CBDC

What is a CBDC?

A central bank digital currency (CBDC) is a new digital form of sovereign money. CBDCs are issued by the government, where monetary policies are still formed by the central bank.

A central bank digital currency (CBDC) is a new digital form of sovereign money. CBDCs are issued by the government, where monetary policies are still formed by the central bank.

Crypto Week 2025: How Washington Just Rewrote the Rules for Stablecoins, Exchanges, and the Digital Dollar

During "Crypto Week" in July 2025, the U.S. established clear rules for stablecoins, favoring private tokens over a government CBDC, enhancing regulatory clarity.

HKMA Concludes e-HKD Pilot Program, Sets Future Path for Digital Currency

The Hong Kong Monetary Authority (HKMA) has concluded the e-HKD Pilot Programme, unveiling findings and future plans for the digital currency, focusing on wholesale applications.

Dollar vs Digital Yuan: Can India Stay Neutral in the Currency Cold War?

In 2025, India aims for neutrality in the currency landscape, enhancing rupee stability and expanding non-USD payment options while avoiding reliance on the digital yuan or the dollar.

BRICS Coin 2025: What a Common Digital Currency Would Mean for the Rupee

In 2025, there's no official BRICS coin; instead, a focus on local-currency deals and payment interoperability is emerging, benefiting India's rupee without replacing it.

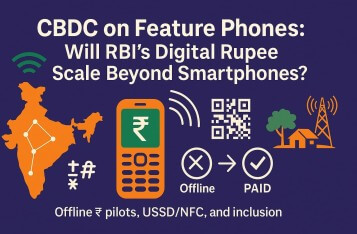

CBDC on Feature Phones: Will RBI's Digital Rupee Scale Beyond Smartphones?

India's digital rupee (e₹) aims to reach feature-phone users, with offline capabilities being tested. Progress exists, but widespread adoption remains a challenge.

Saudi mBridge & Digital Riyal Pilot 2025: Transforming Global Oil Settlement & Trade

Saudi Arabia's Central Bank is piloting a digital riyal through Project mBridge, enabling faster, cheaper oil settlements and reducing reliance on the US dollar.

eRupee Offline Wallets 2025: Supported Banks, Transaction Limits & Data-Free Payments

Discover eRupee offline wallets for 2025—supported banks, limits, and secure digital payments in India without data access.

Offline e-Rupee Pilot: RBI Tests INR 2 K Bluetooth CBDC Wallets Across Rural Odisha & Bihar

India’s offline e-rupee pilot targets 400M feature-phone users in low-connectivity areas. With ₹2K/wallet limits & Bluetooth sync, it aims for disaster-proof payments. Success could make it the 1st scalable feature-phone CBDC.

Hong Kong and Brazil Collaborate on Cross-Border Tokenization Initiatives

The Hong Kong Monetary Authority and Banco Central do Brasil are collaborating on cross-border tokenization projects, focusing on CBDC infrastructures and financial market innovation.

Hong Kong Treasury Markets Summit 2024 Highlights Key Financial Innovations

The Treasury Markets Summit 2024, hosted by HKMA and TMA, focused on offshore renminbi business, DeFi, Metaverse, and CBDCs.