LIQUIDITY

The availability of assets is determined by the ability for that asset to be converted into cash without dramatically affecting market prices.

HashKey Launches Wealth Management Platform for Institutional Investors

HashKey Group has launched a wealth management platform for professional and institutional investors in response to growing demand for virtual assets. The Hong Kong-based digital asset firm is expanding its over-the-counter trading service and increasing its liquidity coverage to 24/7.

Ripple Launches Liquidity Hub to Bridge Crypto and Fiat

Ripple has launched a liquidity solution for businesses to access digital assets, including BTC, ETH, ETC, BCH, and LTC, through various market makers. The Ripple liquidity hub aims to bridge the gap between crypto and fiat, and reduce the cost of operations on high-volume transactions. Notably, XRP is not mentioned in the product launch, which could be attributed to Ripple's ongoing court battle with the SEC.

Conflux to Deploy Uniswap v3 on Network

Conflux plans to deploy Uniswap v3 on its network, offering access to millions of potential new users in the Chinese and Asian markets. The move comes after the Uniswap v3 code license expired, allowing developers to fork the protocol and deploy their own decentralized exchange. Conflux has experienced a spike in traffic in the first quarter of 2023 and has a market capitalization of nearly $1 billion.

Allbridge Provides Compensation Plan for Hacked Users

Allbridge has posted a recovery plan after being hacked for $573,000 on April 1, stating that users with funds stuck on the token bridge are first in line to receive compensation. Allbridge has already started the compensation process for users despite only recovering part of the funds. The protocol aims to fully compensate those affected by the exploit with funds available to them.

Bitcoin Liquidity Drops Despite Price Surge

Despite a 45% price gain, Bitcoin's liquidity has dropped to a 10-month low due to the ongoing financial crisis and regulatory actions against crypto companies. The collapse of crypto-friendly banks has led to a liquidity crisis, causing increased price volatility and higher fees for traders.

PancakeSwap Launches V3 with Lower Fees and Enhanced Capital Efficiency

PancakeSwap has launched version 3 of its automated market maker platform, featuring lower fees and enhanced capital efficiency. Liquidity providers can now select custom price ranges, allowing specific control over capital investments, and the release also includes four new trading fee tiers. The platform serves over 1.5 million unique users and has more upcoming features in development.

Institutional Investors Seek Tokenization Solutions

Institutional investors are seeking solutions for easy implementation of tokenization to improve liquidity for global assets expected to reach $145.4 trillion by 2025. Polygon has been working with global players such as Hamilton Lane, which has already tokenized part of its $824 billion assets under management, and JPMorgan, which executed its first cross-border DeFi transaction on the Polygon network.

Circle Plans to Cover USDC Shortfall After SVB Shutdown

Circle, the issuer of the stablecoin USD Coin (USDC), has announced that it will use corporate resources to cover the shortfall on its reserves after Silicon Valley Bank (SVB) was shut down by the California Department of Financial Protection and Innovation. USDC liquidity operations will resume as normal when banks open on Monday, enabling redemption at 1:1 with the US dollar. The stablecoin lost its $1 peg on March 11, trading as low as $0.87, due to the disclosure of $3.3 billion of Circle's reserve held at SVB.

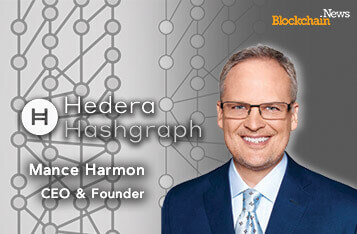

Hedera Mainnet Exploited, Leading to Theft of Liquidity Pool Tokens

Hedera Hashgraph has confirmed a smart contract exploit on its mainnet, resulting in the theft of liquidity pool tokens from decentralized exchanges (DEXs) that use code derived from Uniswap v2 on Ethereum. The suspicious activity was detected when the attacker attempted to move the stolen tokens across the Hashport bridge, leading operators to temporarily pause the bridge. The exact amount of tokens stolen is unknown, and the Hedera team is working on a solution to remove the vulnerability.

POSA Publishes Two White Papers

The nonprofit cryptocurrency industry group Proof of Stake Alliance (POSA) has produced papers on receipt token legality.