Searching for: "

Show More

Stablecoin

"STABLECOIN

Description

A stablecoin (or stable coin), as its name indicates, is a stable cryptocurrency designed to be resistant to the type of price volatility synonymous with cryptocurrencies like Bitcoin and Ether.

The key is to understand "stable": what is "stable"? which references are pegged to make its value "stable"? In terms of what we measure the "stability".

A stablecoin (or stable coin), as its name indicates, is a stable cryptocurrency designed to be resistant to the type of price volatility synonymous with cryptocurrencies like Bitcoin and Ether.

The key is to understand "stable": what is "stable"? which references are pegged to make its value "stable"? In terms of what we measure the "stability".

Stablecoin

What is stablecoin? In terms of what we measure the "stability". Understand stablecoin in different features. Central Bank Digital Currency (CBDC)

Bitpay Now Supports Binance's Stablecoin For Global Payments

Binance and Bitpay have partnered to enable consumers and merchants to access Binance stablecoin.

Canadian Dollar Stablecoin QCAD Launched for Mass Market

Canada Stablecorp Inc. has launched a new regulated Canadian Dollar stablecoin called “QCAD”.

Global Currency Organization Launches New USD Stablecoin USDD

The Global Currency Organization (GCO) has launched a new USDD token, a US dollar-backed stablecoin, intended for revenue sharing in institutions.

Stablecoin Reserves May Be Held in National Banks, US Treasury Office Provides Insight

The OCC announced that national banks and federal savings associations could hold reserves for customers with stablecoin assets.

Thai Central Bank Issues Stern Warning about Thai Baht Digital (THT) Stablecoin

The Bank of Thailand is warning citizens against using the illegal THT stablecoin.

Tether becomes First Stablecoin to be Integrated into Algorand 2.0 Blockchain

Tether, a reputable stablecoin provider, has incorporated its U.S. dollar-backed stablecoin USDT into Algorand’s blockchain ecosystem. Tether’s presence on Algorand will facilitate block confirmation in less than four seconds and transaction fees will be a fraction of a cent.

Ethereum Continues to Grow with the Majority of Stablecoin Projects Leveraging its Network

Ryan Watkins, a researcher at Messari, believes that the numerous stablecoin protocol experiments on the Ethereum network are impressive.

Tether Launches Stablecoin Backed by Offshore Chinese Yuan

Reported in late August, Tether had made plans to add a new stablecoin pegged to the Chinese Yuan, named “CNHT.”

Tether Plans to Issue Stablecoin Backed by Chinese Yuan

Tether has been reportedly working on a new stablecoin pegged to the Chinese Yuan. The stablecoin project named “CNHT” came from the intention of Zhao Dong, one of the shareholders of the Bitfinex crypto exchange.

US Lawmakers Want STABLE Act to Force Stablecoin Issuers to Secure Bank Charters

US lawmakers have introduced a new bill to Congress seeking to impose federal control over the entire stablecoin industry and would mandate issuers to secure bank charters.

Pickle Finance DeFi Protocol Loses $19.7 Million In DAI Stablecoin in “Massive” Hack

Pickle Finance becomes the latest DeFi Protocol to suffer from hacking, losing almost $20 million in DAI stablecoin.

Stablecoins Could Threaten Monetary Sovereignty and Financial Stability, Says ECB’s Christine Lagarde

Christine Lagarde, the president of the European Central Bank (ECB), has highlighted that stablecoins could pose a serious threat to monetary sovereignty and financial stability.

Hong Kong Resumes Discussion on Stablecoin Regulation, Offering 5 Options to the Public

The Hong Kong Monetary Authority (HKMA) has published a discussion paper in which it is soliciting the public’s contributions to its proposed regulatory approach to digital currencies and stablecoins.

US Treasury Department Warns Regulators of Potential Risks of Digital Assets

The Financial Stability Oversight Council (FSOC) of the US Treasury Department has released its annual report with a crucial warning of digital assets disruption.

MAS Seeks to Ban All Forms of Crypto Credits in Singapore

The Monetary Authority of Singapore wants crypto service providers to avoid issuing credits for consumers to trade crypto

Stablecoins Pose Risks to Financial Stability: Yellen

The instability of the UST stablecoin has pushed the United States Treasury Secretary, Janet Yellen, to advocate for introducing a tighter regulatory framework to govern the entire stablecoin offshoot of the crypto ecosystem.

US CFTC Holds Meeting on Stablecoins Joined by Paxos, MakerDAO and JPM Coin Executives

The United States Commodity and Futures Trading Commission (CFTC) held a meeting earlier this week to study the potential impact of the stablecoin industry. The derivatives regulator met with stablecoin industry experts to understand its future implications.

UK Finance Ministry Proposes Safety Net Measures against Stalling Stablecoins

The proposals presented by the British finance ministry are aimed to mitigate risks related to stablecoins amid the recent TerraUSD de-pegging fiasco.

Fed Governor Warns ECB Forum that Libra Risks are Immense

The Governor of the Federal Reserve, Lael Brainard warned a European Central Bank (ECB) forum in Germany, that the risks posed by the potential mainstream adoption of the Facebook proposed stablecoin Libra, are too immense.

UK Treasury Drafting Private Stablecoin Regulations and Researching CBDC with BoE

The United Kingdom’s Treasury Department has announced it is drafting private stablecoin regulation while it continues central bank digital currency (CBDC) research.

Privately Issued, Regulated Digital Crypto Might Better than CBDC, Says Australian Central Bank

Australian central bank boss admits that private digital tokens could be better and their benefits will be enhanced if regulatory arrangements are made right.

Singapore's MAS to Open Public Consultation on Stablecoins Soon

Singapore’s apex bank, the Monetary Authority of Singapore (MAS), is ramping up plans to open up discussions with the public for stablecoin regulations.

IMF to Play a Crucial Role in Monitoring Digital Money Evolution

The IMF is set to play a crucial role in monitoring the advancement of digital currencies.

Japanese Lawmakers to Introduce New Bill, Empowering Crypto Seizure

In a bid to strengthen its regulatory landscape, Japanese lawmakers are reportedly looking forward to amending the Act on Punishment of Organized Crimes and Control of Proceeds of Crime (1999)

Canada's Federal Government Begins Consultations on Digital Currency

The federal government of Canada announced in a budget address that it has started discussions on cryptocurrencies, stablecoins and central bank digital currencies.

OCC Head Brian Brooks Testifies Before Senate On Cryptocurrency and Stablecoins

The OCC Boss, Brian Brooks has testified before the US Senate Banking Committee about the growing use of cryptocurrencies and stablecoins in the country

FTX Shares 10-Point Regulatory Proposals to American Congress

Cryptocurrency trading platform FTX Derivatives Exchange has published a 10-point regulatory proposal, aims at helping American regulators to provide better regulatory oversight of the broader cryptocurrency ecosystem.

BoE's Committee Recommends Taking a Closer Look on Crypto Regulation

In its latest Financial Stability Report, the Financial Planning Committee (FPC), an offshoot of the Bank of England has recommended pushing for an ‘enhanced’ regulatory framework.

Bitfinex and Tether's Appeal Rejected by New York Judge

Judge Cohen reportedly decided to give a 90-day extension to the case, which will give the New York Attorney General’s office to continue investigating. Judge Cohen also dismissed Bitfinex and Tether’s motion to appeal after the ruling.

EU Plans to Bar Interest Payments on Deposits in Stablecoins

Patrick Hansen, the head of Strategy at DeFi startup, Unstoppable Finance, said the expected MiCA bill could come as early as this month’s ending.

Acting OCC Comptroller Urges Regulators to Collaborate with Crypto Intermediaries

Michael J. Hsu, the Acting Comptroller of the Office of the Comptroller of the Currency (OCC) has advocated that regulators should collaborate with major crypto intermediaries in order to get a grasp of how the ecosystem functions.

UK Treasury Doubles Down on Stablecoin Regulations in New Bill

Zahawi presented the Financial Services and Markets Bill to the members of Parliament on Wednesday with a proposal to regulate stablecoins and "digital settlement assets" as a form of payment assets in the UK.

G7 Reports Stablecoins Like Libra Threaten Financial Security

According to the BBC, the G7 group of nations has drafted a report outlining nine major risks that digital currencies, such as Facebook’s proposed Libra, pose to the global financial system.

U.S. Financial Regulators Warn Crypto Firms to Tighten Stablecoin AML Risk Controls

U.S. regulators have issued a strict warning on money laundering risks associated with stablecoins and has warned providers to tighten AML protections and controls.

House Stablecoin Bill to Seek Two-year Ban on Issuing New Algorithmic Stablecoins

U.S. House of Representatives is drafting a new bill to impose a two-year ban on issuing new algorithmic stablecoins similar to TerraUSD (UST), according to Bloomberg.

Bank of England Solicits Funds to Enhance Crypto Crackdown

The Bank of England, through the Prudential Regulation Authority (PRA), is looking to raise as much as £321 million ($419 million) from the commercial institutions as it is planning to shore up its regulatory efforts in the digital currency ecosystem.

