High Transaction Volumes are Boosting Ethereum’s Price Rally

Ethereum (ETH) continues to scale heights not seen in its six-year journey. The second-largest cryptocurrency recently breached the psychological price of $3,000, and its rally upwards has seen it hit a new all-time high (ATH) above $3,200.

ETH is up by 30.49% in the last seven days to trade at $3,250 at the time of writing, according to CoinMarketCap.

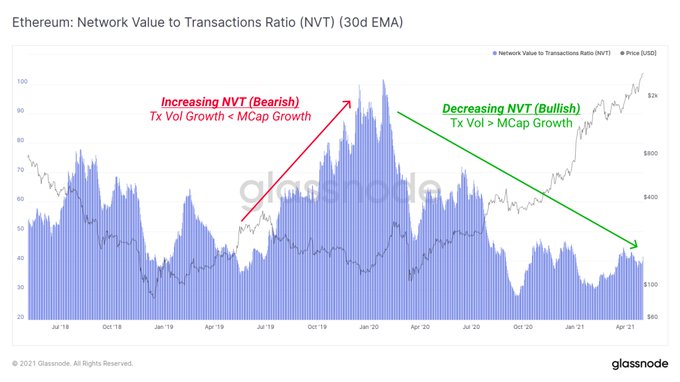

Glassnode has revealed that high transaction volumes in the Ethereum network are boosting its upward momentum. The on-chain metrics provider explained:

“As ETH price reaches over $3,000 setting a new ATH, the NVT Ratio is driven back down towards this cycle’s lows. Low NVT Ratios indicate transaction volumes are high and growing faster than the network market cap.”

In the first quarter of 2021, Ethereum settled transactions worth $1.5 trillion compared to $1.3 trillion in 2020. This, therefore, shows the considerable transaction volume ETH has been enjoying, which has aided its price rally.

This uptrend in transactions is based on the fact that more participants are joining the Ethereum bandwagon. For instance, WeWork, an American commercial real estate company that provides flexible shared workplaces, has partnered with Coinbase and Bitpay to accept crypto payments in the form of Bitcoin, Ethereum, USD Coin, and Paxos.

Ethereum flips Bank of America’s market capitalization

With a market capitalization of $373.77 billion, Ethereum has exceeded Bank of America's valuation of $347.31 billion. ETH is also more valuable than Home Depot, Walt Disney, Procter and Gamble, and Nestle, who have a market cap of $348.1B, $337.67B, 307.99B, and $337.38B, respectively.

This price rally has also enabled ETH addresses in profit to hit an ATH of 58 million, as acknowledged by Glassnode.

According to data analytics firm Skew, CME Ethereum futures saw record volumes recently as open interest surged past $360 million, whereas daily volume breached the $300 million mark.

Image source: Shutterstock