Bitcoin Institutional Inflows Are Rising as Grayscale Bitcoin Portfolio Now Estimated to be Worth $23.69 Billion

Bitcoin (BTC) continues being the talk of the town after it set a new high of $41,500, but it has since tumbled to around the $35K level based on a looming correction. Nevertheless, Bitcoin has traded at highs of 38K this week, but despite its ongoing volatility, BTC has managed to retain a level above the 30K for some time, and this seems may prove to be a crucial support level.

The overwhelming appetite for BTC by institutional investors seems to be increasing because the leading cryptocurrency is continuously stamping its authority as an inflationary hedge.

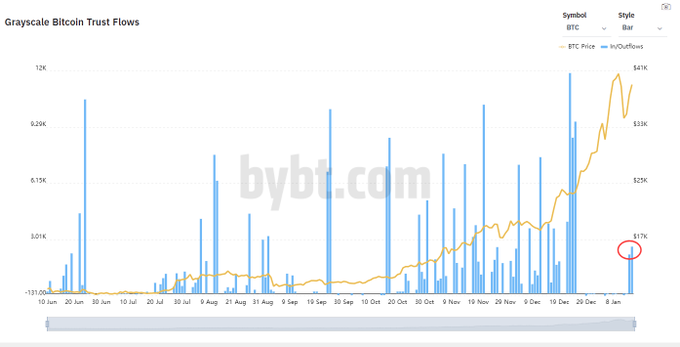

Bybt cryptocurrency trading platform has disclosed that Bitcoin institutional inflows are not showing any signs of slowing. The aggregated derivative exchange noted:

“Bitcoin (BTC) institutional inflows show no signs of slowing down; there may be a new round of buying. Grayscale Bitcoin Trust Clocks $23.69 Bln.”

Grayscale, a digital asset management firm, has been setting the ball rolling as one of the leading corporate giants heavily invested in Bitcoin based on its $23.69 billion BTC portfolio. Michael Saylor, the MicroStrategy CEO, has disclosed that Bitcoin is emerging as a new and compelling institutional-grade safe-haven asset. Therefore, it is appealing to the eyes of institutions as an ideal inflationary hedge.

MicroStrategy, a leading business intelligence firm, has also been on a spending spree because towards the end of 2020, it added more BTC to its portfolio. This time, a total amount of Bitcoin worth $650 million was added to its treasury reserve.

Institutional investors are protecting the $30,000 level

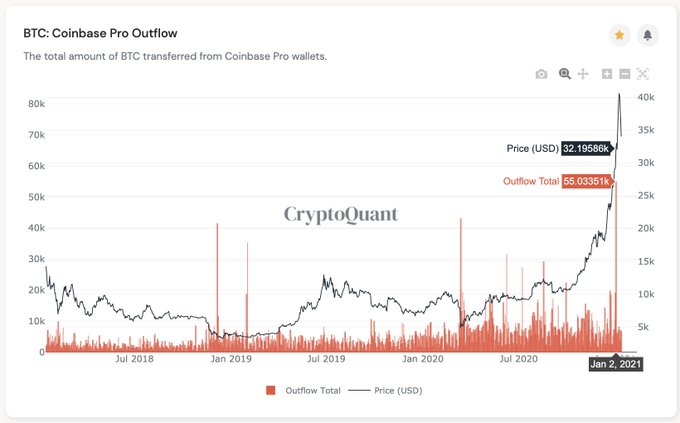

Ki Young Ju, the CEO of on-chain data provider CryptoQuant.com, noted that many institutional investors bought Bitcoin at the $30-32k level, so they felt obligated to put up a shield. He explained:

“There are many institutional investors who bought BTC at the 30-32k level. The Coinbase outflow on Jan 2nd was a three-year high. Speculative guess, but if these guys are behind this bull-run, they'll protect the 30k level. Even if we have a dip, it wouldn't go down below 28k.”

Institutional investors have been touted as game-changers in the current Bitcoin bull run and as the fear of missing out (FOMO) continues to cripple many investors. Time will tell what is in store for BTC moving forward.

Image source: Shutterstock