Searching for: "

CBDC

"CBDC

What is a CBDC?

A central bank digital currency (CBDC) is a new digital form of sovereign money. CBDCs are issued by the government, where monetary policies are still formed by the central bank.

A central bank digital currency (CBDC) is a new digital form of sovereign money. CBDCs are issued by the government, where monetary policies are still formed by the central bank.

What is CBDC?

CBDC stands for Central Bank Digital Currency, and represents the digital form of a nation’s fiat money (currency backed by trust or faith in the regulating government).

Can CBDC Drive Financial Inclusion?

There are still 1.7 billion unbanked in the world. What are the reasons behind such a significant number of unbanked? Can CBDC drive their financial inclusion?

Bank of Japan Testing Digital Yen CBDC

The Bank of Japan (BoJ) has just announced that it will begin experimenting with a Digital Yen, its own Central Bank Digital Currency (CBDC) to test its technical application and feasibility.

Messaging Giant LINE is Developing a Platform for CBDC

Japanese messaging giant Line is developing a platform to aid Asian central banks in their pursuit of central bank digital currencies (CBDC).

Consensys Report: CBDC are Risk-Free Compared to Facebook Libra

In a recent white paper entitled Central Banks and the Future of Digital Money—Consensys offers an insightful and practical overview of the potential and risks of CBDC. The research paper also offers an example of how the Ethereum blockchain can be leveraged to design and build a CBDC and takes a deep dive into what the practical implementation of a CBDC would require.

Bank of Canada Governor Advocates Globally Coordinated Approach to CBDC

The governor of the Bank of Canada Tiff Macklem has advocated for a “globally coordinated” approach with respect to CBDC development.

Facebook's Libra Sparked CBDC Race, COVID-19 Made Central Banks Realize Its Necessity

Digital innovation and central bank digital currency adoption (CBDC) have been on the rise despite the ongoing COVID-19 pandemic. What has driven CBDC forward?

Central Bank Digital Currency (CBDC) Race: 2020 Year in Review

As 2020 comes to a close, we take a look back at the most important developments regarding the pursuit of Central Bank Digital Currencies (CBDC).

Bank of Spain Plans to Look at Design Proposals and Economic Implications of a CBDC

Spain’s Central Bank mentioned that it would study the design proposals and economic implications of a CBDC in the country.

US Federal Reserve Weighs the Pros and Cons of a Digital Dollar CBDC

The US Federal Reserve has continued to research the benefits and impact of implementing a central bank digital currency (CBDC).

South Korea’s CBDC Pilot to Enter into Distribution Phase Next Year

South Korea’s central bank is looking to start the testing of the distribution of its central bank digital currency (CBDC) next year.

Reserve Bank of Australia May Still Have Its Eye on CBDC After All

Reserve Bank of Australia's Tony Richards has said that the RBA will continue to consider the potentials of issuing a CBDC.

China to Launch Its Own Digital Currency Later This Year

In order to remain ahead in the global competition, China plans to launch its own digital currency known as Digital Currency Electronic Payment (DCEP). The digital currency will stimulate daily banking activities like deposits, payments, and withdrawals from the digital wallet. Crypto news website Coin Journal shows that the People’s Bank of China, China’s central bank has initiated the efforts to roll out its very own digital currency. It is an effort aimed at staying ahead among all the central banks worldwide as well as preserving financial sovereignty.

JP Morgan: Groundwork Now in Place for Mainstream Blockchain and Digital Currency Adoption

JPMorgan published a report showing a significant move towards blockchain, enormous growth of blockchain, and challenges hindering mainstream adoption.

List of Important Resources on Central Bank Digital Currency (CBDC)

Blockchain has the potential to change the whole monetary and financial industry. But it still has a long way to go, as currently, the money issuance power is in the hands of central banks. The compromised way of welcoming blockchain technology in the monetary and financial industry are the central bank issued stablecoins - CDBC.

Stablecoin

What is stablecoin? In terms of what we measure the "stability". Understand stablecoin in different features. Central Bank Digital Currency (CBDC)

American Bankers See No Compelling Case for Digital Dollar

The ABA said that it has not seen a compelling case for the pursuit of the Digital Dollars as any attempt to float the new form of money will undermine the role of banks and private financial institutions in the country.

RBL Bank Partners with Accenture to Build A Digital Bank Infrastructure

RBL Bank announced that it will partner with Accenture, who envisions that it will enhance the bank’s information technology (IT) network and services.

U.K. Central Bank and Treasury Believe Digital Pound is Needed

The Bank of England predicts a UK CBDC by 2030.

BIS Conference Addresses Cybersecurity in Central Bank Digital Currencies (CBDC)

Agustín Carstens, General Manager of the Bank for International Settlements, highlighted the importance of cybersecurity for central bank digital currencies (CBDCs) during a conference in Basel, Switzerland, emphasizing the need for secure, user-friendly, and adaptable systems.

Albania to Begin Levying Crypto Tax Next Year, Report says

Southern European country Albania is reportedly on track to begin taxing digital currency earnings as of 2023. Individual miners could be charged up to 15% of capital gain tax.

Jeff Bezos Amazon Among 5 Partners to Design Digital Euro Prototype

The European Central Bank (ECB), has confirmed Jeff Bezos's tech company AMAZON, as part of the five partners to design a digital euro prototype

Argentina’s Central Bank Set to Prove Non-Crypto Use Cases of Blockchain Technology with its New Clearing System

The Central Bank of Argentina (BCRA) is now looking to test a blockchain-based clearing system to be used by the country’s major financial institutions. The aim of the blockchain clearing system is to provide efficiencies for fiat payments and enable them to be more reliable and to provide end-to-end traceability.

The Launch of CBDC May Destroy Bitcoin - Arthur Hayes

BitMEX co-founder Arthur Hayes believes the advent of CBDCs may not be a good tale for Bitcoin

The Reserve Bank of Australia Refuses to Join the CBDC Bandwagon

The Reserve Bank of Australia (RBA) has refused to join the bandwagon with respect to the development and issuance of a Central Bank Digital Currency (CBDC).

Bahamas’ Sand Dollar CBDC Begins Facial-Recognition Rollout to Authorize Mobile Payments

Millions of Bahamas smartphone users have started using facial recognition technology to authenticate Sand Dollar CBDC payments made through smart devices.

Chile's Central Bank Wants More Time to Study CBDCs

Chile’s apex bank, Banco Central de Chile is exploring more research options to determine whether it will issue a Central Bank Digital Currency (CBDC) or not

Bank of Spain Chooses Adhara, Cecabank, and Abanca to Test CBDC

Banco de España, Cecabank, Abanca, and Adhara Blockchain are launching a pilot program to explore the use of a wholesale Central Bank Digital Currency, aiming to simulate interbank payments.

Mexican Central Bank Reveals CBDC Distribution in 2024

Banco de México, the Central Bank of Mexico has revealed that its projected CBDC will be up for public distribution by 2024.

The Bank for International Settlements Gives CBDCs Full Backing

The Bank for International Settlements (BIS) announced its full support for developing central bank digital currencies (CBDCs) in pursuing financial and monetary stability through international cooperation with the mandate and support by central banks.

Bank of China Hong Kong Completes Digital RMB Sandbox Trial

Bank of China Hong Kong announces that the second phase of its digital Renminbi (e-CNY) priority experience events, staged in collaboration with Bank of China's mainland branches, was a success.

Bank of China Achieves Groundbreaking $14 Million e-CNY CBDC Settlement in Gold

The Bank of China's Shanghai branch successfully settled a $14 million e-CNY CBDC for gold, marking a significant advancement in digital currency's role in international trade.