ECB Publishes New Stablecoin-Featured Framework for Overseeing Payments

The European Central Bank (ECB) has released a new framework geared towards overseeing all forms of electronic payments in the region, including those bordering on stablecoins.

European Central Bank Encourages Clear Regulatory Structure for Stablecoins to Reap the Benefits While Minimizing Potential Risks

The European Central Bank (ECB) published an in-depth report on global stablecoins, focusing on highlighting the requirement for clear regulatory parameters for stablecoins, and the risks it may pose to financial stability. The ECB suggests that a “robust regulatory framework” must be established to address risks before its benefits could be explored.

UK to Unveil Plans for Crypto Regulation, Eyeing Stablecoins

According to CNBC, the U.K. government will announce a cryptocurrency regulatory regime in the next few weeks, with a focus on stablecoins, and the details of the plan are still being actively discussed.

Will Crypto Assets Have a Future in Russia After All? State Duma Passes DFA Bill

The State Duma of Russia passed a law regarding digital financial assets (DFA) in the financial bill’s third reading, which determined the fate of Bitcoin and other cryptocurrencies.

Janet Yellen Urges Regulators to Move Fast on Regulating Stablecoin Rules

US Treasury Secretary Janet Yellen pushed top US financial regulators to speed up regulations of stablecoin cryptocurrencies.

EU Agreement on MiCA May Not Favor Stablecoins

After much deliberation and compromises from the European Commission, Assembly, and Council, a final agreement that builds the comprehensive framework for the digital currency ecosystem has finally been made

OCC Says US Banks Can Use Blockchains and Stablecoins in Bank Payments

According to the OCC, regulated banks in the US can leverage stablecoins to conduct payments as well as participate as validator nodes on blockchain networks called INVNs.

Japan’s Financial Regulator Proposes New Legislations, Limiting Stablecoin Issuance to Banks

Japan’s FSA is working on a legislation that is set to be introduced next year. The regulations seek to make it only wire transfer companies and banks can issue stablecoins.

Russian Policy Boss Wants to Block Cryptocurrencies, Says They Are Difficult to Regulate

Anatoly Aksakov, head of the State Duma Financial Market Committee, stated that the country should explore other options for crypto regulation.

Crypto Regulation Takes New Leap as European Council Adopts MiCA

The European Union is drawing closer to adopting the comprehensive Markets in Crypto Assets (MiCA) regulation as the European Council has passed the framework.

European Parliament Ratifies MiCA Framework in Landslide Vote

The long-awaited Markets in Crypto Assets (MiCA) regulation has just scaled through the European Parliament as MPs voted massively in favour of the bill.l

Bitfinex and Tether Claim Lawsuit Allegations of Market Manipulation are Baseless

BitFinex and Tether have officially spoken out against what they are describing as a baseless lawsuit, designed to undermine the cryptocurrency ecosystem.

Five EU Member States Take Position Against Stablecoins

Five members of the 27-member European Union Bloc has urged the body to pass regulations to stiffen the emergence and existence of stablecoins in the region

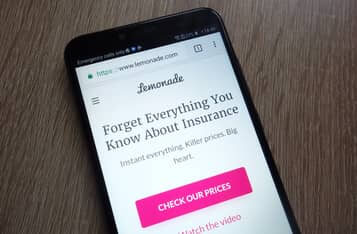

Lemonade to Offer Blockchain-Powered Climate Insurance for Farmers in Emerging Markets

American insurance company Lemonade has revealed the formation of Lemonade Crypto Climate Coalition which will offer blockchain-enabled climate insurance to the most vulnerable farmers across the globe.

Dai Stablecoin Reaches 100 Million in Debt Ceiling – An All-Time-High

The Dai (DAI) stablecoin reached the protocol’s built-in debt ceiling of 100 million as there has been 100 million Dai tokens minted. The nearly two-year-old stablecoin project had an original debt ceiling of 50 million, which was raised to 100 million in July 2018.

European Central Bank Plans to Take the Lead on Stablecoins

European Central Bank President Christine Lagarde has urged the ECB to take the lead regarding stablecoins, citing increased interests in the space from central banks in Britain, Canada, and China.

FinTech Association of Hong Kong Supports HKMA's Risk-Based Approach to Regulate Stablecoins

The FinTech Association of Hong Kong said that it is in principle supportive of the Hong Kong Monetary Authority's January discussion paper on crypto assets and stablecoins.

Mauritius Jumps on Digital Currency Bandwagon

The issuance of Central Bank Digital Currency (CBDC) has been making airwaves with nations, such as China, leading the hype. The Bank of Mauritius, the central bank of the Republic of Mauritius, seeks to join this bandwagon based on an announcement that it wants to introduce a digital currency.

Paxos’ Blockchain Settlement Platform Goes Live with Settling Credit Suisse and Instinet Trades

New York-regulated stablecoin issuer, Paxos, launched its blockchain-based settlement platform, after announcing the service in late 2019. The new service enables settlement of US-listed equity trades between broker-dealers Swiss financial services firm Credit Suisse and Nomura Group-backed Instinet.

Switzerland’s Sygnum Crypto Bank Launches Swiss Franc-Backed Stablecoin to Facilitate Trading of Financial Assets

Sygnum, a Swiss-based crypto bank, has launched a fiat-based stable coin, DCHF token, tied to the Swiss Franc, in an effort to increase transaction efficiency by enabling faster payment when trading financial assets.

Libra Faces Competition as Celo Foundation Hands Out First Grants Expanding the Use of its Platform

Libra has been facing some competition as the Celo Foundation has awarded its first grants of $700,000 in total to 13 projects that expand the use of its platform.

Terra-Based Anchor Protocol Hits $12b in Total UST Deposits

Anchor Protocol, a lending and borrowing protocol built atop the Terra blockchain network, its total UST stablecoins deposit has hit 12 billion, a show of the massive embrace it is currently receiving from the Terra ecosystem.

Banks Are Increasingly Starting to Offer Cryptocurrency Services in 2020

Banks have increased their interest in cryptocurrencies. Many of them have decided to join the cryptocurrency market, either by offering investments in cryptocurrency or by exploiting the capabilities of blockchain technology, which is already used in various areas with financial services.

Marketlend Launches New Stablecoin Against the Australian Dollar for Security Token Purchasing

Marketlend creates a digital currency to be backed by the Australian dollars to create a secondary market for corporate loans prompting a means through which assets can be tokenized over the blockchain.

Fusion Hacked? CEO Says That 10M FSN Tokens are Gone

The blockchain-based financial platform, Fusion Network has announced a compromised wallet on Sept. 28. The Fusion swap wallet compromise resulted in a theft of 10 million native FSN tokens.

Ethereum Co-Founder: Facebook Not Fit to be Libra’s Driving Force

Joseph Lubin, Ethereum’s co-founder, has asserted that Facebook should not spearhead the Libra project based on the concerns raised about its reputation.

Crypto Tax Payments Permitted in Bermuda

Bermuda has started accepting tax payments using Circle's stablecoin known as USD Coin (USDC).

Tether Brings into Play Anti-Money Laundering Solutions with Chainalysis Tool

Tether, the most leveraged stablecoin provider based on market capitalization, has deployed a tool provided by Chainalysis, a blockchain analytical company, in its quest to have anti-money laundering (AML) compliance solutions

Recap on 2019 Blockchain Use Cases: Who Got Off the Ground?

A quick look at some of the most exciting blockchain use-cases of 2019.

Bruno Le Maire Insists He Cannot Support Facebook’s Libra

Since the social media giant, Facebook announced its plan to launch its digital currency known Libra, one critic has repeatedly made his opinion known. Bruno Le Maire cannot and will not support the stablecoin project.

G20 Agency Warns Countries of Systemic Risks Posed by Global Stablecoins

The Financial Stability Board (FSB), the G20 body that advises on ways to improve the global financial system, has published a study on the challenges, which stablecoins pose for the global economy. The FSB stated that regulatory frameworks have already covered several activities associated with stablecoins, although there are other risks that many national regulators could be left unprepared for.

Stablecoin and Its Potential Business Uses

Blockchain innovation has significantly changed the way we thought in the traditional financial sector. All of those concepts and business models, such as decentralization, cryptographic tokens, and digital ledger, also brought us more imaginations toward the future forms of money.

NYDFS Approved: Binance and Paxos New Stablecoin Collab & Paxos Gold-Backed Token

Crypto exchange giant Binance, and digital asset trust company Paxos recently announced their partnership to launch a USD-backed stablecoin. The announcement comes after the approval from the New York State Department of Financial Services (NYDPS). New York-based exchange and stablecoin operator, Paxos launched a gold-backed Ethereum-based token named Pax Gold (PAXG).

China’s Central Bank Digital Currency Research Unit Signs Deal with Huawei

The Chinese central bank, People’s Bank of China’s (PBoC) Digital Currency Research Institute has signed an agreement with multinational telecommunications giant Huawei.

