Holding onto Bitcoin Long Term is the Way to Go, says Crypto Analyst

Bitcoin (BTC) is up by 9.89% in the last 24 hours and is trading at $35,796 at press time after hitting an intraday low of $32,829.

The leading cryptocurrency has enjoyed an incredible bull run in recent weeks that saw it breach the $41,500 level as greed and fear of missing out (FOMO) came into play.

Crypto trader and technical analyst Michael van de Poppe believes that holding onto BTC for the long term is key, as its price is still skewed upwards above the all-time high (ATH) of $20,000 set in December 2017. He explained:

“Today is a new day in the markets of Bitcoin. We've witnessed an outrageous start of the week, but the price is still acting heavily above the all-time high in 2017. The long term is the game. “

He added that the interaction between altcoins and BTC was crucial in the coming period. The trader noted:

“When BTC calms down, they should start doing well in which altcoins outperform Bitcoin.”

Bitcoin's drop in price means that it may be the ideal time to buy it

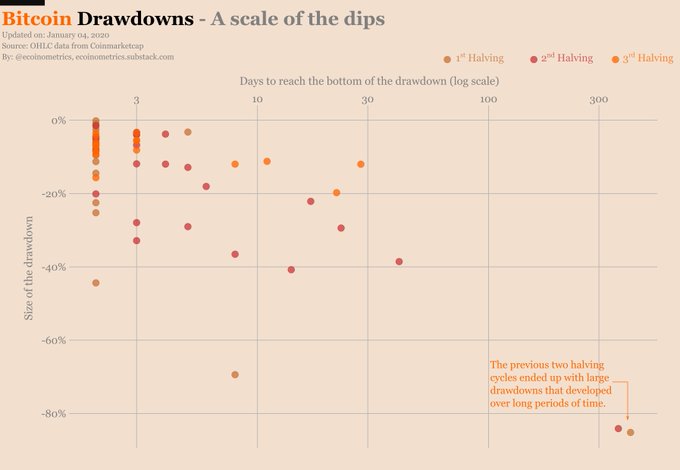

Bitcoin has been experiencing a price correction, and this decline, or drawdown, is seen as the dip needed by investors to gather more coins, as revealed by ecoinometrics. The data provider stated:

“During the previous cycles, the Bitcoin drawdowns in the 20% to 40% range have taken anywhere from a day to a little over a month to find a bottom. If you were waiting for the dip, then it is the occasion to accumulate while you can. ”

Crypto whales have been hiding the call to buy the dip, as shared by Elias Simos, a protocol specialist at Bison Trails, who noted that addresses with more than 1,000 BTC continued to grow. The whales, therefore, see the temporary low in the Bitcoin market as the silver lining to buy more cryptocurrencies.

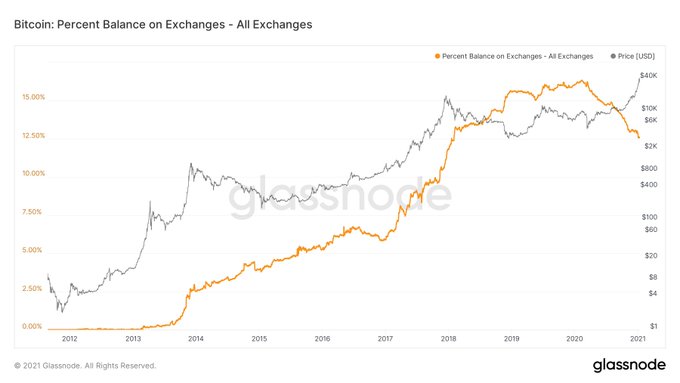

Bitcoin Archive has also revealed that investors are moving their BTC from exchanges to cold storages. The BTC tracking platform noted:

“Investors continue to move bitcoin off exchanges and into cold storage. The most fundamental law of economics "Supply & Demand" at play. Lower supply and Higher demand => Bitcoin goes up.”

Bitcoin’s price is therefore speculated to go up based on limited supply.

Image source: Shutterstock