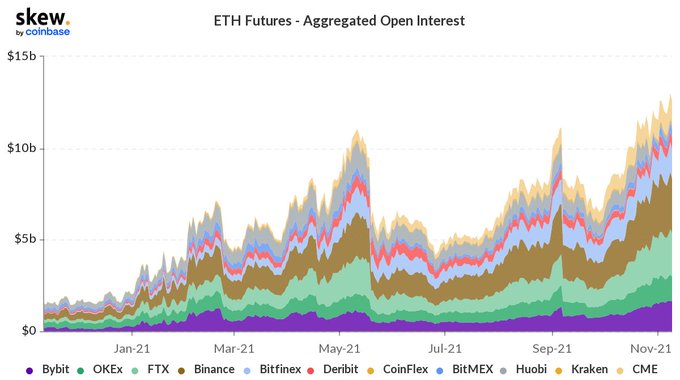

Ethereum’s Open Interest Surges to Historic Highs of $13B

Even though Ethereum (ETH) had retraced to the $4,655 level during intraday trading, the second-largest cryptocurrency has been on overdrive by hitting historic highs after another.

For instance, ETH set an all-time high of $4,650 earlier this month, and days later, it broke this record by topping $4,800. Therefore, Ethereum has defied many odds to attain these historic high prices from an all-time low of $0.4 recorded in 2015.

Open interest has been rising in tandem with the price based on their strong correlation. Market insight provider unfolded explained:

“Ethereum global OI hits $13 billion, a new all-time-high.”

Meanwhile, $5,000 has emerged as the largest open interest strike price for ETH options.

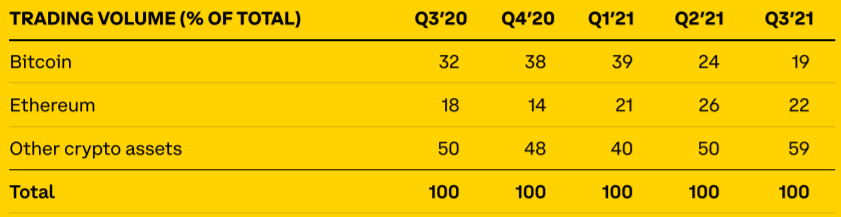

Ethereum accounted for 22% of Coinbase Q3 earnings

The earnings of leading American crypto exchange Coinbase show that Ethereum’s volume surpassed that of Bitcoin in both the second and third quarters of this year. On-chain analyst Josh Lelito acknowledged:

“Coinbase Q3 earnings are out, Ethereum volume surpassed Bitcoin volume for the 2nd straight quarter (ETH 22% of volume vs BTC at 19%). We are starting to see a shift.”

ETH mining difficulty hits a record high

According to on-chain metrics provider Glassnode:

“Ethereum mining difficulty just reached an ATH of 11,474,727,308,949,000.”

The Ethereum mining difficulty measures how many hashes in statistical terms must be generated to find a valid solution to solve the next ETH block and earn the mining reward.

With this metric reaching record highs, the Ethereum supply will continue depleting because it is becoming harder to generate more coins.

On the other hand, the Ethereum network continues grappling with the challenge of high gas fees because they have been averaging $63.50, which is a 6-month high. Furthermore, total gas paid recently surged past 5 million ETH.

Whether this problem will be solved by a transition from a proof-of-work (POW) consensus mechanism to a proof-of-stake (POS) framework availed by Ethereum 2.0 remains to be seen.

Image source: Shutterstock