Ethereum Gas Fees Surge to a Monthly High, Supply on Exchanges Continues to Decline

After hitting highs of $4,350 recently, Ethereum (ETH) retraced to $3,871 at the time of writing, according to CoinMarketCap.

The crypto market experienced shock waves after Tesla, the American electric car manufacturer, decided not to accept BTC payments, citing concerns of negative environmental impact.

The Ethereum network has enjoyed notable milestones ever since the second-largest cryptocurrency breached the previous record of $1,400 set in 2018.

For instance, the total fees paid hit a monthly high of 746.026 ETH, as acknowledged by on-chain metrics provider Glassnode. Moreover, ETH’s dominance reached a record high of 19.13%.

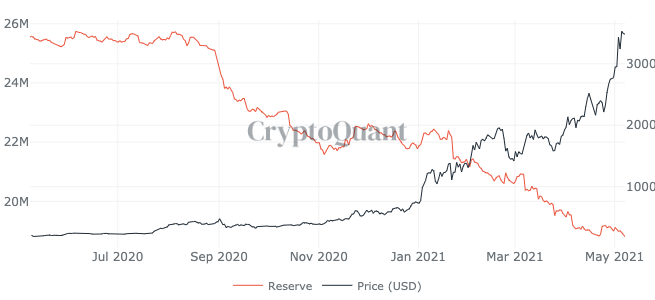

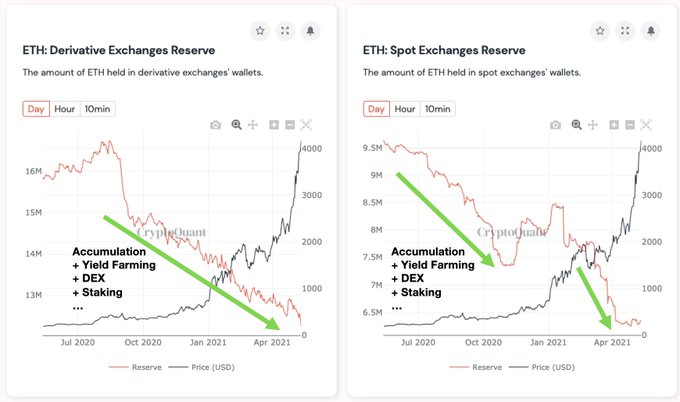

Ethereum’s supply on exchanges continue to be depleted

According to market analyst Joseph Young:

“The supply on exchanges continues to nosedive. Feels very different from the last bull cycle.”

Glassnode had previously reported that ETH on exchanges dropped to 12% of circulating supply, as Ether in smart contracts rose to 22.8%.

CryptoQuant CEO Ki Young Ju attributes this trend to Ethereum’s usability and ecosystem, which has made ETH holdings decrease both in derivative and spot exchanges. As a result, the sell-side liquidity crunch has been intensified.

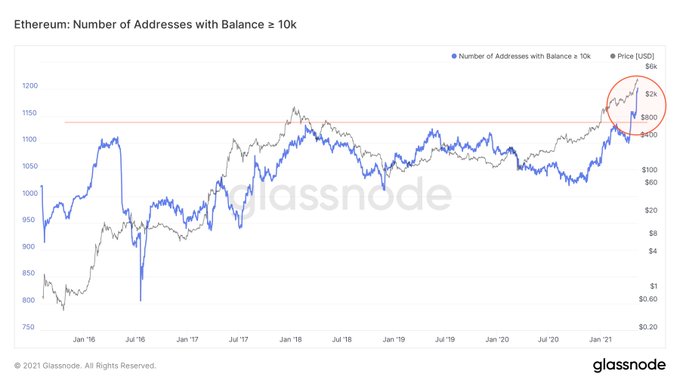

Crypto addresses with at least 10,000 ETH hit ATH

Lex Moskvoski, the CIO at Moskvoski Capital, noted that crypto addresses with more than 10,000 ETH broke the record in the last 30 days. He explained:

“Number of Ethereum addresses with more than 10k ETH are repeatedly hitting ATH in the last 30 days. Looks like the beginning of massive accumulation. Smart contracts are excluded in this chart.”

Furthermore, decentralized finance (DeFi) projects on the Ethereum network has expanded at an incredible rate, absorbing more than $100 billion in liquidity in less than a year. Ethereum smart contracts are one of the most sought after features in DeFi.

Time will tell whether ETH will hit the psychological price of $5,000 this year, given that Ether has enjoyed a remarkable bull run in just the first quarter of 2021. Many are inclined to think that Ether will eventually reach $5,000 in value. Dallas Mavericks owner Mark Cuban seems to think that Ethereum will dwarf Bitcoin in the future, given the reliance of other blockchain projects on its network.

Image source: Shutterstock

Coinbase Revenue Triples in Q1 2021 amid Lower Than Expected Earnings per Share