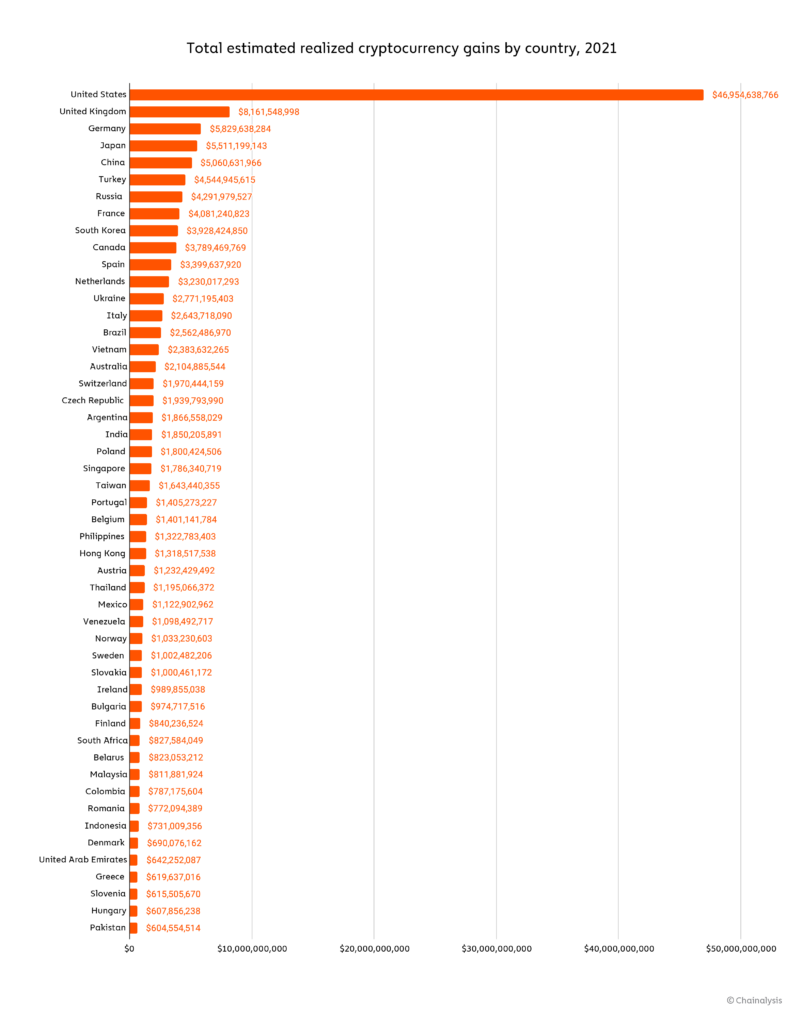

Crypto Investors’ Realized Gains Increased by 400% to Hit $162.7m in 2021, Study Shows

With 2021 emerging as a strong year for cryptocurrencies, global investors made $162.7 million in realized gains, according to blockchain analytic firm Chainalysis.

The result represented a 400.6% surge from $32.5 billion recorded in 2020, with Americans making the most gains. Per the report:

“The United States leads by a wide margin at an estimated $47.0 billion in realized cryptocurrency gains, followed by the UK, Germany, Japan, and China.”

Source: Chainalysis

The United Kingdom came a distant second with $8 billion. Pakistan capped the top 50 countries in realized crypto gains with $604 million.

Realized gains entail profits accrued after selling a financial instrument like a commodity, share, or cryptocurrency.

Therefore, realized gains in the United States skyrocketed by 476%, from $8.1 billion recorded in 2020 to $47 billion in 2021.

China recorded a lower growth rate at 194% based on intensified crackdowns on crypto activities. Per the study:

“In 2021, China’s total estimated realized cryptocurrency gains were $5.1 billion, up from $1.7 billion in 2020, for a year-over-year growth rate of 194% … the UK saw a 431% increase, while Germany’s gains grew by 423%.”

Ethereum elbowed Bitcoin in 2021

According to Chainalysis:

“Ethereum edged out Bitcoin in total realized gains globally at $76.3 billion to $74.7 billion. We believe this reflects increased demand for Ethereum as the result of DeFi’s rise in 2021.”

Ethereum has been one of the sought after blockchains in the decentralized finance (DeFi) sector because it offers smart contracts needed to eliminate intermediaries present in conventional financial processes.

Therefore, 2021 was a significant year for Ethereum because it generated revenue worth $9.9 billion, Blockchain.News reported.

Furthermore, both Bitcoin and Ethereum attained all-time high (ATH) prices in November 2021. Bitcoin scaled the heights to hit $69,000, whereas Ethereum reached historic highs of $4,850.

Image source: Shutterstock