Bank of England Reveals How Banks Can Adjust to Cryptocurrency Growth

The Deputy Governor of the Bank of England Jon Cunliffe has said that it is not the bank's job to protect commercial banks from the impact of cryptocurrencies.

Bank of France Tests Out Potential Central Bank Digital Currency by Launching Experiment Program

The Bank of France (Banque de France) is launching a program of experiments testing out a potential central bank digital currency (CBDC) aimed for interbank settlements. Potential participants are being invited to submit their applications, as the Bank of France is calling for applications to experiment with the use of a digital euro.

Bank of France Becomes the First to Successfully Test Out the Digital Euro on Blockchain

The French Central Bank, Banque de France has recently successfully trialed a central bank digital currency (CBDC) – the digital euro, operating on a blockchain. The Bank of France experimented with the use of a central bank digital currency to test a sale of securities, which was carried out by Société Générale Forge. Banque de France launched a program of experiments to test out potential central bank digital currency (CBDC) aimed for interbank settlements. Potential participants have been invited to submit their applications to experiment with the use of a digital euro.

French Central Bank Succeeds in CBDC Experiment in the Issuance of a Government Bond

The Banque de France or Bank of France, the central bank of France, has prospered in undertaking an experiment on using a central bank digital currency (CBDC) to issue a French government bond.

Ghana Apex Bank Says To Launch Central Bank Digital Currency

The Bank of Ghana Governor, Ernest Addison said the agency is now “in the advanced stages” of introducing its CBDC.

Bank of Ghana to Drive Financial Inclusion through CBDC

The focus of the CBDC in the country was confirmed by Kwame Oppong, the head of fintech and innovation at the Bank of Ghana (BOG).

The Bank of Israel to Accelerate Its CBDC Research for a Digital Shekel

The Bank of Israel is accelerating its CBDC research.

Israeli Central Bank Official Embraces CBDC Competition with Banks for Economic Growth

In a recent speech, Bank of Israel Deputy Governor Andrew Abir expressed his support for the competition between commercial banks and the forthcoming Central Bank Digital Currency (CBDC) known as the digital shekel. Abir believes that the digital shekel has the potential to enhance competition in the financial system and benefit the economy as a whole.

Bank of Israel Has Conducted Digital Currency Shekel Crypto Testing

Israel announced that the country has already conducted a pilot test on its digital shekel as part of its efforts to issue the Central Bank Digital Currency for public use.

Bank of Jamaica Mints First Tranche of CBDC

The Bank of Jamaica has minted its first batch of its CBDC, the Digital Jamaican Dollar, and has entered a pilot testing phase.

Jamaica on Track to Launch CBDC, says Jam-Dex

The Jamaican Decentralized Exchange (Jam-DEX), the official name of the Jamaican CBDC is set to go live for domestic use later this month, according to Bank of Jamaica Governor Richard Byles.

Bank of Japan Wants to Hear From Public About Digital Yen Development

The head of Bank of Japan (BOJ)’s payments and settlement systems department, recently said that the Central Bank was seeking public opinion on the digital yen.

Bank of Japan to Launch CBDC Proof-of-Concept in 2021

The Bank of Japan (BOJ) has revealed its plan to kick start an early proof-of-concept on the issuance of its central bank digital currency (CBDC) next year.

Japan May Take Several Years To Issue a CBDC says Former BoJ Executive

Hiromi Yamaoka, a former executive of the Bank of Japan believes the central bank will need several more years before it can issue its proposed CBDC.

Bank of Korea Initiates CBDC Pilot Plan on Samsung Galaxy Smartphones

Samsung Electronics will participate in South Korea’s Central Bank Digital Currency pilot project. The electronics tech giant will help to determine whether CBDC transactions could be conducted on smartphones without the availability of an internet connection.

Bank of Korea Prepares for 2024 Public Trial of Its Central Bank Digital Currency

The Bank of Korea, South Korea's central bank, is setting the stage for its first public trial of a Central Bank Digital Currency (CBDC) in 2024.

South Korea's Digital Won Project Sees First Trial Stage Completed

The Bank of Korea (BOK) announced that it has completed the first stage of its Central Bank Digital Currency (CBDC) or Digital Won trials, according to its official press release.

South Korea Seeks Tech Partner to Build the Pilot Program for CBDC

South Korea's central bank on Monday said it would choose a technology supplier to build a pilot platform for a digital currency, moving a step closer to creating a central bank-backed digital currency.

Bank of Lithuania Launches First Blockchain-Based Digital Collector's Coin As Test for CBDC

The Bank of Lithuania has launched the first central bank-produced digital collectors coin dubbed “LBCOINS” as part of its trial of blockchain technology and testing in its development of central bank digital currencies.

Bank of Russia Commences Digital Ruble Trials

The Bank of Russia (BoR) has announced the commencement of its Digital Ruble trials, making the most ambitious push for a functional CBDC in the country.

Bank of Russia Reveals the Possibility of Developing a CBDC in Public Consultation Report

In the recently published public consultation on the digital rubble, the Bank of Russia acknowledged it is considering the potentials of issuing a CBDC.

Bank of Russia Delays CBDC Pilot Rollout

The Bank of Russia's CBDC pilot rollout has been delayed indefinitely due to legislation only passing through the first reading. The number of participating private banks has also changed to 13 from 15, with the pilot involving real operations and limited consumers.

Gazprombank suggests banks be given more time to adjust to digital

Gazprom, a Russian state-owned company, suggested allowing banks extra time to deploy the "digital ruble."

Bank of Russia to Debut Digital Ruble in April 2023

The Bank of Russia is planning a consumer pilot for the digital ruble and a gold-backed cryptocurrency.

Bank of Tanzania Preparing for the Launch of CBDC

The Bank of Tanzania is preparing to start exploring a possible launch of a central bank digital currency (CBDC). The central bank termed the move inspired by Nigeria’s central bank launch of its national digital currency.

Bank of Thailand to Start Retail Test for its Retail CBDC

The Central Bank of Thailand also known as the Bank of Thailand (BOT) plans to begin a pilot study of Retail central bank digital currency (CBDC)

European Digital Currencies Soon to Become Legal Tenders, ECB Says

Central Bank Digital Currencies may soon become legal tenders in their jurisdictions as planned by major central banks in Europe as officials are currently studying such initiatives.

EY-Led Consortium Submits Bid To Help Develop South Korea's CBDC

A consortium led by Ernst & Young has made the first and only bid to construct the business model for the Bank of Korea’s Central Bank Digital Currency project.

France & Switzerland Central Banks Succeed Pilot CBDC Trials in Conjunction with BIS

The trio of the Central Banks of France, Switzerland, and the Bank of International Settlements (BIS) has successfully conducted a wholesale Central Bank Digital Currency (wCBDC) trial involving both country’s fiat notes.

Bank of France Conducts CBDC Test to Settle Listed Securities

The French central bank has conducted an experiment involving digital MNBC and the settlement of securities.

France Central Commission Proceeds CBDC-Backed Treasury Bond Trials

The Central Bank of France commissioned a trial involving the settlement of treasury bonds by using Central Bank Digital Currencies (CBDCs).

StanChart CEO Bill Winters: Mass Adoption of Digital Currencies is "Absolutely Inevitable"

Standard Chartered CEO Bill Winters delved into the issue of digital currencies and said that he believes their widespread creation and rollout was absolutely inevitable.

Binance CZ: We Have No Immediate Plans for a Chinese Yuan-Based Stablecoin

Recent announcements have created waves in the blockchain industry. Binance has been making its way around the world, enabling better adoption and an overall understanding of crypto. With China’s President Xi Jinping urging its nation to use blockchain technology and its development, how is Binance leveraging on new collaborations around the world?