FSB Releases High-Level Recommendations for Global Stablecoin Regulation

The Financial Stability Board (FSB) has published a comprehensive report outlining key recommendations for the regulation, supervision, and oversight of global stablecoin (GSC) arrangements. The report aims to address potential financial stability risks posed by GSCs at both the domestic and international level.

Binance Launches Incentive Campaign for USDC-M Perpetual Contracts

Binance launches a dual-incentive promotional campaign for USDC-margined perpetual contracts, targeting deposits and trading activities to stimulate market engagement and diversify trading options in the crypto futures market.

Circle Denies Receiving 'Wells Notice' Over USDC

Circle's CSO refused SEC Wells notices for its USDC token.

Paxos Discusses BUSD Stablecoin With SEC Following Wells

Paxos CEO Charles Cascarilla said the business was "engaged in productive negotiations" with the SEC and will continue to communicate privately.

Circle CEO Expects Yuan-Backed Stablecoins Despite China's Crypto Ban

According to SCMP, despite the stringent ban on cryptocurrencies in mainland China, Jeremy Allaire, the co-founder and CEO of Circle, a leading operator of the USDC stablecoin, foresees a significant role for yuan-backed stablecoins in the global crypto market.

Aave Outpaces Market with 9% Growth in Q2 2023, Launches GHO Stablecoin

ave's Q2 2023 report shows a 9% growth in total value supplied, outpacing the market. Key developments include the launch of GHO stablecoin, a rise in stETH deposits, and the anticipated release of Portals.

Circle Deploys New Pre-Mint Address for USDC on Solana (SOL)

Circle has introduced a new pre-mint address for USDC on the Solana blockchain, streamlining operations in anticipation of the Cross-Chain Transfer Protocol launch.

Binance CEO Responds to Forbes Article on Fund Shuffling

Binance CEO Changpeng Zhao responded to a Forbes article that focused on the movement of funds by the cryptocurrency exchange. The article drew parallels between Binance and the now-defunct FTX and discussed the failed Voyager bid by Binance.US, as well as the United States Securities and Exchange Commission’s planned legal action against Paxos Trust Company, the issuer of the Binance-branded stablecoin, Binance USD (BUSD). Binance transferred $1.8 billion in stablecoin collateral to hedge funds such as Tron, Amber Group and Alameda Research between August and December 2022. Binance says it still supports BUSD and is now looking into non-USD stablecoins.

Singapore's MAS Unveils Stablecoin Regulatory Framework

Singapore's MAS releases a regulatory framework for stablecoins after public consultation in 2022. It aims to ensure value stability and sets key requirements for issuers.

Bitcoin (BTC) and Stablecoins Threaten Emerging Market Currencies, Report Suggests

Bitcoin and stablecoins are posing a significant threat to weak emerging market currencies, according to CoinShares.

New MiCA Stablecoin Rules to Impact European Crypto Users, Announces Binance

Binance announces significant changes due to new MiCA stablecoin rules in the EEA.

Circle Seeks Collaboration with BIS for Project Agorá

Circle applies to join BIS's Project Agorá, aiming to enhance global financial systems.

Paxos: The Crucial Role of Stablecoins in Transforming DeFi

Explore the impact of stablecoins on DeFi and their future prospects.

Ripple (XRP) Completes Acquisition of Standard Custody, Appoints Jack McDonald to Lead Stablecoins

Ripple (XRP) finalizes Standard Custody acquisition, appoints Jack McDonald as SVP of Stablecoins, enhancing its financial infrastructure.

Circle's USDC Achieves MiCA Compliance: Implications for Binance Users

Circle's USDC has been authorized as a MiCA-compliant e-money token, impacting Binance users in the European Economic Area (EEA).

SEC Drops Stablecoin Probe, Marking a Win for Paxos and the Crypto Industry

In a significant move, the SEC has ended its investigation into Paxos' BUSD stablecoin, signaling a potential shift in regulatory stance toward the crypto industry.

Hong Kong Proposes Regulatory Framework for Stablecoin Issuers

The Hong Kong Monetary Authority and FSTB release consultation conclusions on a legislative proposal for stablecoin regulation.

HKMA Reveals Participants for Stablecoin Issuer Sandbox

The Hong Kong Monetary Authority (HKMA) has announced the participants of its stablecoin issuer sandbox, fostering the development of Hong Kong's stablecoin ecosystem.

Standard Chartered, Animoca Brands, and HKT Collaborate in HKMA Stablecoin Issuer Sandbox

Standard Chartered, Animoca Brands, and HKT are joining forces in the HKMA’s stablecoin issuer sandbox to explore digital asset innovations.

MiCA's Stablecoin Regime: Key Differences Between ARTs and EMTs

Explore the regulatory landscape of MiCA's stablecoin regime, focusing on the distinctions and requirements for ARTs and EMTs in the EU.

Chainalysis: MiCA's Stablecoin Regime Faces Implementation and Legal Challenges

MiCA's stablecoin regime encounters practical and legal uncertainties as EU member states struggle with national implementation laws.

Circle's Euro-Backed Stablecoin EURC to Launch on Base

Circle is set to introduce EURC, its euro-backed stablecoin, on the Base network, enhancing the ecosystem with faster and cheaper commerce solutions.

Polygon (MATIC) CDK Integrates Bridged USDC Standard for Enhanced Stability

Polygon (MATIC) CDK is the first chain development kit to integrate Circle's Bridged USDC Standard, offering seamless upgrades and improved liquidity.

Ripple (XRP) USD (RLUSD) Beta Testing Commences on XRP Ledger and Ethereum Mainnet

Ripple (XRP) begins beta testing its stablecoin, Ripple USD (RLUSD), on the XRP Ledger and Ethereum mainnet, a significant step in digital finance.

Tether (USDT) to Launch UAE Dirham-Pegged Stablecoin in Collaboration with Phoenix Group

Tether announces plans to introduce a stablecoin pegged to the UAE Dirham (AED), in partnership with Phoenix Group and Green Acorn Investments.

Circle's Euro-Backed Stablecoin EURC Launches on Base

Circle's EURC stablecoin is now live on the Base mainnet, enabling developers and users to mint and redeem EURC. Supported by major partners like Coinbase and Uniswap.

Circle Proposes New Capital-Risk Framework for Stablecoins

Circle's top financial leaders introduce a risk-based capital framework tailored for stablecoins, addressing unique risks and operational challenges.

Balanced Integrates Injective (INJ) to Enhance Cross-Chain DeFi

Balanced, a cross-chain DeFi platform, integrates with Injective, introducing the bnUSD stablecoin and expanding DeFi capabilities.

AUSD Stablecoin Now Integrated with Sui Network

AUSD stablecoin launches on Sui, enhancing the network's utility, accessibility, and interoperability, according to The Sui Blog.

Binance Introduces Fixed Rate Loans for Stablecoin Borrowing

Binance Loans launches Fixed Rate Loans, offering users predictable rates for stablecoin borrowing and lending. Learn more about this new financial service.

Binance Introduces Zero Fee for EURI Purchases via SEPA Bank Transfer

Binance launches a zero-fee SEPA bank transfer option for EUR deposits to receive EURI, enhancing user experience and compliance with MiCA regulations.

Etherfuse Launches Mexican Stablebond on Solana (SOL) Blockchain

Etherfuse introduces a Mexican Stablebond on the Solana (SOL) blockchain, aiming to revolutionize financial inclusion and democratize financial systems.

BNB Chain's Role in the Future of Stablecoin Payments

Explore how BNB Chain is shaping stablecoin use in DeFi, ecosystem diversity, user experience, and commercial applications.

BNB Chain Introduces Gas-Free Stablecoin Transfers Amidst Expanded Infrastructure

BNB Chain launches 'Gas-Free Carnival' enabling gasless stablecoin transfers with partnerships from leading exchanges, wallets, and bridges.

BNB Chain Enhances Stablecoin Use with New Incentive Programs

BNB Chain introduces innovative programs to boost stablecoin integration and adoption, aiming to onboard the next billion Web3 users.

Tether (USDT) Marks a Decade of Stablecoin Leadership with 350 Million Users

Tether celebrates 10 years of innovation, solidifying its role as the leading stablecoin with 350 million users worldwide. Discover Tether's impact on global finance and its future vision.

Linea and Aryze Collaborate to Innovate Digital Asset Solutions

Linea teams up with Aryze to enhance digital finance by integrating tokenized Real-World Assets and customized stablecoin services into the Linea blockchain ecosystem.

USDC Launches on Sui Mainnet, Boosting DeFi Ecosystem

USDC, a major stablecoin, is now available on the Sui Mainnet, enhancing liquidity and value transfer within the DeFi ecosystem as Sui's TVL surpasses $1 billion.

Institutional Engagement and Staking Surge: Insights from Coinbase and Glassnode's Q4 Crypto Report

Explore the latest trends in crypto markets, including Bitcoin ETFs, Ethereum staking, and stablecoins, as highlighted in Glassnode and Coinbase's Q4 report.

