LIQUIDITY

The availability of assets is determined by the ability for that asset to be converted into cash without dramatically affecting market prices.

Bitcoin Liquidity Drops Despite Price Surge

Despite a 45% price gain, Bitcoin's liquidity has dropped to a 10-month low due to the ongoing financial crisis and regulatory actions against crypto companies. The collapse of crypto-friendly banks has led to a liquidity crisis, causing increased price volatility and higher fees for traders.

PancakeSwap Launches V3 with Lower Fees and Enhanced Capital Efficiency

PancakeSwap has launched version 3 of its automated market maker platform, featuring lower fees and enhanced capital efficiency. Liquidity providers can now select custom price ranges, allowing specific control over capital investments, and the release also includes four new trading fee tiers. The platform serves over 1.5 million unique users and has more upcoming features in development.

Institutional Investors Seek Tokenization Solutions

Institutional investors are seeking solutions for easy implementation of tokenization to improve liquidity for global assets expected to reach $145.4 trillion by 2025. Polygon has been working with global players such as Hamilton Lane, which has already tokenized part of its $824 billion assets under management, and JPMorgan, which executed its first cross-border DeFi transaction on the Polygon network.

Circle Plans to Cover USDC Shortfall After SVB Shutdown

Circle, the issuer of the stablecoin USD Coin (USDC), has announced that it will use corporate resources to cover the shortfall on its reserves after Silicon Valley Bank (SVB) was shut down by the California Department of Financial Protection and Innovation. USDC liquidity operations will resume as normal when banks open on Monday, enabling redemption at 1:1 with the US dollar. The stablecoin lost its $1 peg on March 11, trading as low as $0.87, due to the disclosure of $3.3 billion of Circle's reserve held at SVB.

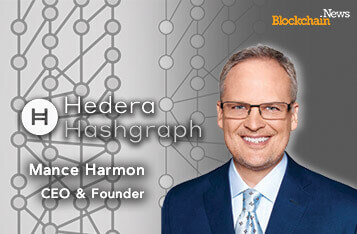

Hedera Mainnet Exploited, Leading to Theft of Liquidity Pool Tokens

Hedera Hashgraph has confirmed a smart contract exploit on its mainnet, resulting in the theft of liquidity pool tokens from decentralized exchanges (DEXs) that use code derived from Uniswap v2 on Ethereum. The suspicious activity was detected when the attacker attempted to move the stolen tokens across the Hashport bridge, leading operators to temporarily pause the bridge. The exact amount of tokens stolen is unknown, and the Hedera team is working on a solution to remove the vulnerability.

POSA Publishes Two White Papers

The nonprofit cryptocurrency industry group Proof of Stake Alliance (POSA) has produced papers on receipt token legality.

Digital Currency Group Suspends Payouts To Maintain Liquidity

Digital Currency Group (DCG) has suspended quarterly dividend payments. Genesis Global Trading, a crypto broker company, causes financial troubles. Genesis stopped withdrawals on Nov 16.

Crypto Social Activities Hit ATH with Over 6.9 Billion Engagements amid FTX Crisis

The unfolding FTX saga has made social engagement, social mentions, and social contributions reach historic highs in the crypto market, according to social intelligence company LunarCrush.

Sequoia Capital's $213.5m Investments in FTX Marks Down to $0

Amid the liquidity crisis in FTX, Sequoia Capital announced to mark down its FTX investment to $0.

Ripple Rolls Out On-Demand Liquidity Solutions in Sweden and France

To render seamless and real-time cross-border payments, Ripple, a leader in blockchain and crypto enterprise solutions, has established On-Demand Liquidity (ODL) solutions in France and Sweden.