Ethereum 2.0 Full Upgrade Will Prompt a 1% Annual Deflation Rate

A transition to the proof of stake(PoS) consensus mechanism through Ethereum 2.0 will prompt a 1% annual deflation rate on the ETH network, according to crypto service provider LuckyHash.

Per the report:

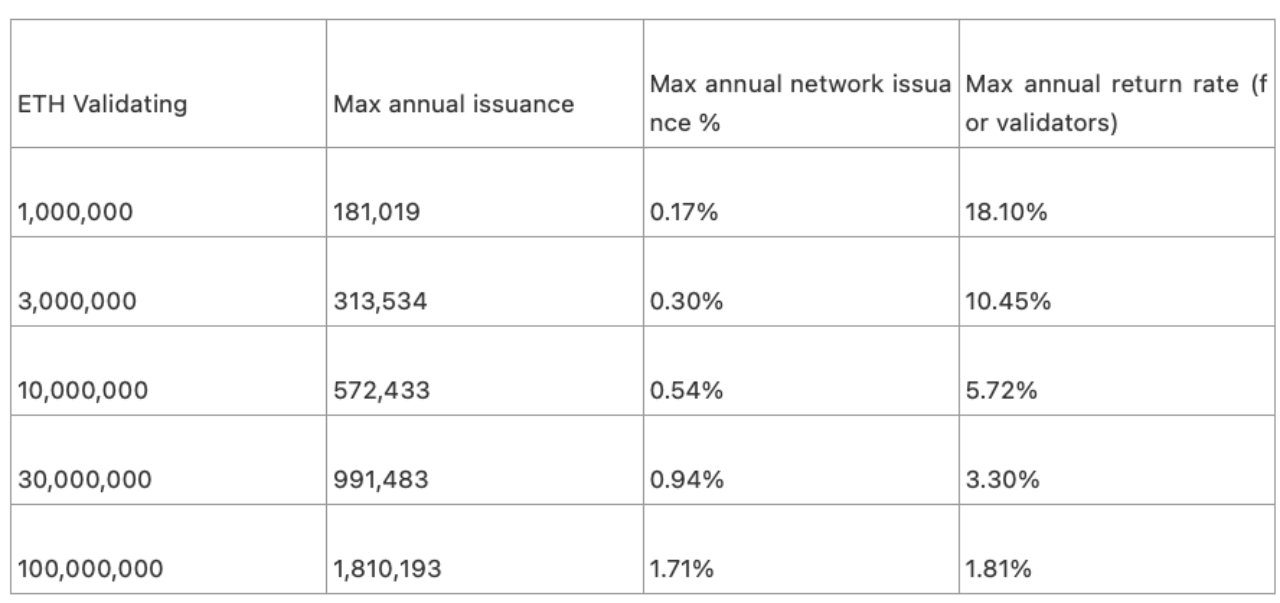

“When the quantity of pledge exceeds 100 million, the annual issuance rate will stabilize at 1.71%, that is, the average daily output is about 5600. If by then the upgraded Ethereum can maintain the current burn volume, it can achieve 1% deflation every year.”

Ethereum’s annual inflation rate of nearly 4.1% has been reduced to 1.4% by the burning mechanism introduced by the London Hard Fork or EIP 1559 upgrade that went live in August.

Therefore, LuckyHash speculates that a complete upgrade to Ethereum 2.0 will further reduce the inflation rate, prompting deflation by attaining a negative number.

The crypto service provider added that the annual issuance of Ethereum rises in tandem with the number of pledges based on ETH’s economic model.

A recent report by the Ethereum Foundation acknowledged that a merge to Ethereum 2.0 from the present proof of work (PoW) is expected to happen in the second quarter of 2022, even though the ETH 2.0 deposit contract launched in December 2020 has been showing the viability of the PoS consensus mechanism.

The PoS framework takes a different approach because validating blocks depends on the amount of ETH staked, given that it is used as collateral against dishonest behaviour.

Meanwhile, Microsoft’s director of digital transformation, Yorke Rhodes, believes that Ethereum will be the decentralized app store in 2023. He added:

“The Ethereum network is distributed, decentralized, has single sign-on to applications, as well as payments, identity, and P2P commerce.”

Therefore, Rhodes trusts that Ethereum will scale through rollups and updates to become the flagship marketplace of Web3 in two years.

Image source: Shuttstock