Paxos Launches Yield-Bearing Stablecoin on Injective (INJ)Network

Paxos introduces Wrapped Lift Dollar (wUSDL) on the Injective (INJ)Network, offering users a stablecoin that earns yield from treasury bills, enhancing DeFi interactions.

Regulatory Dynamics: State vs. Federal Oversight of Stablecoin Issuers

Explore the implications of state versus federal regulation on stablecoin issuers, including risks and benefits, as analyzed by Paxos. Understand the challenges and opportunities in the evolving regulatory landscape.

Paxos Expands to Stellar Network, Enhancing Global Stablecoin Adoption

Paxos announces integration with the Stellar network at Meridian 2024, aiming to boost institutional adoption of stablecoins and enhance global financial accessibility.

Stablecoins Lead the Charge in Western Europe's Crypto Adoption for 2024

Western Europe sees a surge in stablecoin adoption, accounting for nearly half of all crypto inflows. The UK drives growth in merchant services, highlighting the region's evolving crypto landscape.

M^0 Integrates Wormhole NTT for Multichain Stablecoin Expansion

M^0 partners with Wormhole to enhance the multichain capabilities of its stablecoin M, utilizing Wormhole's NTT framework to boost interoperability and DeFi adoption.

USDT, USDC, and FDUSD: A Comparative Analysis of Leading Stablecoins

Explore the key differences and similarities between USDT, USDC, and FDUSD stablecoins, their market impact, and why BNB Chain is the ideal platform for these digital assets.

Paxos Launches USDG Stablecoin with Regulatory Compliance

Paxos introduces USDG, a US dollar-backed stablecoin, compliant with Singapore's MAS framework. Partnering with DBS Bank for secure reserve management, USDG aims to enhance global stablecoin adoption.

Paxos Introduces USDG and Global Dollar Network for Stablecoin Advancement

Paxos unveils USDG, a US dollar-backed stablecoin, alongside the Global Dollar Network to boost stablecoin adoption globally, according to Paxos.

Binance Launches 'Word of the Day' Game Featuring Stablecoins Theme

Binance introduces a 'Word of the Day' game focused on stablecoins, offering participants the chance to win Binance Points, redeemable for various rewards.

Tether to Invest in Quantoz for MiCAR-Compliant Stablecoin Launch

Tether announces investment in Quantoz to support MiCAR-compliant stablecoins, EURQ and USDQ, leveraging Hadron by Tether for asset tokenization.

Agora Introduces AUSD Stablecoin on Injective (INJ)Blockchain

Agora launches AUSD, a US dollar-backed stablecoin, on the Injective (INJ)blockchain, enhancing liquidity between DeFi and TradFi markets, and supporting seamless financial transactions.

Tether (USDT) Reports $7.7 Billion Profits and Record U.S. Treasury Holdings in Q3 2024

Tether's Q3 2024 report reveals $7.7 billion nine-month profits, $102.5 billion U.S. Treasury holdings, and a $6 billion reserve buffer, highlighting its financial strength.

Global Dollar Network Launched to Boost Stablecoin Adoption

Anchorage Digital, Bullish, Galaxy Digital, and more launch Global Dollar Network to enhance stablecoin usage globally, featuring the new stablecoin USDG.

Transfero Partners with Wormhole for Multichain Stablecoin Integration

Transfero selects Wormhole's NTT framework to enable multichain functionality for its stablecoins BRZ, ARZ, and CLZ, enhancing security and liquidity across blockchain networks.

Analyzing Stablecoins: Insights from Banking History

Explore the evolution and challenges of stablecoins through the lens of banking history. Understand their design, risks, and future in the financial ecosystem.

Tether (USDT) Strategically Shifts Focus, Discontinues EUR₮ Support

Tether announces its strategic decision to discontinue EUR₮ support, focusing on launching MiCAR-compliant stablecoins and enhancing community-driven support.

Stablecoins, TradFi, and Tokenization Fuel Web3's Next Phase

Web3 is evolving with stablecoins, TradFi integration, and tokenization leading growth. Bitcoin reaches new highs and tokenization expands, marking significant industry milestones.

FDUSD Stablecoin Launches on Sui Blockchain

First Digital introduces its stablecoin, FDUSD, as a native token on the Sui blockchain, expanding DeFi options and showcasing institutional confidence in Sui's growing ecosystem.

Quantoz Launches Euro and Dollar-Backed Stablecoins EURQ and USDQ

Quantoz Payments introduces EURQ and USDQ, MiCA-compliant stablecoins, bridging traditional finance and blockchain under EU regulations, enhancing liquidity in digital markets.

Sui Expands DeFi Horizons with Native Stablecoins

Sui's ecosystem is evolving with the introduction of native stablecoins, reshaping DeFi and unlocking new opportunities. Explore the impact of USDY, AUSD, USDC, and FDUSD.

Bipartisan Support Grows for Key Crypto Issues in the U.S.

U.S. lawmakers from both parties are reaching consensus on essential crypto issues, including regulation, stablecoins, and digital asset innovation, according to a16z crypto.

Crypto Trends for 2025: AI Integration, Stablecoins, and Onchain Government Bonds

Explore key crypto trends for 2025, including AI's role in blockchain, stablecoin adoption by enterprises, and onchain government bonds, according to a16z crypto.

USDT Adoption Surges: Over 330 Million On-Chain Wallets by Q3 2024

USDT's widespread adoption is evident with 330 million on-chain wallets by Q3 2024, highlighting its role as a key player in the digital asset landscape, especially in emerging markets.

Paxos and Standard Chartered Enhance Stablecoin Reserve Management

Paxos partners with Standard Chartered to advance stablecoin reserve management, strengthening digital asset infrastructure and regulatory compliance across global markets.

Stablecoins: The Backbone of Cryptocurrency Transactions

Explore the rise of stablecoins, their mechanisms, market trends, and regulatory landscape. Discover why they are pivotal in cryptocurrency transactions and financial inclusion.

OKX Ventures Backs USUAL for Decentralized Stablecoin Innovation

OKX Ventures invests in USUAL, a decentralized stablecoin protocol integrating Real-World Assets, enhancing DeFi with governance and ownership features.

Are Stablecoins the Future of Global Digital Payments?

Explore the potential of stablecoins in transforming global digital payments, as discussed by experts from Paxos and Chainalysis.

Bitfinex Lists StablR USD (USDR) and Euro (EURR) Stablecoins to Meet European Demand

Bitfinex announces the listing of StablR USD (USDR) and StablR Euro (EURR), aiming to enhance liquidity and stability in the European digital asset market.

Tether Invests in Zengo Wallet to Boost Stablecoin Adoption

Tether announces a strategic investment in Zengo Wallet, aiming to enhance self-custody solutions and drive global stablecoin adoption, reflecting its commitment to secure digital asset management.

Standard Chartered, Animoca Brands, and HKT to Launch HKD-Backed Stablecoin

Standard Chartered, Animoca Brands, and HKT are forming a joint venture to issue a stablecoin backed by the Hong Kong dollar, pending regulatory approval.

Crypto Regulatory Developments: CFTC Leadership and New Legislation Initiatives

Explore recent developments in crypto regulation, including CFTC leadership changes, legislative initiatives on stablecoins, and key actions by the DOJ and SEC.

Stablecoins Revolutionize Global Payments by Eliminating Intermediaries

Stablecoins offer a transformative approach to global payments, reducing costs and increasing efficiency by bypassing traditional financial intermediaries.

BNB Chain Extends Gas-Free Stablecoin Transfers Until June 2025

BNB Chain extends its Gas-Free Carnival, allowing free USDT, USDC, and FDUSD transfers until June 2025. The initiative supports stablecoin usage and accessibility.

Ripple CEO Garlinghouse Foresees Ether ETF Approval, Critiques SEC's Approach

Ripple CEO Brad Garlinghouse predicts the approval of an Ether ETF by the SEC, critiquing the commission's approach under Gary Gensler as a political liability and detrimental to the U.S. economy's growth.

Iran and Russia Seek A Gold-Backed Stablecoin

Iran and Russia are planning a gold-backed cryptocurrency. In Astrakhan, Russia began accepting Iranian goods, a stablecoin would function. Instead of utilizing dollars, rubles, or rials, the initiative would allow cross-border transactions.

NY Fed's digital currency Test Reveals Feasibility

The Innovation Center of the Federal Reserve Bank of New York (NYIC) has successfully completed its proof-of-concept of a regulated liability network (RLN), which was carried out in collaboration with nine significant financial institutions and the Swift network.

Luna Foundation Says Plans to Repay Terra Investors Thwarted by Litigation Woes

The plans to compensate affected Terra users is still far from reality.

FTX Continues to Move Funds Amid Ongoing Investigations

Addresses associated with FTX and its subsidiary, Alameda Research, have reportedly transferred $145 million in stablecoins to various platforms, as the cryptocurrency exchange faces demands to return funds to different groups of investors amid ongoing investigations and lawsuits.