BIS and Global Central Banks to Explore Asset Tokenization in "Project Agora"

The BIS collaborates with major central banks to study asset tokenization's potential to enhance the monetary system and cross-border efficiencies.

BIS builds out "game-changing" blueprint for the future monetary and financial system

The Bank for International Settlements (BIS) is set to redefine the global financial landscape with its newly released blueprint for a futuristic monetary system.

BIS Launches Project Icebreaker with Central Banks to Explore CBDC

The Bank for International Settlements (BIS) has rolled out Project Icebreaker with the central banks of Sweden, Norway, and Israel to see how CBDCs can be utilized for international remittance and retail payments.

BIS Identifies Three Key Factors as Challenges of Wholesale CBDC

The Central Bank Digital Currency (CBDC) project of the Bank for International Settlements (BIS) is generating more questions than answers as the multinational banking institution weighs in the technical and governance challenges that embody the attempt to create a multi-platform CBDC product.

BIS Survey: 93% of Central Banks Engaged in CBDCs, 15 Retail and 9 Wholesale CBDCs Expected by 2030

The Bank for International Settlements (BIS) has released a survey revealing that 93% of central banks are now engaged in some form of Central Bank Digital Currency (CBDC) work, with retail CBDCs taking the lead over wholesale CBDCs.

Regulating the Metaverse: BIS's Call for Unity

BIS emphasizes the need for interoperable payment technologies and robust regulatory framework to prevent metaverse fragmentation and private interests dominance, emphasizing Central Bank Digital Currencies' importance.

BIS Advances Technology in Finance: Quantum, AI, and Green Initiatives for 2024

The Bank for International Settlements announces six innovative projects for 2024, focusing on quantum security, AI, and green finance, to enhance global financial system resilience.

IMF Urges Countries to Consider Banning Cryptocurrencies

US Treasury Secretary Janet Yellen underlined the need for effective cryptocurrency regulation.

Bitcoin Transaction Fees as a Percentage of Total Miner Revenues Hit Lowest Point Since June 2020

BTC transaction fees have plunged based on the ongoing Chinese crackdown on Bitcoin mining facilities.

The U.K. government is recruiting for a head to its central bank digital currency project

The U.K. is hiring a central bank digital currency (CBDC) chief to establish a digital pound. CBDCs promise financial inclusion and lower corporate and consumer expenses. A former Bank of England senior advisor opposed CBDCs. In 2021, 23 million Brits did not use cash, and fewer than 15% of payments are done using cash.

Bank of England is for Stablecoin and CBDC, but Says ‘Bitcoin Has No Connection at All to Money’

The governor of the Bank of England, Andrew Bailey, shared his views on Bitcoin and said that the cryptocurrency “had no connection at all to money.”

Next 2-3 Years to be a Turning Point for Bitcoin, BTC to follow Tesla's Footsteps - Deutsche Bank Analyst

According to Deutsche Bank analyst and Harvard economist Marion Laboure, the next two to three years should be a turning point for Bitcoin.

Brazil Could Deploy CBDC by 2022, Says Central Bank President

According to Brazil’s Central Bank president Roberto Campos Neto, the country has all the necessary implementations set in place for a digital currency issuance to happen in 2022.

Governments Will Eliminate Bitcoin, Says Investor Jim Rogers

Will decentralized cryptocurrencies like Bitcoin—that are beyond the influence of Sovereign Governments—be allowed to survive? Not according to American investor and financial commentator Jim Rogers.

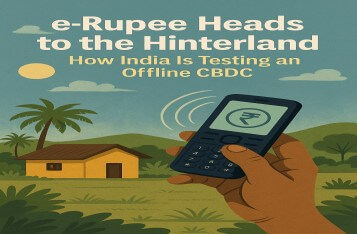

India UPI expanding services to Singapore

The eight-bank digital rupee pilot programme has processed 770,000 transactions.

SAMA is Ramping Up Its Research into Central bank digital currencies

SAMA is expanding its central bank digital currency study (CBDCs). Saudi Vision 2030 aims to diversify the economy, decrease oil dependency, and improve public services.

World's First National Digital Currency to Be Built on Algorand

World’s First National Digital Currency to Be Built on Algorand

The UK is a step closer to launching a central bank digital currency

The Bank of England thinks crypto stablecoins and a central-bank-issued "digital pound" might coexist.

Blockchain Asia: Technological Solutions to Cultural Mistrust

Jochen Biedermann is also the Founder and CEO of Blockchain Asia which was established in 2016. In this second installment, we discuss Blockchain’s applications throughout Asia, clashes in culture and China’s mission to be the first country with an operating central bank digital currency (CBDC).

Bank Indonesia Plans to Launch its Central Bank Digital Currency

Bank Indonesia is planning to launch its central state digital currency in response to the increasingly prosperous cryptocurrency market.

Bank of Korea Seeks a Consulting Partner to Accelerate CBDC Launch

The Bank of Korea (BoK) is in search of a consulting partner to help develop the architecture for its Central Bank Digital Currency (CBDC).

Five Russian Banks Ready to Lead Russia's CBDC Pilot Test

Five Russian Banks will participate in the pilot test for the Bank of Russia’s proposed Digital Rubble following the release of its public consultation report.

Bank for International Settlements to Issue a PoC CBDC With the Swiss Central Bank Before the End of 2020

The Bank for International Settlements is set to issue a CBDC at the Proof of Concept stage in conjunction with the Swiss National Bank before year-end.

Singapore Payment Services Act Now in Effect For Crypto Firms

The Monetary Authority of Singapore now requires cryptocurrency providers and exchanges to be licensed under some of the same regulatory elements as traditional financial service providers.

Australian Senator Bragg Releases New Draft on Digitial Assets

Australian Liberal Senator Andrew Bragg proposed a new draft of the titled Digital Assets (Market Regulation) Bill 2022, aimed at regulating digital asset exchanges.

How Australia's National Blockchain Roadmap Will Change The Future

Australia was one of the first countries to recognize the immense potential of blockchain technology and to incorporate it into various sectors in the country.

Advancing CBDC: Bank of Canada In Search of Digital Currency Economist

The Bank of Canada is in search of an economist with expertise in digital currencies and financial technologies to help advance its CBDC drive.

Russia's Central Bank Plans to Launch its CBDC-Digital Ruble across all Banks in 2024

The Bank of Russia launched a digital ruble experiment in 2022 to explore business models and innovative use cases for central bank digital currencies (CBDCs).

Canada’s Central Bank Considers Launching a Digital Currency to Combat the “Direct Threat” of Cryptos

Canada’s Central Bank, the Bank of Canada, is considering launching a digital currency that would enable the collection of how Canadians spend their money.

Canada's Federal Government Begins Consultations on Digital Currency

The federal government of Canada announced in a budget address that it has started discussions on cryptocurrencies, stablecoins and central bank digital currencies.

Federal Reserve Considers a FEDcoin in Wake of Rising Stablecoin and CBDC Development

Federal Reserve Governor, Lael Brainard said that the Fed is weighing the developments and policy issues in the digital payments sector and experimenting with central bank digital currencies (CBDC) in consideration of potentially issuing it own digital currency.

Bank of Korea Completes 2nd Phase of CBDC Simulation Test

The Bank of Korea said that it has completed a 10-month CBDC simulation experiment research work on the 10-month central bank digital currency.

Regulated Blockchain Will Power Central Bank Digital Currencies

So far, the story of blockchain has been one of new financial services built on decentralised

technology. As the continuing prominence of Bitcoin demonstrates, these decentralised finance,

or DeFi, applications have built up a following amongst a band of loyal supporters.

