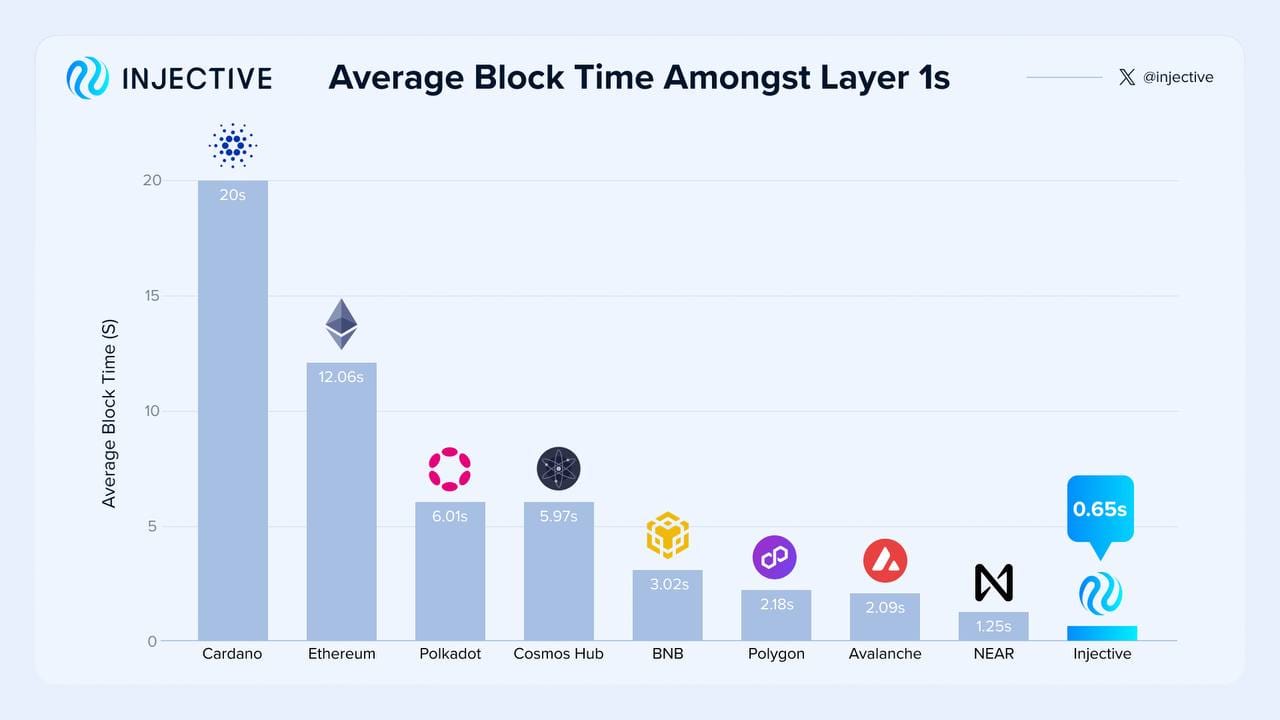

Injective (INJ) Achieves Major Performance Milestone with 0.65-Second Block Times

Injective (INJ)is continuing to redefine blockchain performance, consistently delivering faster and unmatched experiences for developers and users alike. Recent performance upgrades have slashed block times down to just 0.65 seconds on average. This milestone marks a significant leap from the sub-second block times achieved a year ago, positioning Injective as one of the fastest layer 1 blockchains ever created, according to blog.injective.com.

Analyzing Blockchain Performance

In the blockchain industry, throughput or Transactions Per Second (TPS) has become a catch-all term often used to gauge performance. However, throughput or TPS alone is an umbrella term that can oversimplify and even misrepresent the true capabilities of a network. The reality is that blockchain performance is a multifaceted concept, better understood through a combination of metrics such as block size, block time, processing, and finality—each of which plays a critical role in determining the efficiency and reliability of a chain.

Performance is not merely about how many transactions a network can handle per second; it’s about how effectively those transactions are processed from start to finish. To further assess blockchain performance, it is imperative to first define a few important terms:

- Block size dictates how much data can fit into a single block (transaction types vary in data size). Broadly speaking, though, block size represents the maximum number of transactions that can be included in a single block. Optimizations around processing transactions significantly influence this variable, where computational efficiency is vital for maximizing the actual number of transactions included per block.

- Block time refers to the interval required to validate and record a block of transactions. In essence, it can also be understood as the average time it takes to add a new block on a network.

- Finality measures the time it takes for a transaction to be considered irreversible and secured against any future changes.

Together, these metrics offer a more nuanced and accurate picture of network performance. As this piece will highlight, Injective is able to achieve the highest standards of throughput with lightning-fast block times and instant transaction finality.