The UK is a step closer to launching a central bank digital currency

The Bank of England thinks crypto stablecoins and a central-bank-issued "digital pound" might coexist.

Binance sees surge in withdrawals amid spooked investors

Investors have pulled billions from Binance in the past day due to US Securities and Exchange Commission and New York Department of Financial Services action against BUSD and Paxos.

USDC Holders Panic Sell Amid Solvency Concerns

On March 10, concerns about the solvency of USD Coin (USDC) led several holders to panic sell their holdings and switch to other stablecoins. One user lost over 2 million USDC in a failed attempt to exchange them for Tether (USDT) using KyberSwap's decentralized exchange aggregator. Tron founder Justin Sun reportedly withdrew 82 million USDC and exchanged them for Dai (DAI) using Aave v2, while IOSG Ventures sold 118.73 million USDC for 105.67 million USDT and 2,756 Ether (ETH). The USDC price has since slowly recovered, and Circle, the company behind USDC, disclosed holding $3.3 billion at the Silicon Valley Bank.

Terraform Labs Seeks Citadel Securities' Trading Data amid SEC Lawsuit

Terraform Labs has filed a motion against Citadel Securities seeking critical trading data for its defense in a lawsuit by the SEC. The case revolves around market destabilization allegations during the May 2022 Depeg event of TerraUSD stablecoin. The motion urges disclosure of trading strategies between March and May 2022, amidst indications of Citadel Securities' alleged intentions to short UST. Terraform Labs stresses the documents' importance in countering the SEC's fraud allegations, proposing a transfer to another court for a decision if necessary.

Tether Holdings Hires Major Wall Street Firm to Manage Treasury Portfolio

Tether has recruited a Wall Street company to handle its Treasury holdings.

BTG Pactual Launches Stablecoin Backed by USD

Brazilian investment bank BTG Pactual has launched its own stablecoin, BTG Dol, which is pegged to the value of the US dollar on a 1:1 ratio. The stablecoin will allow customers to "dollarize" a portion of their equity and will facilitate interaction between traditional finance and the digital economy.

Circle Partners with Cross River Bank for USDC Production and Redemption

Circle has partnered with Cross River Bank for USDC production and redemption, as well as expanded relationships with other banking partners like BNY Mellon. The USDC stablecoin recently experienced a peg-breaking incident but has since recovered.

Circle Rolls Out Native USDC on the Celo Blockchain, Expanding Stablecoin Access

Circle has integrated USDC directly onto the Celo blockchain, enabling faster and cheaper transactions with its native stablecoin. This aligns with Circle and Celo's shared mission of increasing financial access.

Crypto Adoption in Latin America: A Tool Against Economic Woes and Authoritarianism

The cryptocurrency landscape in Latin America, particularly in Argentina and Venezuela, is evolving as a mechanism to counter economic and political adversities. While Argentina sees crypto as a bulwark against economic instability, Venezuela is utilizing it as a tool for humanitarian aid and resistance against authoritarianism. The divergent crypto adoption narratives in these nations underscore the asset class's potential to address complex societal challenges.

Circle's USDC Reserve Exposure and Potential Risks

Circle's latest audit report reveals that the company's exposure to the US banking system stands at nearly $9 billion, with its reserves held by a number of regulated financial institutions, including SVB, BNY Mellon, and Silvergate. However, recent events such as the shutdown of SVB and Silvergate's decision to shut down its crypto bank arm have raised concerns about potential risks for Circle and its stablecoin USDC.

FSB 2024 Agenda: Strengthening Crypto Regulation and Embracing AI"

The Financial Stability Board (FSB) has announced its 2024 Work Programme, focusing on crypto regulation, AI, and digital innovation, aiming to enhance global cooperation and stability in finance.

Federal Reserve's Bowman Discusses Digital Currency Innovations Amid CBDC Debate

Federal Reserve Governor Michelle Bowman, in a discussion at Harvard Law School, explored the evolving digital payment landscape, touching on CBDC, stablecoins, and the necessity for a robust regulatory framework. While recognizing the potential of digital assets, she emphasized a cautious approach, underscoring the importance of continued research and international collaboration to navigate the digital transformation responsibly.

Terraform Labs co-founder defends against SEC allegations

Do Kwon, co-founder of Terraform Labs, has defended himself against allegations of fraud from the US Securities and Exchange Commission (SEC). Kwon’s lawyers have requested the dismissal of the lawsuit, claiming that the SEC's allegations are unfounded and that US law prohibits regulators from asserting jurisdiction over the digital assets in question. The lawyers also argued that the SEC failed to prove Kwon’s involvement in the collapse of Terra’s stablecoin, UST.

Cryptocurrency Soars in Q1 2023

CoinGecko's Q1 2023 Crypto Industry Report shows Bitcoin as the best-performing asset, with a gain of 72.4%. DeFi and NFTs have also surged, while stablecoins saw a drop in market cap due to Binance USD shutdown and USDC depeg. The overall market capitalization reached $1.2 trillion at the end of Q1.

Financial Services Reforms Advance UK Crypto Ambitions

The U.K. Chancellor of the Exchequer, Jeremy Hunt, laid out a number of reforms aiming to "drive growth and competitiveness" to the country's financial services sector. The reforms include consulting on proposals for the establishment of a central bank digital currency (CBDC), extending a crypto tax break for investment managers and creating a sandbox that lets firms and regulators test new technologies.

Breaking: Visa Expands Stablecoin Settlement On Solana

Visa has expanded its stablecoin settlement capabilities, incorporating the Solana blockchain and initiating pilot programs with merchant acquirers Worldpay and Nuvei. The move aims to modernize cross-border money movement by leveraging stablecoins like Circle's USDC. Visa has conducted live pilots, transferring millions of USDC between partners over Solana and Ethereum blockchain networks to settle fiat-denominated payments authorized via VisaNet. The new settlement options enable Visa to send funds on-chain to acquirers like Worldpay and Nuvei, serving various sectors.

Financial Stability Board Finalizes Global Crypto Asset Regulatory Framework

FSB finalizes a global regulatory framework for crypto assets, aiming for consistent regulation. The framework includes high-level recommendations for crypto-asset activities and stablecoins.

Terraform Labs Co-Founder Indicted for Terra Stablecoin Collapse

Shin Hyun-seong, co-founder of Terraform Labs, has been indicted along with nine other individuals for the collapse of the Terra stablecoin ecosystem. They are accused of fraud, breach of trust, and embezzlement, with illicit profits of nearly $350 million suspected. Prosecutors have seized assets worth a total of $180 million.

Tether Criticizes UN Report for Overlooking USDT Traceability and Law Enforcement Collaboration

Tether rebuts a UN report accusing USDT of facilitating illicit activities, underscoring its traceability and law enforcement collaboration, and highlighting USDT's positive impact on developing economies.

Tether Ventures into Sustainable Energy Production and Bitcoin Mining in Renewable-Rich Uruguay

Tether, the company renowned for powering the world's foremost stablecoin, announced today its ambitious venture into energy production and sustainable Bitcoin mining in Uruguay.

HKMA Initiates Stablecoin Issuer Sandbox Program

The HKMA has announced the launch of a stablecoin issuer sandbox, a step forward for fintech innovation in Hong Kong, aligning with regulatory oversight.

US Senators Introduce Bipartisan Stablecoin Bill to Establish Regulatory Framework

Senators Kirsten Gillibrand and Cynthia Lummis have introduced the Lummis-Gillibrand Payment Stablecoin Act, a new bipartisan legislation aimed at creating a clear regulatory framework for payment stablecoins. The bill aims to protect consumers, promote innovation, and maintain the dominance of the US dollar while addressing concerns related to money laundering and illicit finance.

Japan to Adopt New Stablecoin Regulations

Japan's Financial Services Agency (FSA) is trying to legalise stablecoin distribution. New 2023 legislation enable stablecoins like Tether (USDT) and USD Coin (USDC).

MakerDAO Keeps USDC as Primary Collateral for Dai

MakerDAO has voted to keep USDC as the primary collateral for Dai, rejecting a proposal to diversify into GUSD and USDP. The decision was made based on reduced risks from a cascading bank run in the US and USDC's return to a $1 peg.

Stablecoins Could Bolster U.S. Dollar and Economic Competitiveness: Circle CEO

In a compelling testimony delivered to the House Financial Services Committee, Jeremy Allaire, CEO and Co-Founder of Circle, underlined the significant role stablecoins, such as the U.S. Dollar Coin (USDC), could play in strengthening the global position of the U.S. dollar.

Poundtoken and BitcoinPoint will make the country's first 100% backed GBP stablecoin

Two UK firms employ ATM stablecoins to make Britain a "crypto centre."

Dismissal of Lawsuit Against Tether and Bitfinex Affirmed, Plaintiff Drops Appeal

Tether and Bitfinex have won a lawsuit against Shawn Dolifka and Matthew Anderson, despite allegations of misleading statements about USDT reserves, underscoring the importance of transparency in the cryptocurrency sector.