The Central Bank of Nigeria to Conduct its Central Bank Digital Currency Pilot on October 1

The Central Bank of Nigeria (CBN) officially announced to pilot its central bank digital currency programme on the Hyperledger Fabric blockchain on October 1.

Seven Key Takeaways You Need to Know About Central Bank Digital Currencies

Why are Central Bank Digital Currencies (CBDCs) important? Do we really need them? What are the implications? How will they be designed? Here are seven key takeaways you need to know.

China Guangzhou Public Transport Launches Digital RMB Payment Function

China's Guangzhou became the first city to launch a pilot function of a digital RMB payment code to pay for bus rides.

U.S. Should Examine Chinese Digital Yuan Rollout during Winter Olympics: Senator Toomey

Senator Pat Toomey, a senior member of the U.S. Senate Banking Committee, urges the Treasury and State Departments closely examine Beijing’s CBDC rollout during the Olympic Games.

China Continues to Influence Crypto Activities Worldwide, Study says

Blockchain data platform Chainalysis published a report Wednesday, indicating China remains one of the largest cryptocurrency markets worldwide and continues to influence crypto activities worldwide.

Crypto Review 2021: Full of Uncertainty and Volatility

Before the end of 2021, Blockchain.News summaries serval key events and milestones that the crypto sector has witnessed this year.

BIS to Adopt DeFi Implementation in Forex CBDC Markets

The Bank for International Settlements (BIS), along with the “Eurosystem” – central banks of France, Singapore, and Switzerland will be launching a new project called “Project Mariana.”

Mainstream Adoption of DeFi and DLT Is Coming, It Will Replace Banks, Says US Currency Comptroller

The US acting Comptroller of the Currency disclosed that roles played by banks will soon change due to cryptocurrencies and decentralized finance (DeFi).

Stablecoins Will See Bigger Adoption than CBDCs, says Circle Founder

Central bank digital currency (CBDC) across global economies appear to be inevitable, as central banks have been issuing their own pilot tests of CBDC.

Road to a US CBDC? Ex-CFTC Chairman Released Written Remarks on Digital Dollar in Davos 2020

Davos 2020 to host ex CFTC Chairman, J. Christopher Giancarlo, and his insights on the possibility of CBDC and its many advantages!

BIS Newest Quarterly Report: What Potentials Do CBDCs and Distributed Ledger Technology Hold?

The Bank for International Settlements (BIS) has released its newest quarterly report on the changes in the payment industry, including the market impact of the recent coronavirus outbreak. Some of the trends mentioned in the report include stablecoins, tokenized securities, central bank digital currencies (CBDCs), cross-border payments, and peer-to-peer payments.

Dutch Central Bank Grants First-Ever Crypto Service Registration

The Amsterdam Digital Asset Exchange (AMDAX) has secured the De Nederlandsche Bank (DNB) in line with EU Anti Money Laundering guidelines.

Fundstrat’s Thomas Lee Discusses: What Happens After the 10 Best Days for Bitcoin?

Thomas Lee, the Co-Founder, Managing Director, and Head of Research at Fundstrat Global Advisors, known for his opinions on the Bitcoin and crypto market has sat down with Blockchain.News to discuss his views on some macro trends and the Bitcoin industry we’re currently observing.

Nearly 100 Countries are Developing their CBDC by July - IMF

According to the International Monetary Fund (IMF) report, as of July 2022, nearly 100 central bank digital currencies (CBDCs) are in the research or development stage around the world.

India Reportedly Postpones to Test Digital Rubee in Q1 in 2023, Amid Banning Private Cryptos

Reportedly, the Indian government has postponed the trial date of testing digital Rubee until Q1 of 2023, the digital form of central bank digital currency (CBDC), according to local media outlets.

Bitcoin Can’t Drive Financial Inclusion for Unbanked But CBDC Can says Mastercard CEO

Ajay Banga, the CEO of Mastercard believes Bitcoin is unable to function as an inclusive currency for the world’s unbanked due to volatility, CBDCs are a different story.

Mastercard Reveals to Develop CBDC as The Private Payment Provider

Digital payment Mastercard CEO Michael Miebach expresses his strong support for CBDC on the Q3 earnings conference call.

Swedish Central Bank Completes Second Phase Testing of E-Krona

The Riksbank, Sweden's central bank, said it completed the second phase of the e-krona test, known as the e-krona, ready to be integrated into the banking network and facilitate transactions.

Top Four South Korean Banks Announce Plans to Provide Cryptocurrency Custodial Services

Two of South Korea’s top banks have recently announced that they were looking into providing cryptocurrency custodial services to their clients.

The Bank of Tanzania to Introduce CBDC, Strengthening Domestic Payment System

The Bank of Tanzania is actively introducing a CBDC to strengthen the domestic payment system.

First Blockchain National Currency Platform Ready for Central Banks’ CBDC Issuance

The blockchain national currency platform issued by blockchain company Apollo Fintech was finalized and completed on August 12.

Bank of China Launches e-CNY Smart Contract Product for Off-campus School Education

The Bank of China, in collaboration with the Education Bureau and financial authorities of Longquanyi District, Chengdu, has launched an educational electronic RMB smart contract prepaid fund management product, according to Chinese news media Sohu.com.

Venezuela to Launch its Central Bank Digital Currency in October

The Central Bank of Venezuela officially announced to launch central bank digital currency (CBDC) in October this year.

Digital Yuan Transactions Overtakes Visa during Beijing Winter Olympics

According to a Wall Street Journal, at the opening ceremony of the 2022 Winter Olympics in Beijing, the number of transactions using the digital yuan greatly exceeded that of Visa.

OKEx Allows Traders to Purchase Tether through Brazilian Reals via PIX

OKEx exchange officially announced establishing a strategic partnership with CuboPay, a local payment processor in Brazil. Exchange users are now allowed to use Brazilian real through PIX in exchange for Tether purchases.

The Bahamas Central Bank Digital Currency Will Be Rolled Out in October

The Bahamas Central Bank has announced its CBDC, dubbed Sand Dollars, will be ready by next month for roll out.

The Bank of Jamaica Suggests Court Order Approval Required for Tracking CBDC Transactions

The Bank of Jamaica (BOJ) believes it must obtain a court order approval for tracking CBDC transactions, apart from wallet holders and issuers.

South Korea Sets Up Panel to Accelerate CBDC Launch

In a bid to keep up with global trends in the development of a Central Bank Digital Currency, South Korea launches a 6-man panel to review regulatory issues

Bank of Thailand Projected to Go Forward with Central Bank Digital Currency Prototype

The Bank of Thailand (BOT) announced its plans for a Central Bank Digital Currency (CBDC) prototype to be in effect by 2021. The BOT plans to begin the production of their prototype for a CBDC next month.

Digital Currency: Trust in Government or Elegy for Privacy?

Today, many countries are eagerly investing their resources to create a digital version of their currencies. Cryptocurrencies, once written off by the lawmakers are now inspiring the same authorities. What does Digital Currency mean to the governments, to the people and to the society?

China Central Bank Releases Digital CNY Smart Contract Prepaid Fund Management Product

In China, the Digital Currency Research Institute of the People's Bank of China has launched a digital renminbi smart contract prepaid fund management product - "Yuanguanjia".

Canada, Netherlands, Ukraine Central Banks Say Blockchain Not Necessary for CBDC

In a conference hosted by National Bank of Ukraine, some central banks recently suggested that blockchain is unnecessary for digital fiat currency

Bank of Korea Speeds up Digital Currency Research, States Central Banks are Driven towards DLT

The Bank of Korea (BoK), South Korea’s central bank and monetary issuer, has released its research on the use of digital currencies and blockchain technology for the banking industry.