Beyond Throughput: The Role of Latency

When considering end-to-end performance, latency should also be a focal point. Latency, or the time it takes for a transaction to be fully confirmed from initiation to finalization, is inherently tied to block size, block time, and finality. Faster block times and finality reduce end-to-end latency, making the network more responsive and user-friendly. Likewise, larger block sizes can reduce the time a transaction has to wait for inclusion in the next block, meaning lower latency. These factors collectively define the network's ability to complete a transaction's full lifecycle, which is ultimately what matters most for users and developers alike—it is, in a sense, a direct assessment of network performance.

A Primer on Layer One Scalability

Scalability has been largely conflated with throughput, evolving into a synonym in general discourse within the industry. Yet again, this obfuscates the nuances of actual scalability. For a blockchain network to “scale” effectively, it must encompass not just performance, but also resilience and upgradability. These elements together form the foundation that allows a network to support an increasing array of services, i.e., scale its operational footprint and capability.

Just as throughput doesn’t mean much with lackluster finality, it also doesn't mean much if transactions within the blocks are vulnerable to manipulation. For a network to scale effectively, it must be resilient—resilient to practices such as MEV, sandwich attacks, and front-running. This is particularly true in financial ecosystems, where the stakes are high, and the margin for error is low. Applications will not be able to grow effectively and reach mass adoption if such resilience does not exist within the underlying layer 1 chain, and if they do, they won’t be there long.

Similarly, long-term sustainability for dApps requires the long-term viability of the chain itself. A network that can be easily updated and improved without massive engineering overhauls ensures that it can evolve alongside emerging threats and opportunities. A self-evolving blockchain that can be rapidly upgraded—whether for security, additional optimizations, or new features—will always be better equipped to stand the test of time. In an environment where there are hundreds of “Internets” or layer 1 chains to select from, adoption will ultimately occur within chains that minimize risk while over-indexing on agility.

Thus, scalability is not just about throughput; it’s about a network’s ability to grow in all dimensions—performance, security, and adaptability. Only by integrating performance, resistance to attacks, and upgradability can a network truly scale, supporting an ever-increasing array of dApps and use cases while meeting the demands of users and developers.

A Self-Evolving L1 Network

Injective’s speed to improve is one of its strongest features. This is largely due to Injective’s pioneering work in creating on-chain modules. Modules are essentially pre-built pieces of infrastructure that allow developers to instantly augment their applications with new functionality. The plug-and-play approach allows Injective to quickly adopt new capabilities, such as its recently released RWA module, offering a customizable experience for seamlessly tokenizing real-world assets in a compliant and secure manner.

As the only module-based L1, Injective ensures its future viability, routinely building ahead of the curve. In turn, this also signals to the market that Injective is the premier destination where projects and institutions can launch and evolve over time.

Building Resilient Systems: A Truly MEV Resistant Chain

When it comes to resilience, Injective is unlike any other blockchain. Injective is the first-ever blockchain to embed Frequent Batch Auctions (FBA) into the chain itself, making it a truly MEV-resistant L1.

Injective's FBA system batches transactions over discrete time intervals rather than processing them individually. By collecting and matching orders at the end of each interval, it eliminates the timing advantage for malicious actors, thus preventing front-running. Transactions within each batch are executed at a uniform clearing price. This ensures that no participant can manipulate the order prices within the same batch, maintaining fairness and reducing price manipulation opportunities. Orders are kept confidential until the end of the auction interval when they are revealed and executed (sealed bids). The use of sealed bids leaves no room for validators to perform maximum extractable value (MEV) strategies, as the transaction batch is hidden prior to execution.

The fully on-chain FBA system creates an extremely resilient chain, free of common limitations such as rampant front-running and MEV threats seen on many prominent networks today. Additionally, Injective's FBA system aligns perfectly with its Tendermint BFT-based PoS consensus, providing instant finality for transactions. So not only can transactions proceed without any potential MEV, but they are also finalized with certainty, meaning that transactions can't be reverted or fail as is often the case on other networks. This combination of MEV resistance with instant finality on Injective ensures a robust development environment, which in turn powers a next-gen user experience for all.

Enshrining Instant Finality

On the performance side of the equation, Injective blocks, which can fit up to 100 MB of data per block, are now created every 0.65 seconds following the latest upgrade. If the average size of a transaction in a block is 250 bytes (a common reference size for testing), Injective’s upper bound is 400,000 transactions per block, or ~615,000 TPS. In practice, Injective is operating at 16,250 transactions per block, or 25,000 TPS. However, this does not necessarily provide the full picture (see above, performance ≠ TPS); Injective’s finality is instant with its custom implementation of Tendermint’s BFT consensus mechanism. Not only does this significantly reduce latency, but it also means transactions are immediately considered irreversible, a crucial characteristic in the context of financial processes moving on-chain. Ultimately, this all adds up to superior performance and superior scalability.