US Draft Bill Proposes Framework for Stablecoins

A new draft bill has been published in the United States proposing a regulatory framework for stablecoins. The bill would put the Federal Reserve in charge of non-bank stablecoin issuers, such as Tether and Circle. Insured depository institutions seeking to issue stablecoins would fall under federal banking agency supervision. The bill also includes a ban on issuing stablecoins not backed by tangible assets and proposes a study on "endogenously collateralized stablecoins."

Paxos Trust Company Disagrees With U.S. Securities

Paxos, a stablecoin issuer, received an SEC Wells notice earlier this month and "categorically denies" that BUSD is a securities.

Russia Collaborates With Other Countries to Setup Stablecoin Cross-border Clearing Platform

Russia is already working with several countries to establish clearing platforms for cross-border settlements of stablecoins, according to the state-backed TASS news agency.

Citizens Trust Bank Holds $65 Million in USD Coin reserves

Citizens Trust stated the USDC reserves would support financial literacy and small business funding.

Banks increase risks to stablecoins

The death of the Terra ecosystem triggered a bear market in 2022, causing losses in billions, affecting investor sentiment, and intensifying the regulatory spotlight over cryptocurrencies. Recently, Circle's disclosure that Silicon Valley Bank (SVB) did not process its $3.3 billion withdrawal request led to the depegging of its USD Coin (USDC). This event caused Binance CEO CZ to believe that traditional banks are a risk to stablecoins that are usually pegged 1:1 with fiat currencies, like the U.S. dollar.

Tether Implements Wallet-Freezing Policy Aligned with US Regulations

Tether's wallet-freezing policy, in line with US OFAC regulations, is a proactive approach to cybercrime, setting a new standard in the crypto industry.

Circle CEO Criticizes SEC Stablecoin regulations

As payment systems, stablecoins are not securities, according to Circle's CEO.

Circle's Stablecoin USDC Affected by Collapsed Bank

Circle's USDC stablecoin briefly de-pegged after news that $3.3 billion of its cash reserves were stuck with collapsed bank Silicon Valley Bank. USDC's dollar peg has since recovered, but mass redemptions have led to a drop in the stablecoin's market cap by nearly 10% since March 11.

US House Committee to Discuss Stablecoin Regulation

The US House of Representatives Committee on Financial Services will conduct a hearing on stablecoin regulation on April 19th, following the introduction of a draft bill on stablecoin regulation. The hearing will include testimonies from experts, including Austin Campbell, a managing partner at Zero Knowledge Consulting and adjunct professor at Columbia Business School, who believes stablecoins will expand the reach of the US dollar and increase financial inclusion.

Cryptocurrency Community Debates Fallout from Closure of Major American Banks

The closure of three major American banks that serve cryptocurrency firms, including Silicon Valley Bank and Signature Bank, has sparked debate within the cryptocurrency community. The closure of Silicon Valley Bank, which held over $3.3 billion of USD Coin issuer Circle's $40 billion reserves, has caused particular concern. As a result, the cryptocurrency ecosystem is now exploring neobank services and other options to bridge the gaps exposed by the latest mainstream banking failure.

Paxos Identifies Key Opportunities During Crypto Winter

Blockchain infrastructure provider Paxos has published a report identifying opportunities for crypto projects during the current market conditions, including seeking solutions and partnerships. The report highlights the usefulness of stablecoins while acknowledging the need for greater transparency. Partnerships with businesses addressing real-world needs were also deemed important. The CEO of the Stellar Development Foundation suggested that regulating stablecoins may be necessary to maintain a strong dollar, while a recent Bank of International Settlements report deemed stablecoins a less preferable form of tokenized money.

HKUST Vice-President Urges Hong Kong to Issue Stablecoin HKDG

According to TKWW, key figures including HKUST Vice-President suggest that the Hong Kong government should issue its own stablecoin, referred to as HKDG, as a strategic move to bolster the city's digital economy.

Bermuda Remains Committed to Crypto Despite FTX Collapse

Bermuda's Premier and Finance Minister, Edward Burt, stated that despite the collapse of crypto exchange FTX in nearby Bahamas, Bermuda will continue to accommodate digital asset and blockchain technology companies due to the benefits they offer. The territory, which implemented a regulatory framework for digital assets, recently released its first stablecoin powered by the Polygon blockchain.

Tether Denies Receiving Any Loans From Celsius

Tether's chief technical officer Paolo Ardoino denied borrowing from Celsius in response to Celsius' examiner report.

Celsius Files for Permission to Sell Its Stablecoin Holdings

Celsius is seeking to generate liquidity through sales from its $23 million in stablecoin holdings.

CBN Approves Africa Stablecoin Consortium's cNGN for Regulatory Sandbox Pilot

CBN approves ASC's cNGN stablecoin, a regulated digital currency pegged to the Naira, launching on Feb 27, 2024.

TrueUSD Depegging Linked to Binance Launchpool Activities

TrueUSD (TUSD) depegged below its $1 parity, dropping to $0.97, amid significant selling on Binance and issues with real-time reserve attestations. The depegging was linked to activities on Binance Launchpool and raises questions about stablecoin stability and transparency.

DeFi Platform Raft Compromised, Loses $3.3 Million in Ether

Raft DeFi platform hacked, loses $3.3M in ETH. Attacker burns most stolen ETH, faces net loss.

Depegging of USDC and DAI Saves Borrowers $100 Million

The depegging of USD Coin (USDC) and Dai (DAI) from the US dollar resulted in more than $2 billion in loan repayments on decentralized lending protocols Aave and Compound, with borrowers saving a total of over $100 million. USDC and DAI started heading back toward their peg, and repayment activity tapered off in the following days.

UK Extends Stablecoin Regulation Consultation Period, Seeks Inclusive Feedback

The Bank of England and the Financial Conduct Authority have extended the feedback deadline for stablecoin regulation to February 12, aiming for a comprehensive, inclusive regulatory framework.

Circle Introduces Native USDC on OP Mainnet: What It Means for the Ecosystem

Circle launches native USDC on OP Mainnet, replacing Ethereum bridged liquidity. Collaborating with Optimism, it will be available on Coinbase's Base, Solana, Ethereum, and Mercado Pago.

Breaking: Key US House Committee Leaders Challenges Federal Reserve on Stablecoin

The House Financial Services Committee is concerned about the Federal Reserve Board's recent regulatory actions on payment stablecoins, arguing they could hinder Congress's digital asset framework, impose additional regulatory burdens, and potentially cause financial repercussions.

The third-largest French bank Introduces Euro-Pegged Stablecoin

Société Générale has introduced EUR CoinVertible, a euro-pegged stablecoin, marking a significant shift in the integration of traditional finance with digital assets.

Regulated Stablecoins Likely to Remain in Use by 2030

A panel of digital regulatory experts at the World of Web3 (WOW) Summit in Hong Kong discussed the future of regulated stablecoins. The group concluded that regulated stablecoins are likely to remain in use by 2030 and that their growth rate in the market supports this idea. The panelists acknowledged the growth of the crypto industry and emphasized the importance of both centralized and decentralized approaches to digital assets.

Circle Plans to Increase Workforce by 15-25%

Circle's $42 billion USDC is the second-largest stablecoin behind Tether's USDT.

Australian Senator Proposes Digital Asset Regulation Bill

Senator Andrew Bragg has proposed a Digital Assets (Market Regulation) Bill 2023 to regulate cryptocurrency services in Australia. The bill recommends stablecoin regulations, licensing of exchanges, and custody requirements to protect consumers and promote investment.

Hong Kong Politician Seeks DeFi-Based Stablecoin CBDC

Hong Kong authorities are currently considering issuing a CBDC as a government-backed stablecoin. Wu Jiezhuang, a Legislative Council member of the Hong Kong Special Administrative Region, thinks converting e-HKD into a stablecoin will mitigate Web3 virtual asset concerns.

Visa New Crypto Initiative

Visa is developing a new crypto product to promote the adoption of public blockchain networks and stablecoin payments. The company is seeking software engineers with experience in programming, Web3 technologies, and Solidity to build the product.

Circle's USDC Reserve Mishap Leads to Massive Sell-off

Circle's announcement that Silicon Valley Bank failed to transfer $3.3 billion of its USDC reserves led to a significant sell-off, causing the stablecoin to depeg from the U.S. dollar. Investors who tried to cut their losses by exchanging USDC for other stablecoins, such as USDT, faced exorbitant prices.

Crypto Market Consolidation and Key Trends in Q2 2023

Q2 2023 saw a slight 0.14% increase in the crypto market, with Bitcoin (BTC) and Ethereum (ETH) rising by 6.9% and 6.0% respectively.

Montenegrin Prime Minister Dritan Abazovic has announced a pilot digital currency project

After meeting with Ripple at the World Economic Forum, Montenegrin Prime Minister Dritan Abazovic launched a prototype digital currency initiative.

