Ethereum’s Top 5 Mining Pools Account for 65.4% of ETH Blocks

Despite Ethereum’s 6-year journey being marked by ups and downs, this quarter has emerged to be the most rewarding so far because the second-largest cryptocurrency based on market cap recently hit an all-time high (ATH) price of $4,650.

This has been a remarkable milestone, given that Ethereum’s all-time low was recorded in 2015 at $0.4.

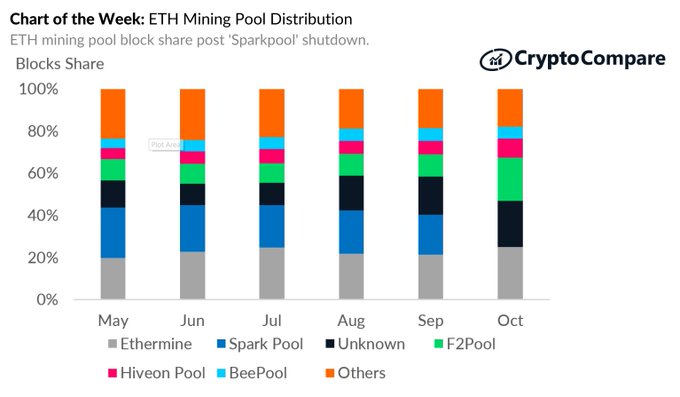

On the other hand, ETH miners have been making notable strides. For instance, the top 5 Ethereum mining pools account for 65.4% of all the ETH mined. Market insight provider CryptoCompare explained:

“Ethermine remained the largest ETH mining pool with 25.0% share, up 21.5% from September - followed by unknown miners (21.8%) and F2Pool (20.5%). The top 5 known pools now account for 65.4% of ETH blocks.”

Ethereum miners have earned the most in 2021

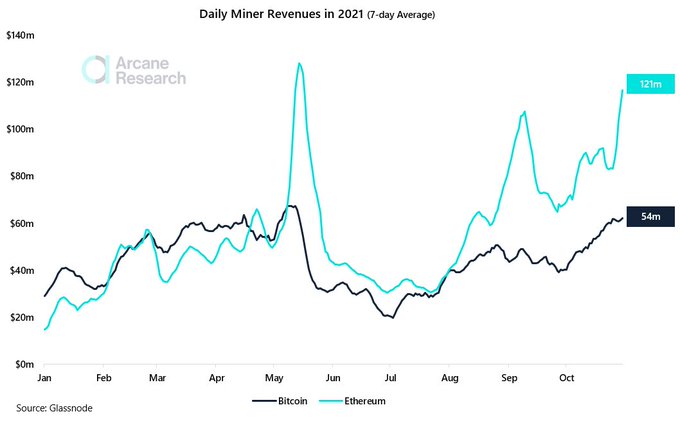

Ethereum miners have cashed in the most in the crypto space so far this year, even surpassing Bitcoin miners. Crypto insight provider Arcane Research noted:

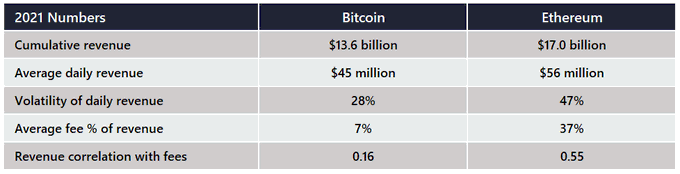

“Bitcoin miners may get the most attention in the mining sector, but Ethereum miners have earned the most in 2021. - BTC miner revenue in 2021: $13.6b. - ETH miner revenue in 2021: $17b.”

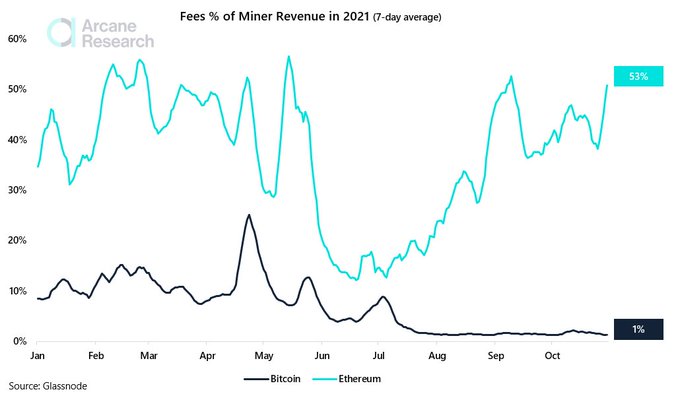

Arcane Research stated that the biggest reason Ethereum miners have earned more than Bitcoin miners in 2021 is based on the massive activity on the ETH network, which is pushing up transaction fees.

For instance, the average revenue fees stood at 37% for Ether miners, whereas their Bitcoin counterparts recorded 7%.

The crypto insight provider added:

“The ether miner revenues are far more dependent on transaction fees than Bitcoin miners, in turn leading the daily ether miner revenue to be far more volatile than for Bitcoin miners. ETH miners' daily revenue volatility is 47%, while being "only" 28% for BTC miners.”

Meanwhile, Ethereum has recorded seven consecutive positive quarters, and if the current one closes in green, it will be the eighth.

Image source: Shutterstock