Crypto Interest in Asia is Brewing, Showing Long-Term Optimism in the Market

As the global crypto market capitalization inches closer to the $2 trillion mark, cryptocurrencies are no longer ignored in the financial sector as digital assets are rising in popularity.

The value of the crypto market currently stands at $1.76 trillion, according to CoinMarketCap.

Crypto analyst and investor Joseph Young has disclosed that Asia is showing considerable interest in the crypto market. He explained:

"The interest in crypto in Asia is just brewing. South Korea's biggest search engine and internet conglomerate, Naver, invested in Hashed’s $120 million venture round in December 2020. Massively optimistic in the market long-term.”

The Asian continent continues to stamp its authority in the crypto space, as evidenced by the Bank of Japan governor’s remarks that the nation should prepare “thoroughly” for the issuance of its central bank digital currency (CBDC).

Bitcoin’s open interest across major exchanges recently hit a record high of close to $20 billion as more participants join its network. This trend made Pierre Rochard, a market analyst, point out that most people might be inclined towards holding Bitcoin compared to investing in stocks, bonds, or real estate in the future. If this sees the light of day, time will tell whether Asians will make the bulk of them.

Bitcoin’s last level of resistance stands between $58-59.3k before new highs

According to IntoTheBlock, Bitcoin has to surge past the last level of resistance between $58,879 and $59,241 before the skies clear for new highs. The crypto data firm acknowledged:

“Bitcoin smashes through the $55,000 resistance and heads back up to $58,000. The IOMAP indicator reveals that the last level of resistance is between $58,879 and $59,241, where 220k addresses previously bought 73.95k BTC. After that, clear skies towards new highs.”

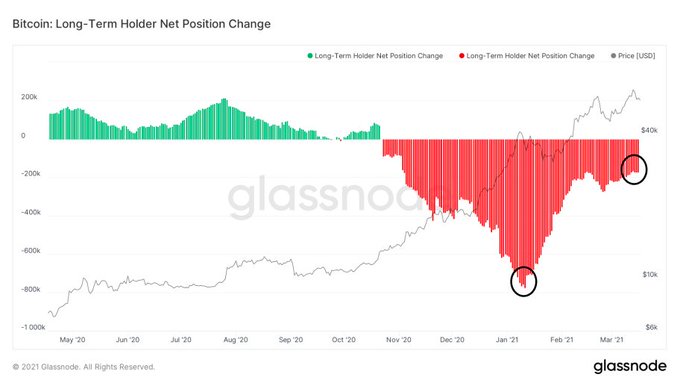

Jan & Yann, the co-founders of leading on-chain data provider Glassnode, have also disclosed that the impact of long-term BTC holders who are taking profits is less evident now than during January’s peak.

As more participants continue joining the crypto bandwagon, Asia looks set not to miss out.

Image source: Shutterstock