Singapore Consults China on Central Bank Digital Currency

Singapore is considering a partnership with China as it works on developing a Central Bank Digital Currency dubbed Project Ubin

CBDC for Stimulus Payments Advocates Honorary Christopher Giancarlo

During an open hearing by the House Committee On Financial services yesterday, the Honorable Christopher Giancarlo once again advocated for the use of a central bank digital currency (CBDC), effectively digital dollars, as a solution to directly distribute the COVID stimulus packages to citizens.

The Bank of Ghana Cooperates with German Giesecke+Devrient to Conduct its CBDC Pilot

The Bank of Ghana has launched cooperation with Giesecke+Devrient to conduct a pilot project for its Central Bank Digital Currency (CBDC) in West Africa Ghana.

The Central Bank of the Republic of Turkey Plans to Launch CBDC in 2023

The Turkish government has submitted the President’s annual plan, which included discussions on the launch of CBDC. The administration plans to launch its country’s CBDC by next year.

Bank for International Settlements Reveals Findings on Central Bank Digital Currencies

The Bank for International Settlements released its analysis report in which it evaluated central bank digital currencies globally.

Bank of Lithuania Calls For Uniform Regulation for Digital Financial Innovation Across Europe

Bank of Lithuania, Lietuvos Bankas, has proposed uniform regulations throughout the European Union in response to the European Commission’s consultations for the development of the digitalization of financial services in Europe.

$6.2 Million Worth of Digital Yuan is Officially Piloted in Beijing

The Chinese digital renminbi is officially piloted in the capital of China-Beijing. The authority plans to issue a total of $6.2 million worth of digital currency to Beijing residents through a lottery, totaling 40 million RMB.

China's DCEP Will Not Compete With WeChat and AliPay

China’s digital currency also known as the Digital Currency Electronic Payment (DCEP) will not be competing with WeChat and AliPay says Research head.

ConsenSys Picked to Help Develop Phase 2 of Hong Kong's CBDC Project

Blockchain firm ConsenSys has revealed that it has been awarded a cross-border payment network study project by the Hong Kong Monetary Authority (HKMA)

The End of Physical Cash is an Inevitable Reality and Not to be Feared Says Union Bank President

As the world tries to come to terms with the coronavirus outbreak, recently Edwin Bautista chief executive and president of UnionBank of the Philippines revealed how digital services could support consumers as they increasingly self-isolate themselves or have to work remotely for an extended timeframe. The fintech leader projected the end of cash as the coronavirus crisis provokes banks to fast track the shift towards digital. But will the end of physical cash become a reality? The trend towards cashless remains inevitable as the current events seem to accelerate this process.

HKMA Announces Joint Research with Bank of Israel, BISIH for Retail CBDC

The Hong Kong Monetary Authority announced joint research with the Bank of Israel and the Bank for International Settlements Innovation Hub Hong Kong Centre for retail CBDC.

Bank of England is Considering Developing a Central Bank Digital Currency Amid Surge in Crypto Popularity

The Bank of England has confirmed it is considering the development of its central bank digital currency (CBDC). The confirmation was made by the governor of the bank Andrew Bailey in a webinar session with college students.

Local Officials Set Ambitious Targets for Digital Yuan Transactions

In 2022, the e-CNY processed $50.5 billion in municipal transactions.

Philippines Central Bank Considering Issuing its own CBDC

The Central Bank of the Philippines has inaugurated a committee to understudy CBDCs based on technical feasibility and policy implications

Former US Head of Treasury Lawrence Summers Backs Cryptocurrency

In an interview with CEO of the digital currency company Circle —Jeremy Allaire, Former US head of Treasury Lawrence Summers advocates for cryptocurrency’s benefits.

China's Pursuit of Digital Yuan "Unswerving" in Wake of COVID-19 Global Pandemic, says Central Bank

China’s central bank has further galvanised its public commitment to creating the first central bank digital currency (CBDC), a digital version of the Yuan, at an annual meeting hosted last Friday by the People’s Bank of China (PBoC) vice governor Yifei Fan.

Federal Reserve Bank of Boston Partners with MIT to Research How Crypto Can Co-exist with the Dollar

The Federal Reserve Bank of Boston has partnered with the Massachusetts Institute of Technology (MIT) to research the feasibility of cryptocurrencies co-existing with fiat currencies

Alipay and WeChat Pay Could Be Casualties of China's Digital Yuan

Still strategizing to curb the dominance of Alipay and WeChat Pay, the People’s Bank of China will be using its DCEP system to break the cashless payment duopoly.

How Far Away is Japan’s CBDC? Bank of Japan Meets with Monetary Authorities on Potential Digital Yen Issuance

Japan’s Monetary Authorities Get Serious About CBDC Research and Roll Out

Bank of Japan Puts Top Economist in Charge of CBDC Development

Bank of Japan’s top economist, Kazushige Kamiyama is now the head of payments and settlements and at the helm of Japan’s exploration of its Central Bank Digital Currency (CBDC) project.

Japanese Lawmaker Urges Digital Yen Development to Curb China Dominance

Japanese Lawmaker, Kozo Yamamoto has called for the expedited development of Japan’s digital yen as the race to be the first nation with an operating central bank digital currency (CBDC) heats up.

Bank of Japan Now Considers its CBDC Project a Top Priority

A review of the recent uptick in activities and as confirmed by a Bank of Japan’s senior official, Japan now considers its CBDC project a top priority

Bank of Canada Says CBDCs Have Inherent Risks in New Study

A new report released by the Bank of Canada has revealed that the bank believes Central Bank Digital Currencies can pose security risks to users

Australia to Continue Treating Cryptos as Assets

According to the Australian government's budget announcement on Tuesday, legislation will be put upon treating digital currencies such as bitcoin as an asset.

Estonia's Central Bank Launches Research Project into CBDC

Estonia’s Central Bank also known as Eesti Pank has launched a multi-year research project into central bank digital currencies.

Ethereum’s Vitalik Buterin: Centralized Digital Currencies Without Privacy Are a Huge Step Back

Vitalik Buterin the Ethereum co-founder believes that mainstream adoption of digital currencies is inevitable, with or without blockchain, but will that currency be sovereign, corporate or decentralized?

China to be First Cashless Society with Digital Yuan Launch in 2022, SCMP Report

China is poised to become the world’s first cashless society should roll out its Digital Yuan DCEP before it hosts the 2022 Winter Olympics according to the SCMP

China Leads Pan-Asian Digital Currency Project to Compete with Facebook's Libra

Led by China, four Asian countries are in the early stages of developing a joint digital currency. The currency will help keep the Dollar and Libra in check

Mastercard Launches Virtual Platform to Help Governments Test CBDCs

Payment giant Mastercard has unveiled a virtual platform that will enable central banks to assess and explore Central Bank Digital Currencies (CBDCs).

Nigeria's E-Naira Gains Momentum, Tackles Influence of Volatile Cryptos

Nigeria's further efforts to curb the influence of cryptocurrencies have begun to bear fruits as its introduction of a centralised digital currency eNaira has lured about half a million users within three weeks.

China PBOC Views CBDC Race as "New Battlefied" Between Sovereign Nations

China through its apex bank, the People’s Bank of China (PBOC) has reiterated its desire to be the first nation to issue a Central Bank Digital Currency (CBDC)

China's Central Bank Governor Says no Timeline for Digital Currency Launch

The Governor of the People's Bank of China has declared that there is no timeline to the release of the country's digital Yuan, an innovation that has entered its test pilot phase.

