitcoin (BTC) retested the $60k level after it recently set an all-time high of $61.7K. Nevertheless, the leading cryptocurrency has retraced to $58,357 at the time of writing, according to CoinMarketCap.

Crypto analyst Carl Martin tweeting under the pseudonym The Moon has revealed that all is not lost because Bitcoin has set its eyes on the $60k price level. He explained:

“Bitcoin inverse head & shoulders on the 15 min time frame. Target is $60,300!”

BTC continues to be the talk of the town based on the milestones it is continuously making. Veteran market analyst and trader Peter Brandt recently disclosed that the current bull run is extraordinarily compared to the 2015-2017 bull cycle. For instance, it has pushed Bitcoin’s market value above the $1 trillion mark.

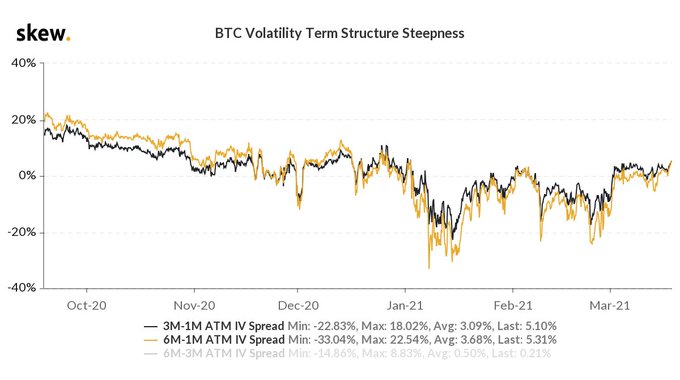

Bitcoin options term structure is normalizing

According to data analytics firm Skew, BTC options term structure has started to normalize.

Term structure is a way for investors to view the implied volatility of options. It shows how the maturity date of an option will change the implied volatility over time. With the term structure normalizing, BTC options will take sometime before materializing.

The banking fraternity is continuously keeping a keen eye on BTC. For instance, American banking giant Morgan Stanley recently made history as the first US bank to offer its clients access to Bitcoin fund investments.

The investment banking giant succumbed to its clients’ request to provide the service, and the provision will let eligible clients have access to three BTC funds.

German multinational investment bank and financial services company Deutsche Bank has also delved into the Bitcoin issue and acknowledged that it is too important to ignore based on its more than $1 trillion market capitalization.

The bank added that big players who buy and sell Bitcoin have considerable market-moving power, and as long as asset managers and companies continue to enter the market, BTC price could continue to rise.

Image source: Shutterstock