Ethereum Median Fees Slip to 6-Month Low, Will this Reignite Rebound?

Over the weekend, the crypto market was in the red, with Ethereum (ETH) dropping below the psychological price of $3,000.

The second-largest cryptocurrency based on market capitalization was down by 2.14% in the last 24 hours to hit $2,866 during intraday trading, according to CoinMarketCap.

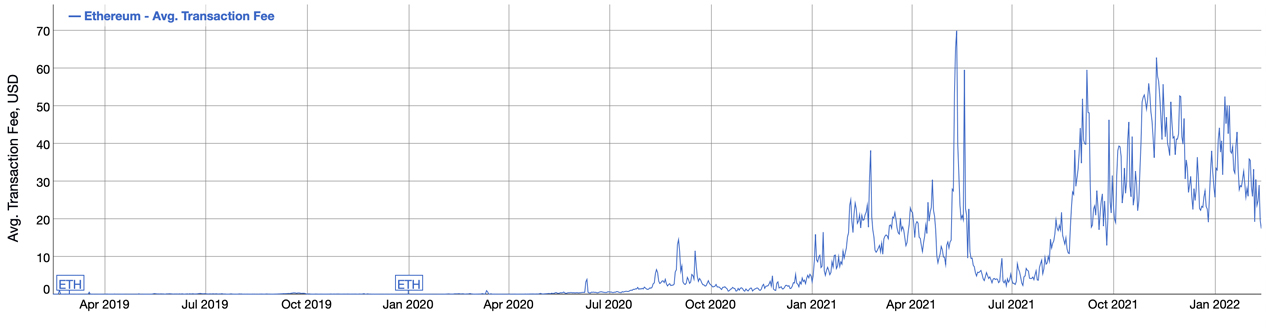

As a result, ETH’s median fees dropped to lows not seen since July 2021. Market insight provider Santiment explained:

“With Ethereum dropping back below $3,000, the demand to make $ETH transactions has stayed relatively low. And with this, transaction fees are now officially at their lowest level since July 28, 2021. Low fees typically maximize the chances of a bounce.”

Source:Santiment

Furthermore, the average gas fee on the Ethereum network slipped to $15.13 or 0.0052 ETH per transfer, a scenario not seen since September 2021, according to crypto insight provider Bitinfocharts.

Source:Bitinfocharts

A drop in gas fees is bullish because it can attract more participants to the ETH ecosystem, thus reigniting demand, and this boils down to a price increase based on market forces.

The fee issue is fundamental in aiding the sustainability of the Ethereum network, given that users have developed a keen eye as to where to get value for money in the crypto space.

For instance, “Ethereum killers” like Solana have gained steam because of their relatively lower fees and faster transaction rates.

With the merge to a consensus layer, formerly Ethereum 2.0, slated for the second quarter of this year, it remains to be seen whether the high gas fee challenge in the ETH ecosystem will be amicably addressed.

The consensus layer seeks to transition the present proof of work (PoW) consensus mechanism to a proof of stake (PoS) framework, deemed more cost-effective and environmentally friendly.

Image source: Shutterstock

Ethereum Price Yearly Trend Suggests Bull Run Ahead, ETH Deposits Doubled in the Last 20 Days