Circle Launches Circle Research with Perimeter Protocol

Circle launches 'Circle Research' to further technical innovation in crypto, blockchain, and Web3 through open-source research. The initiative's first contribution, Perimeter Protocol, sets a new standard for building on-chain credit markets. Circle releases the Perimeter white paper and public GitHub Repo to advance open protocol transacting with a focus on credit, catering to a wide range of credit scenarios.

TrueUSD Partners with Alchemy Pay to Facilitate Direct Crypto Purchases in 173 Countries

Alchemy Pay partners with TrueUSD to enable direct crypto purchases via fiat in 173 countries, enhancing accessibility and transparency in the crypto industry.

HKMA Stablecoin Regulations to Demand Backing by Underlying Assets

The main financial regulator will require stablecoin issuers to always back their values with reserve assets.

National Australia Bank to Launch Ethereum-Based Stablecoin

NAB will introduce an Ether-based Australian dollar-pegged stablecoin. Reports say the AUDN stablecoin streamlines cross-border transfers and carbon credit trading.

Circle Plans to Cover USDC Shortfall After SVB Shutdown

Circle, the issuer of the stablecoin USD Coin (USDC), has announced that it will use corporate resources to cover the shortfall on its reserves after Silicon Valley Bank (SVB) was shut down by the California Department of Financial Protection and Innovation. USDC liquidity operations will resume as normal when banks open on Monday, enabling redemption at 1:1 with the US dollar. The stablecoin lost its $1 peg on March 11, trading as low as $0.87, due to the disclosure of $3.3 billion of Circle's reserve held at SVB.

LidoDAO is considering selling or staking its $30 million

LidoDAO, the decentralized autonomous organization behind Lido, is considering staking or selling its $30 million ETH treasury to meet unexpected market swings.

BIS Survey: 93% of Central Banks Engaged in CBDCs, 15 Retail and 9 Wholesale CBDCs Expected by 2030

The Bank for International Settlements (BIS) has released a survey revealing that 93% of central banks are now engaged in some form of Central Bank Digital Currency (CBDC) work, with retail CBDCs taking the lead over wholesale CBDCs.

FDIC to Offer Guidance on Crypto After it Understands its Associated Risks

FDIC's Martin Gruenberg said more guidance will be given to banks about crypto when it gains more understanding of its inherent risks

Shinhan Bank and SCB TechX Achieve Milestone with Successful Stablecoin Remittance Pilot on Hedera Network

Shinhan Bank, SCB TechX, and Taiwan's largest financial institution have successfully completed a stablecoin remittance proof-of-concept (PoC) pilot on the Hedera network, as announced on July 18th, 2023.

Cryptocurrency Firms Deny Exposure to Troubled US Banks

Major cryptocurrency firms, including Tether, Crypto.com, Gemini, BitMEX, and others, have denied exposure to dissolved U.S. banks like Silicon Valley Bank and Signature Bank. The firms have taken to social media to assure their users that their funds are safe and accessible despite ongoing issues in the U.S. banking system.

Aave Freezes Stablecoin Trading Amid Price Volatility

Lending protocol Aave has temporarily halted trading of stablecoins and set the loan-to-value (LTV) ratio to zero due to the recent price volatility on USD Coin (USDC) following its depegging on March 11. Aave's decision was based on an analysis by decentralized finance risk management firm Gauntlet Network, which recommended a temporary pause of all v2 and v3 markets. The LTV ratio determines how much credit can be secured using crypto as collateral and is calculated by dividing the amount of credit borrowed by the value of the collateral.

Stablecoin Depeg Event Reveals Risks to DeFi and Traditional Finance

Recent failures of established financial institutions, such as Silicon Valley Bank and Signature Bank, have highlighted the potential for distress to spread to the decentralized finance (DeFi) sector. The depegging of stablecoins, including Circle's USD coin (USDC), has also brought governance risks related to the custody of reserve assets to the forefront. Moody's anticipates that regulators could increase their scrutiny of stablecoins and require greater counterparty diversification.

The Financial Stability Board (FSB) is pushing for international regulations

Global standard-setting organisations are helping the Financial Stability Board evaluate DeFi legislation in numerous countries.

Hong Kong's 2024 Budget Introduces 'Regulatory Sandbox' for Stablecoin Testing

Hong Kong to launch a 'regulatory sandbox' for testing stablecoin issuance and business models, as outlined in the city's 2024 budget plan.

First Digital Group Launches New Stablecoin FDUSD to Revolutionize Global Finance

Asia's leading trust company and qualified custodian, First Digital, is making waves in the global financial ecosystem with the announcement of its new stablecoin, First Digital USD (FDUSD)

White House Report Casts Doubt on Cryptocurrencies

The White House's Economic Report includes a chapter questioning the benefits of cryptocurrencies, with 35 pages dedicated to debunking them. It argues that crypto assets fail to deliver on their promised benefits, and that they are too volatile to be a stable store of value or reliable medium of exchange.

BUSD, Paxos, and the Recent Scrutiny of Paxos

Matrixport's director of research believed Paxos' BUSD supervision was too lax, prompting regulatory attention. Stablecoins are not the goal.

Terraform Labs Co-Founder Argues Against SEC Lawsuit

Terraform Labs co-founder, Do Kwon's lawyers have argued in court against the SEC's lawsuit for illegally offering unregistered securities. The lawyers claim the SEC's acquisitions are unfounded and that the stablecoin in question is a currency, not a security. Additionally, Kwon's arrest and subsequent extradition remain uncertain.

Bank of America Says Binance to Benefit from Increased Supply of Its Own Stablecoin

BAC has given more clarification on how Binance’s automatic conversion of other stablecoins could impact its business as well as its own BUSD stablecoin.

Moody warns of stablecoin adoption risk

Moody's Investors Service has warned that the recent turmoil in the traditional banking sector and USDC losing its peg could negatively impact stablecoin adoption and increase calls for regulation. The credit rating agency believes that fiat-backed stablecoins like USDC could face new resistance, limiting their stability and potentially causing a run on banks holding Circle's assets, which could lead to the depegging of other stablecoins.

US Federal Reserve to Create Cryptocurrency Team Amid Concerns Over Unregulated Stablecoins

The US Federal Reserve is planning to establish a specialized team of experts to keep up with developments in the cryptocurrency industry, specifically focusing on stablecoins. The move comes amid concerns that unregulated stablecoins could put households, businesses, and the broader economy at risk. While acknowledging the transformative potential of cryptocurrencies, the Federal Reserve believes that appropriate guardrails need to be in place to ensure that the benefits of innovation can be realized.

The Judge Decides Celsius Owns Money In Earn Accounts, Allowing Stablecoin Selling

On January 4, Reuters reported that US investigators had told a court that they were taking assets tied to FTX and its former CEO, Sam Bankman-Fried. The document included 468 million dollars' worth of Robinhood shares, valued 56 million at the time. The report was released a day after a court ordered SBF to stop accessing FTX and Alameda-related bitcoin and assets.

CoinGecko Report: 2023 Crypto Industry Rebounds with Resilience and Transformation

2023 saw a resilient crypto industry with a 108.1% increase in market cap to $1.72T and a total trading volume of $36.6T. NFT trading reached $11.8B, while stablecoins like Tether maintained a strong presence. Bitcoin's value rose significantly, contributing to the year's positive momentum.

Cardano's New Algorithmic Stablecoin DJED

ADA, Cardano's native token, backs the algorithmic stablecoin, which is tied 1:1 to the US dollar.

BitMEX Co-Founder Proposes Bitcoin-Backed Stablecoin

Arthur Hayes, the co-founder and former CEO of BitMEX, has proposed creating a new stablecoin called the Satoshi Nakamoto Dollar (NUSD) or NakaDollar. Unlike major reserve-backed U.S. dollar-pegged stablecoins, the proposed NakaDollar would be pegged to the sum of $1 worth of Bitcoin and one inverse perpetual swap of BTC against USD, without relying on any USD reserves. The stablecoin's peg to the U.S. dollar would be maintained via mathematical transactions between the new decentralized autonomous organization (DAO) authorized participants and derivatives exchanges.

TrueUSD (TUSD) Strives to Resume Minting with Prime Trust

In recent updates, the TrueUSD (TUSD) team has announced that they are actively engaged in efforts to resume TUSD minting on Prime Trust. This announcement was made following an unexpected pause in TUSD minting via Prime Trust, an event that took place on June 10.

Boyaa Interactive Advances into Cryptocurrency with a $100 Million Acquisition Mandate

Boyaa Interactive plans to invest $100 million in cryptocurrencies, focusing on Bitcoin, Ether, and stablecoins, while ensuring secure platforms in the volatile crypto market.

Elizabeth Warren Urges Treasury Secretary Yellen to Implement Strong AML/CFT Measures for Stablecoins

US Senator Elizabeth Warren has urged Treasury Secretary Janet Yellen to include comprehensive Anti-Money Laundering and Combating the Financing of Terrorism measures for stablecoins, highlighting potential risks of funding terrorist activities.

Circle's 2024 USDC Economy Report Reveals Significant Growth in Stablecoin Adoption

Circle's 2024 report on the USDC economy highlights significant growth in stablecoin adoption and usage, with a 59% increase in USDC wallets and over $12 trillion settled in blockchain transactions since its inception.