Leaked EU Commission Draft on Crypto Assets Law: How Will Cryptocurrency be Regulated?

A leaked European Union legislative draft on digital assets reveals the country's plans for cryptocurrency trading and issuance across the nation.

Ripple says XRP Can Be Used as a Bridge Currency for CBDCs, Will This Push XRP Higher?

Ripple released a new whitepaper that depicted XRP's utility as a bridge currency for CBDCs. XRP has broken through the key level of $0.50. What should be expected of the cryptocurrency in the short term?

Canada’s Central Bank Digital Currency Won't Include Zero-Knowledge-Proofs

Bank of Canada researchers do not feel that the current state of zero-knowledge-proofs is mature enough to be integrated into their development plans for a Central Bank Digital Currency (CBDC).

Federal Reserve Has Been Advancing CBDC Research with US Regional Banks’ Contributions

The Federal Reserve's research and development on a central bank digital currency issuance has been complemented by several regional Federal banks' efforts.

CBDC Privacy and Transparency: Double-Edged Sword of Blockchain

Privacy and transparency of CDBC, to enslave us or free us? that's the question.

Digital Dollar's Benefits Could Affect Financial Stability & Privacy: US Fed

The US Federal Reserve said that the introduction of an official digital version of the US dollar could benefit Americans but it may also potentially affect financial stability and privacy.

Visa Blockchain Payments Will Help Promote Bank CBDC Integration

Visa is enhancing its blockchain payment drives among its merchants through research while forming partnerships with central banks for CBDC issuance

Facebook and Calibra Head David Marcus: What Problems Would Wholesale CBDCs Even Solve?

During a panel discussion at the World Economic Forum which included the topic of Central Bank Digital Currencies (CBDCs), David Marcus, Head of Calibra, highlighted that digital currencies are the key to innovate cross-border payments and solve the issues of the unbanked—regardless of if that digital currency is Libra or not.

Bank Of England Accepts CBDC Wallet "Proof Of Concept" Applications

The Bank of England (BOE) wants a "proof of concept" for a Central Bank Digital Currency wallet (CBDC). The wallet must trade value and solicit payments. The BOE wants a CBDC by 2030.

Bank of Japan Sets Up New Research Team For Digital Yen CBDC Development

Japan’s central bank has recently revealed that it has created a new team to research on Central Bank Digital Currencies.

Blockchain Technology Powers Brazil's National Identity Card Issuance

Brazil has commenced the use of blockchain technology for issuing the National Identity Card (CIN) to enhance security and data integrity in the new identity issuance process. The initial phase begins in three states with a nationwide deadline set for November 6, 2023. This move is part of Brazil's broader initiative towards leveraging blockchain for public service improvement, aligning with global trends of digital identity verification.

BRICS Coin 2025: What a Common Digital Currency Would Mean for the Rupee

In 2025, there's no official BRICS coin; instead, a focus on local-currency deals and payment interoperability is emerging, benefiting India's rupee without replacing it.

Philippines Central Bank To Research Further Before Launching its CBDC

Philippines Central Bank governor Benjamin Diokno has recommended further research with respect to the proposed Digital Peso, central bank digital currency.

The United Kingdom Tax Reform Council Launches Campaign Against Bank of England

UK Tax Reform Council and Bitcoin community worry over Bank of England's CBDC intentions.

Indonesia's Ministry of Trade is reportedly aiming to roll out a national crypto exchange

Indonesian Trade Minister Zulkifli Hasan has set a June 2023 start date for its crypto exchange.

Reliance Retail accept digital rupee at one store

Reliance Retail has pledged to assist India's CBDC throughout its companies.

Cambodia Officially Launches Its State-Backed Digital Currency “Bakong”

The National Bank of Cambodia has announced an official launch of a national digital currency that would operate via smartphone apps.

The National Bank of Cambodia Looking to Launch New Centralized CBDC This Quarter

The National Bank of Cambodia digital currency, which is a central bank digital currency, called Bakong, was launched on a trial basis in Cambodia in July 2019.

Former Canadian Prime Minister Sees Bitcoin As A Potential Future Reserve Currency

Stephen Harper, the former prime minister of Canada, has named Bitcoin as a possible reserve currency in the future.

Canadian Central Bank Partners with MIT for CBDC Research

Although the Bank of Canada still has no plans to issue a Central Bank Digital Currency, it has accelerated its research on such a project.

Canadians Consulted on Digital Currency

The Bank of Canada has opened a public consultation until June 19 to gauge what features Canadians would like to see included in a digital Canadian dollar. The bank clarified it was not beginning work on a CBDC or replacing cash but was looking to explore the concept.

Bahamas Ranks First as The Country with Most Advanced Retail CBDC Development

The Bahamas narrowly beats Cambodia because its CBDC is available to all citizens.

CBDC Surveillance Concerns Spark Legislative Action

Congressman Tom Emmer's CBDC Anti-Surveillance State Act aims to address surveillance risks in government-issued digital currencies, emphasizing privacy and autonomy in the evolving digital financial landscape.

Ripple Operations Expand in Asia as it Looks to Explore CBDCs with Central Banks despite SEC Legal Pressure

Despite the Securities and Exchange Commission’s lawsuit against its firm, Ripple has continued to expand its services as a fintech firm.

UK Announces the Launch of its CBDC Task Force

The UK has launched a CBDC task force where the Bank of England and the HM Treasury will collaborate to study CBDC.

Italy and South Korea's Central Banks Forge a Path in CBDC Development

The Bank of Italy and the Bank of Korea have signed an MOU to collaborate on the development of Digital Currencies (CBDCs), a significant development in the digital currency sector.

BIS analysis reveals unequal CBDC uptake in Africa

CBDC helps African central banks implement monetary policy. A CBDC would save money on banknotes, transportation, and storage. Sub-Saharan Africa sends two-thirds of the world's money.

France and Switzerland Launches Cross-Border Central Bank Digital Currency Trials

The Central Bank of France and Switzerland have launched a joint cross-border CBDC trial.

Central Bank Digital Currencies Are Not Like Bitcoin or Cryptocurrency

CBDC are digital assets, but they are not cryptocurrencies and in fact strike at the heart of the very philosophy that brought Bitcoin into existence.

BIS and Central Bank Research Identifies Principles and Core Features For CBDC Issuance

The BIS along with seven central banks has released a report identifying the principles necessary for CBDCs to help central banks meet their public policy objectives.

Bank of International Settlement Revealed Positive Outlook on Central Bank Digital Currencies

The Bank for International Settlements (BIS), a coalition of 62 central banks, has weighed in on the trending topic of central bank digital currencies (CBDCs). The global central bank noted a positive interest by central banks to develop their state-backed digital currencies.

U.S. Senate Bill Seeks to Limit Federal Reserve's Role in CBDC Issuance

A new Senate bill, dubbed the CBDC Anti-Surveillance State Act, proposes strict limitations on the Federal Reserve's involvement with CBDCs.

Central Bank of Brazil Forms a Digital Currency Study Team to Drive CBDC Research Forward

The Central Bank of Brazil is planning the potential issuance of a Central Bank Digital Currency (CBDC) by setting up a research study group.

Turkey's Central Bank Finishes First CBDC Test With More In 2023.

The CBRT's Digital Turkish Lira has completed its first experiment. On Dec 29, the CBRT announced its first digital lira payments. In the first quarter of 2023, it will conduct restricted, closed-circuit pilot testing with technology stakeholders.