With finality fully optimized, Injective has turned its attention to further improving block time in its latest upgrade, dramatically improving its end-to-end performance and scalability.

The Importance of Faster Block Times and Speed

Every millisecond counts on-chain. Block time directly influences the speed and efficiency of a network, as discussed above. Shaving even a fraction of a second can be game-changing for blockchains and financial markets.

Faster block times translate directly to a more efficient developer environment. When transactions are confirmed more quickly, the entire ecosystem becomes more responsive, reducing the friction that often plagues financial systems. This increased efficiency doesn’t just benefit individual users; it transforms the network into a magnet for liquidity.

Liquidity is the lifeblood of financial markets. As transactions are processed faster, developers and institutional participants experience lower latency, which encourages more frequent usage, reduces the risk of slippage, and curbs arbitrage market impact. This heightened activity attracts even more liquidity, creating a virtuous cycle where efficient markets draw in more capital.

The outcome? Limitless opportunities for everyone. With a network that can process transactions at sub-second speeds, Injective opens the door to a new level of financial dynamism. Traders on native DEXs built on Injective, for instance, can capitalize on price movements with greater precision, while developers can build sophisticated financial applications that thrive using the inherent speed and reliability of Injective.

In essence, faster block times are not just a technical upgrade—they are a fundamental catalyst for achieving unprecedented growth. Faster block times enhance the overall efficiency of the network, making Injective a more attractive platform for developers, users, and institutions. This positions Injective as a leader in creating a more robust and competitive platform relative to other layer 1 chains.

The Power Behind the Performance

The remarkable reduction in Injective block times is the result of carefully engineered optimizations focused on several key areas:

- Optimized State Synchronization and Data Handling: the underlying data structures that manage Injective's blockchain state have been fine-tuned, leading to faster read and write operations. This significantly reduces latency, enabling the network to process transactions more swiftly.

- Enhanced Resource Management: The improvements also include better disk usage and resource management techniques, leading to reduced I/O loads. This means the network can handle a greater number of transactions per second while maintaining the integrity and speed of block production.

- Refined Consensus Mechanisms: An optimized consensus algorithm has been implemented, enhancing the process of validating and confirming transactions. These refinements ensure that the network can swiftly reach consensus even under heavy transaction loads, further accelerating block times.

These upgrades are not just incremental improvements, but are part of a broader strategy to ensure that Injective remains at the forefront of Web3 engineering.

Unlocking a New Paradigm for All

The impact of these advancements is felt across the board:

- For Users: Faster block times translate to a smoother, more responsive experience. This means users can execute transactions with greater confidence and efficiency, a crucial feature, particularly as it relates to financial processes. Quicker block times reduce the risk of slippage and limit the value extracted by arbitrageurs, making Injective an ideal platform for applications such as high-frequency trading and other time-sensitive operations.

- For Developers: The improvements provide a more robust and efficient platform to build on, reducing the time it takes to develop and deploy applications. Developers can thus innovate more quickly, bringing new features and applications to the market at a faster pace. This makes Injective a prime environment for cutting-edge financial applications, setting it apart from slower, less efficient networks.

- For Institutions: Significantly faster block times enable Injective to seamlessly bridge the gap between traditional finance and on-chain environments. One of the major challenges institutions face today is the lack of infrastructure that can replicate the high-speed transactions common in traditional financial markets, where billions of dollars can change hands in mere fractions of a second. Injective now offers an unparalleled experience for institutions, allowing for asset tokenization, trading, and other financial activities to occur at speeds that surpass those of any other L1. This positions Injective as the ideal chain for institutions looking to bring their operations on-chain without compromising on performance or efficiency.

A Future Built on Speed and Innovation

With these improvements and innovations, Injective stands at the forefront of scalability. A block time of just 0.65 seconds is a powerful testament to Injective’s relentless pursuit of excellence. While other blockchains struggle to keep pace, Injective surges ahead, redefining what’s possible for layer 1 chains.

Looking forward, Injective remains committed to continuous performance enhancements. If the past is any indication, future upgrades will undoubtedly further decrease block times and introduce additional optimizations, ensuring that the network continues to lead the pack in terms of performance. The focus will continue to be on building the best blockchain for finance—a chain that provides limitless scale and limitless possibilities for all.

About Injective

Injective is a lightning-fast interoperable layer one blockchain optimized for building the premier Web3 finance applications. Injective provides developers with powerful plug-and-play modules for creating unmatched dApps. INJ is the native asset that powers Injective and its rapidly growing ecosystem. Injective is incubated by Binance and is backed by prominent investors such as Jump Crypto, Pantera and Mark Cuban.