HUSD Stablecoin Drops 56% From Dollar Peg Following Huobi Delisting

According to CoinMarketCap, HUSD stablecoin has fallen massively from its $1 peg, dropping to a low of $0.32 following delisting from crypto exchange Huobi on Friday last week.

Hong Kong to introduce comprehensive stablecoin regulation, focusing on innovation and investor protection.

Hong Kong is launching a public consultation to establish comprehensive stablecoin regulations, aiming to balance innovation with investor protection, marking a significant step in cryptocurrency governance.

South Korean Officials Confirm They Sent Team to Serbia to Find Do Kwon

South Korean authorities have increased their search for Do Kwon and deployed state officials to Serbia.

USD Coin Chief Strategy Officer Twitter Account Hacked

Circle's USD Coin (USDC) stablecoin chief strategy officer Dante Disparte's Twitter account has been hacked, with the account reportedly promoting fake loyalty rewards to long-time users of USDC.

Taiwan's Legislature Considers Virtual Asset Management Bill to Protect Consumers

The Taiwanese Legislature is deliberating on a new Virtual Asset Management Bill aimed at fostering better consumer protection and industry oversight. The bill, seen as moderate, outlines pragmatic mandates for VASPs while leaving room for further regulatory fine-tuning, marking a significant step in Taiwan’s evolving digital asset regulatory landscape.

USDC issuer Circle releases accountant-verified report

Circle's newest reserve report shows $44.5 billion USDC stablecoin assets.

Stablegains Sued for Allegedly Misleading Investors

Stablegains, a DeFi yield platform that closed in May, is being sued in California.

Frax Finance has voted to fully collateralizing

Frax Finance decided to completely collateralize the $1 billion capitalization Frax stablecoin.

NY Fed New Rules Cast Uncertainty on Circle's Access to Reverse-Repurchase Program

The New York Federal Reserve has updated its rules for reverse repurchase agreements (RRP), potentially hindering Circle's access to the Fed's reverse-repurchase program. The Circle Reserve Fund is a money market fund only available to Circle and could be deemed ineligible under the Fed's updated guidelines.

MoneyGram CEO Sees Stablecoin As Future of Payments as Service Needs Grow

Stablecoins provide low-cost and easily accessible digital payments across international borders.

Alameda Research Minted Over $39 Billion USDT, Amounting to Nearly Half of Tether's Circulating Supply

Recent data analysis reveals that Alameda Research minted $39.55 billion USDT, nearly half of Tether's circulating supply. The findings underscore the significant role of major crypto trading firms in stablecoin operations, with a detailed examination of USDT's creation and redemption processes.

Multichain CEO's Arrest Triggers Operational Freeze

In a series of unfortunate events, the Multichain protocol, a cross-chain router protocol, has been left in a state of uncertainty following the arrest of its CEO, Zhaojun, on May 21, 2023. The arrest led to a series of operational disruptions, including the revocation of operational access keys to the Multichain's MPC node servers, which were under Zhaojun's personal control.

Bitcoin Miners Move 54,000 BTC to Binance as Liquidity Drops

Recently, significant Bitcoin transactions have been observed in the market. According to Ki Young Ju, the CEO of CryptoQuant, Bitcoin miners have reportedly transferred a whopping 54,000 BTC to Binance over the last three weeks.

Overnight collapse of two traditional banks triggers chaos

The collapse of Silicon Valley Bank and Signature Bank caused major chaos, resulting in stablecoins depegging from the U.S. dollar. The federal government has taken action to protect depositors, and President Joe Biden has vowed to hold those responsible accountable.

Crypto Market Swings to Extreme Greed as USDT & USDC Issuance Skyrockets

KuCoin's latest research highlights a major shift in the crypto market to extreme greed, backed by a $4.55 billion rise in stablecoins USDT and USDC, signaling increased market liquidity.

Binance pivots to stablecoins after SEC regulatory action

Binance, the largest cryptocurrency exchange by trading volume, has turned to alternative stablecoins such as TrueUSD (TUSD) and decentralized stablecoins, following a regulatory action against its native stablecoin, Binance USD (BUSD), by the US Securities and Exchange Commission (SEC). Binance was forced to seek alternatives after the New York Department of Financial Services (NYDFS) asked BUSD issuer Paxos Trust to stop minting new BUSD altogether.

US House Committee to Discuss Stablecoins Regulation

The US House Committee on Financial Services will conduct a hearing on April 19 to evaluate stablecoins’ position as a means of payment and whether the payment ecosystem needs supporting legislation. Circle's chief strategy officer and head of global policy, Dante Disparte, will testify at the hearing, which will focus on various stablecoins and their use in the payments landscape. A draft bill providing a framework for stablecoins in the United States was recently published in the House of Representatives document repository.

Breaking: PayPal Launches Stablecoin PYUSD

PayPal has launched a U.S. dollar stablecoin, PayPal USD (PYUSD), backed by U.S. dollar deposits and Treasuries.

US Crypto Crackdown Hurts USD Coin

Circle CEO Jeremy Allaire has blamed the declining market capitalization of USD Coin (USDC) on the cryptocurrency crackdown by US regulators. Allaire cited global concern about the US banking system and regulatory environment as major factors.

Heath Tarbert Joins Circle as Chief Legal Officer and Head of Corporate Affairs

Circle Internet Financial has appointed Heath Tarbert as its new chief legal officer and head of corporate affairs, effective from July 1, 2023.

Tether Completes Reserves Attestation by Major Global Accounting Firm

BDO, a global accounting company, has attested Tether's reserves.

IMF: Latin America and the Caribbean Embrace CBDC and Crypto Assets

Interest in central bank digital currencies (CBDCs) is on the rise in Latin America and the Caribbean (LAC), with several countries making significant advancements in their adoption, according to IMF.

Circle's USDC Reserve Exposure and Potential Risks

Circle's latest audit report reveals that the company's exposure to the US banking system stands at nearly $9 billion, with its reserves held by a number of regulated financial institutions, including SVB, BNY Mellon, and Silvergate. However, recent events such as the shutdown of SVB and Silvergate's decision to shut down its crypto bank arm have raised concerns about potential risks for Circle and its stablecoin USDC.

US Congress needs to take control of crypto legislation

Blockchain Association CEO Kristin Smith said crypto regulation is occurring "behind closed doors" and asked for a more collaborative and "transparent approach."

Bitwise to Launch Two Innovative Ethereum Futures ETFs on October 2

Bitwise Asset Management to launch two first-of-its-kind Ethereum Futures ETFs, AETH and BTOP, on October 2. The ETFs offer exposure to CME Ether futures in a regulated format.

Tether Unveils Recovery Tool for Enhanced Blockchain Stability and User Asset Protection

Tether introduces a robust blockchain recovery plan to secure USDT tokens and ensure uninterrupted access across multiple blockchains.

Circle Spokesperson Denies Blaming SEC for Failed $9 billion deal

Circle denies blaming the SEC for its December $9 billion failed IPO. Circle's representative said any contradictory assertions are "inconsistent" with past declarations.

Curve Founder Proposes Venus Protocol Deployment on Ethereum Mainnet

Michael Egorov of Curve Finance proposes launching Venus Protocol on Ethereum Mainnet, incorporating Curve's stablecoin crvUSD and CRV as collaterals, with community support for growth.

KuCoin Ventures Invests in Yuan-Pegged Stablecoin

KuCoin Ventures leads a $10 million investment in CNHC, a Chinese yuan-pegged stablecoin issuer and blockchain payment service provider.

Binance converts remaining $1 billion in Industry Recovery Initiative to native crypto amidst concerns around stablecoins

Binance co-founder and CEO, Changpeng Zhao, announced on March 13 that the exchange will be converting the remaining $1 billion funds in its Industry Recovery Initiative to native crypto amid concerns surrounding stablecoins. This decision was made following the depegging of the USD Coin (USDC) stablecoin caused by the failure of three major crypto-friendly banks - Silicon Valley Bank (SVB), Silvergate Bank, and Signature Bank.

VanEck Spearheads Entry into Stablecoin Market with Agora's AUSD Launch

Agora, backed by VanEck, announces the launch of AUSD, a USD-backed stablecoin, following a successful $12 million funding round led by Dragonfly.

Multicoin Capital's Vision for 2024: Embracing AI, Crypto, and Web3 Innovations

Multicoin Capital's 2024 outlook highlights the transformative role of AI, stablecoins, and innovative token distribution in the crypto and blockchain landscape. The firm foresees significant advancements in remittances, social applications, and various sectors integrating crypto as a foundational element.

Tether Appoints Jesse Spiro as Head of Government Affairs Amid Regulatory Challenges

Tether appoints Jesse Spiro as Head of Government Affairs to strengthen regulatory relations amid U.S. scrutiny, leveraging his PayPal and Chainalysis experience.

U.K. Treasury Proposes Ambitious Crypto Regulations