Swedish Central Bank Delays CBDC Plans Again

The world’s oldest Central Bank, Sweden’s Riksbank, published results of its pilot project for its proposed central bank digital currency, the e-krona.

ECB to Announce by Mid-2021 Whether It Will Move Forward with CBDC Issuance

European Central Bank (ECB) President Christine Lagarde said that a decision on whether or not to launch a CBDC will be made by the middle of this year.

ECB to Meet the Growing Demand for Digital Payments with a CBDC Digital Euro

President of the ECB Christine Lagarde broached the topic of CBDC issuance and why the bank was seriously considering the creation of a digital euro.

WeChat Pay and Alipay May Have Helped China to Track Coronavirus Victims Through Digital Payments

With the novel coronavirus infecting more than 75,000 people around the world, and with the majority of the Chinese population in the Hubei province infected, authorities in the nation decided to track everyone who bought fever medicine in the province.

Crypto Leaders Discuss Libra, China's CBDC and a Cashless Future at the Singapore Fintech Festival

A noteworthy panel followed on the topic of “defining the future of digital currency,” joined by Christian Catalini, co-creator of Libra and Head Economist of Calibra, Mu Changchun, Director-General of the Digital Currency Institute of the People’s Bank of China, HE Serey Chea, from the National Bank of Cambodia and Umar Farooq, Head of Blockchain at J.P. Morgan Chase & Co.

Banque de France and HKMA Collaborate to Enhance CBDC Cross-Border Payments

The Banque de France (BDF) and the Hong Kong Monetary Authority (HKMA) have announced a collaboration to advance CBDC cross-border payment solutions.

eToro CEO: Central Banks will Inevitably Establish Digital Currencies

Yoni Assia, eToro’s CEO, recently weighed in on the issue of Central Bank Digital Currencies. He noted that this matter was no longer an issue of “if,” but of “how and when” because the development of digital currencies by central banks was inevitable.

Financial services reforms advance UK crypto ambitions.

The U.K. Chancellor of the Exchequer, Jeremy Hunt, proposed many financial services industry changes to "promote development and competitiveness." The measures include consulting on a central bank digital currency (CBDC) and prolonging investment managers' crypto tax exemption.

Fed Chair Powell: Cryptocurrencies not Useful Stores of Value and CBDC Issuance Will not be Immediate

Federal Reserve Chairman Jerome Powell’s stance on Bitcoin and cryptocurrencies remains unchanged – he views them primarily as “a speculative asset.”

Impending Central Bank Digital Currency: Data Shows Not All Central Banks Support the Move

The paradox of the situation is that banks with the capacity to push the world into the digital currency era are actually not showing much interest towards adoption; with the reason for their reluctance remaining a question with no answer.

Can Alipay and WeChat Pay Compete With China’s Fee-Free Digital Yuan?

Will Alipay and WeChat Pay survive the People's Bank Of China's rollout of the digital yuan or DCEP?

About 90 Percent of Countries Representing the Global Economy Exploring CBDCs, Report says

A recent testimony by Julia Friedlander to Congress has revealed that more countries are exploring CBDCs, however, the US is lagging behind.

Bank of France Announces HSBC, Accenture Among the 8 Successful Applicants of the CBDC Experimentation Program

Earlier this year, Banque de France, the French central bank launched a program of experiments to test out the potential central bank digital money aimed for interbank settlements. The program of experiments was launched in late March 2020, where the central bank asked participants to submit their applications before May 15, 2020. The French central bank is open to test out new technology, although it did not specify using blockchain.

Indian Finance Minister Sees "Clear Advantages" in CBDC

India’s Finance Minister, Nirmala Sitharaman, has hailed the Central Bank Digital Currency (CBDC) being developed by the Reserve Bank of India (RBI).

CBDC Project will Help Enhance Japan's "Settlement System," Says Bank of Japan Executive

Bank of Japan's Kazushige Kamiyama has revealed that the country’s proposed central bank digital currency will enhance the country’s settlement system.

Slow and Steady Wins the CBDC Race: Why the US is not Concerned with China's Speed

Slow and steady wins the CBDC Race: there are several reasons why the United States' digital dollar development has an edge over China’s speedy approach to its digital yuan.

Digital Dollars—A Two Tier CBDC Design to Maintain US Currency Dominance

The Digital Dollar Project (DDP) is the focus of the Digital Dollar Foundation and advocates the need for a CBDC. In their recently released whitepaper, the DDP stipulates that it aims for the US dollar to maintain its global dominance but further warns that the work needs to begin immediately. The DPP also calls for public-private collaboration, including the use of a two-tier system for the spread and distribution of retail digital dollars.

Six Central Banks Form Working Group to Assess Central Bank Digital Currencies

Six central banks around the world have come together to create a working group to share experiences on use cases on central bank digital currency (CBDC). With significant expertise in exploring digital currencies, these six central banks are the Bank of Canada, Bank of England, Bank of Japan, European Central bank, Sveriges Riksbank in Sweden, and the Swiss National Bank, and the Bank of International Settlements (BIS).

Hong Kong’s Central Bank and Bank of Thailand Announce Results of Blockchain-Based CBDC Study

The Hong Kong Monetary Authority (HKMA) and the Bank of Thailand published the results in a research report of the Project Inthanon-LionRock, by the two central banks on the application of central bank digital currencies (CBDCs) on cross-border payments. In May 2019, the two authorities signed a Memorandum of Understanding (MoU) on fintech collaboration, as Thailand is one of Hong Kong’s top 10 principal trading partners.

Private Firms Can Boost Innovation of Central Bank Digital Currency, says IMF

A synthetic Central bank digital currency (CBDC) could create new pathways for innovation according to a senior member of the International Monetary Fund (IMF).

IMF Believes Central Banks Need Strong Legal Frameworks for CBDCs to Work

The issuance of CBDCs by apex global banks has become a hot topic in the crypto space, and the IMF has delved into it with some precautionary measures.

Central Banks Could Monopolize Commercial Banking Sector via CBDC, Says Federal Reserve

A new working paper from the Federal Reserve Bank of Philadelphia indicates that the development of a central bank digital currency (CBDC) may create a fundamental shift in the way banks operate.

Japan Will Include Central Bank Digital Currency in Honebuto Economic Plan

The Japanese Government has continued its acceleration towards a Central Bank Digital Currency (CBDC) and is set to include its consideration in its formal economic plan.

US States Challenge CBDC as Legal Tender

Four U.S. states - Utah, South Carolina, South Dakota, and Tennessee - have filed bills to exclude Central Bank Digital Currencies (CBDCs) from their legal definitions of money, reflecting rising state-level resistance and concerns over privacy and federal overreach.

CSRC Director Yao Qian: CBDCs Can Run on Ethereum and Diem

China Securities Regulatory Commission Director suggests that China can utilize the BaaS infrastructure of public blockchain networks for CBDCs establishment.

COVID-19 Pandemic-Induced Crisis is Pushing CBDC Adoption, says Bank of Russia

Financial regulators are keeping a keen eye on central bank digital currencies (CBDCs) because they see them as silver linings.

South Korea’s Central Bank Launches Central Bank Digital Currency Pilot Program in Case of Future Necessity

South Korea’s central bank recently announced that it has launched a pilot program assessing the issuance of a central bank digital currency (CBDC). The Bank of Korea has stated that there are no immediate plans to launch a CBDC, however, the pilot program will allow the central bank to be prepared in the future if the changing market conditions require its issuance.

CBDCs Gain Traction Amid Fears of Coronavirus-Contaminated Banknotes, The Economist Survey Uncovers

In a survey conducted by The Economist and Crypto.com, it found that consumers generally had more trust in central bank digital currencies (CBDCs), rather than decentralized cryptocurrencies.

