Ethereum’s Address Activity is Growing Again Following the Recent Panic Selloff

Ethereum (ETH) has been on a negative trajectory ever since the second-largest cryptocurrency dropped from the recent all-time high (ATH) of $4,350. ETH was trading at $2,661, according to CoinMarketCap.

Nevertheless, Santiment has acknowledged that Ethereum is gaining momentum as address activity in this network is growing again. The on-chain metrics provider explained:

“Ethereum’s address activity is growing again, & the amount of active deposits that were prevalent during the major panic selloff last week has died down. The crowd sentiment is bearish, which is a good sign for the bulls.”

The Ethereum network is also being boosted because the number of addresses holding more than 0.01 ETH reached a record-high of 15,741,620.

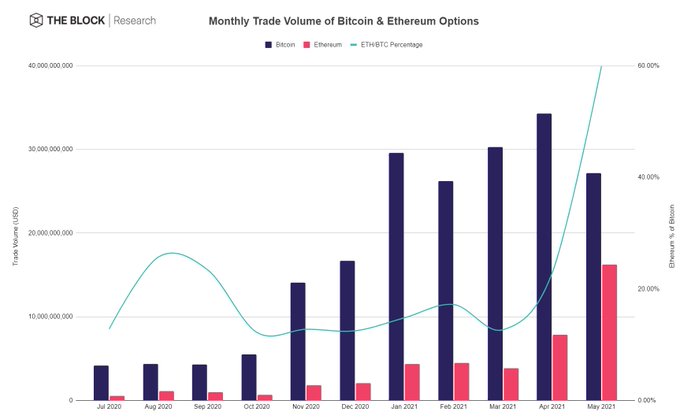

Ethereum options spiked in May

According to crypto data provider Documenting Ethereum:

“Monthly Trade Volume of Bitcoin & Ethereum options. Ethereum volume spiking in May.”

On the other hand, the mean fee paid on the ETH network hit a 4-month low of $6.73.

Ethereum has been grappling with the challenge of high gas fees, which at one time became unbearable for those general traders.

The launching of ETH 2.0 in December 2020 is expected to tackle this problem, given that it will transit the present proof-of-work (POW) consensus mechanism to a proof-of-stake (POS) platform. Furthermore, scalability and efficiency are to be boosted.

Meanwhile, the world’s first Ether Exchange Traded Fund (ETF) by Purpose Investments surpassed 50,000 ETH on May 29.

The Ether ETF is a type of security that tracks the overall price of ETH. It enables investors to trade and purchase shares of it on traditional exchanges or circumventing crypto trading platforms.

Therefore, it was expected to offer investors a simple, affordable, and efficient way to attain direct exposure to ETH with the convenience of eligibility in any investment account.

Image source: Shutterstock