Hong Kong and Brazil Collaborate on Cross-Border Tokenization Initiatives

The Hong Kong Monetary Authority and Banco Central do Brasil are collaborating on cross-border tokenization projects, focusing on CBDC infrastructures and financial market innovation.

UAE to Launch and Test in-house Digital Currency

The Central Bank of the United Arab Emirates has plans to develop an in-house digital currency by 2026.

Visa Crypto Executive: CBDC is the Most Important Trend for Future of Money

Central Bank Digital Currencies (CBDC) could be the most important payment trend in development with the most profound effects on our systems of payment and money issuance according to Cuy Sheffield, Visa’s head of cryptocurrency.

Four Countries to Conduct Cross Border CBDC Payment Trials

The Bank for International Settlements (BIS) has joined forces with the central banks of South Africa, Malaysia, Singapore, and Australia to kick start a project dubbed Dunbar aimed at testing the use CBDCs in cross border payments.

Hong Kong Monetary Authority's Project mBridge Achieves MVP Milestone

Project mBridge reaches MVP stage, exploring CBDCs for cross-border payments.

9 in 10 Central Banks are Eyeing CBDCs, BIS Study Shows

90% of apex banks have shown intentions of rolling out central bank digital currencies (CBDCs), according to a study by the Bank for International Settlements (BIS).

Bahamas Looks to Deploy its CBDC The Sand Dollar Across Borders

The Central Bank of the Bahamas (CBOB) has says it wants its digital currency dubbed the Sand Dollars integrated with other countries' currency.

Russia's Crypto Ban Will Ease Risks But Limit Tech Diffusion: Fitch

The proposed attempt by the Central Bank of Russia (CBR) to ban digital currencies and related operations in the country has been identified by Fitch Ratings as a double-edged move that has its ups and downs.

CBDCs Require Balance between Data Access & User Privacy Protection, HashCash CEO Says

CBDC would need a delicate balancing act between data access and user privacy protection in terms of taming illegal activities, according to HashCash Consultants CEO Raj Chowdhury.

At least 70% of Global Finance Leaders Believe CBDCs Will Spur Financial Inclusion - Ripple Study

Central bank digital currencies (CBDCs) have triggered overwhelming consensus among global finance leaders, according to a survey by Ripple, a leader in enterprise crypto and blockchain solutions.

Brazil Considers CBDC Project as a Means to Innovate Digitally: Economist

The development of CBDC means several things to several people, and for Brazil, it is a broad complement to its already transforming payment ecosystem.

Montenegrin Prime Minister Dritan Abazovic has announced a pilot digital currency project

After meeting with Ripple at the World Economic Forum, Montenegrin Prime Minister Dritan Abazovic launched a prototype digital currency initiative.

The Bank of England and the United Kingdom's Treasury are working on a digital asset

UK's finance minister said the Digital Pound's goal is to create a "trust, accessible, and easy-to-use" digital asset.

Bitcoin Will Not Likely Be Held by Central Banks in the Future, Says ECB President Christine Lagarde

Christine Lagarde, the President of the European Central Bank, has once again made her stance on Bitcoin clear.

CBN is continuing to develop its eNaira

R3, the CBN's possible technology partner, will help design a new system to give the CBN complete authority over the CBDC.

The IMF Releases a Report on Jordan Preparations for a Central Bank

The IMF published a technical analysis on Jordan's retail central bank digital currency.

The Bank of Russia Wants Strict Limits for Non-Professional Russian Crypto Investors

Russia has published a proposal that sets strict limits on the amounts of digital assets acquired by non-professionals investors in a year.

Six Leading Central Banks to Brainstorm the Issuance of Digital Currencies in Mid-April

The leaders of six major central banks are scheduled to meet in mid-April to conceptualize on creating their own digital currencies as they can be instrumental in substituting the digital yuan or Facebook’s Libra.

Central Bank Executive Says Hong Kong Working On Investor Protection Measures

Central bank governors from around the world are currently in Thailand to discuss the role of central banks amid evolving financial technology. Eddie Yue, chief executive of the Hong Kong Monetary Authority discussed the rise of digital assets and central bank digital currencies (CBDC) and the risks associated with the new technology. Changyong Rhee, governor of the Bank of Korea was not so optimistic about the future of blockchain technology, especially in the monetary sector.

Chinese E-Commerce Giant JD.com to Build CBDC Digital Wallet to Support China’s DCEP

JD.com has recently partnered with the People’s Bank of China Digital Currency Research Institute to build mobile apps and wallets to support China’s CBDC.

China to Award DCEP Worth $1.5 Million to Shenzhen Residents to Test Digital Yuan

China’s central bank, the People's Bank of China (PBOC), has teamed up with Shenzhen city to distribute DCEP worth 10 million yuan, approximately $1.5 million to residents.

China’s CBDC Research Institute Partners with Didi Chuxing to Explore “Smart Travel” with the Digital Yuan

China’s Central Bank Digital Currency Research Institute and Chinese transportation giant Didi Chuxing have reached an agreement to explore and develop the use of digital yuan in the transportation industry.

Hong Kong to “Seize the Opportunities” of China’s Digital Yuan CBDC Development

The Hong Kong government is considering collaborating with the mainland Chinese authorities on the country’s central bank digital currency (CBDC) project.

China's Digital Yuan Has Topped Over $14 Billion in Transaction Volume

The Chinese Central Bank Digital Currency (CBDC) also known as the e-CNY has hit close to $14 billion (100.04 billion Yuan) from 360 million transactions as it gains widespread acceptance in country

China to Test its CBDC on Tencent-Backed Platform and Other Domestic Firms to Break Dependence on the US

China’s central bank has taken another major step forward toward the digital yuan’s mass adoption with its testing on food delivery giant Meituan Dianping. Backed by Tencent, Meituan has been having discussions with the People’s Bank of China’s central bank digital currency (CBDC), also known as digital currency electronic payment (DCEP) research wing.

The Issuance of China's CBDC On The Horizon, According to Insiders

The issuance of central bank digital currencies (CBDCs) has been gaining traction as various nations have shown interest. The People’s Bank of China (PBoC), China’s central bank, has finished the development of a CBDC’s basic function and relevant laws are being drafted to set the ball rolling for its circulation.

CBDC Activity Subsidizes Consumption During Lunar New Year

After COVID-19 restrictions were eased, Chinese local governments are pushing the usage of the country's digital currency, the digital yuan, to boost e-CNY use and consumption.

China's Central Bank Says Digital Yuan Will Not Raise Inflation

Bank of China claims that the introduction of digital yuan will not cause the occurrence of inflation.

McDonald's, Subway and Starbucks Among the First to Trial China's Digital Yuan

Mcdonalds has been named along with coffee giant Starbucks as one of the 19 restaurants that will be first to try out China’s Digital Yuan in the new district of Xiong’An.

China’s $1.5 Million Digital Yuan Giveaway in Shenzhen Left Analysts Excited, Citizens Unimpressed

As part of China’s rollout of its central bank digital currency (CBDC), the government had a $1.5 million giveaway of digital yuan to its citizens in Shenzhen.

China’s CBDC Should Start Replacing Cash But Not Confined to Substitution, says Former Chinese Banker

Former Chinese banker, Wang Yongli suggested that a push for digital currencies to substitute all currencies is needed to support monetary operation reforms.

China’s Major State-Run Commercial Banks Test CBDC Digital Wallet

China’s major state-run banks are testing out its central bank digital currency (CBDC) digital wallet application. The Chinese central bank, having said that its CBDC, also known as digital currency electronic payment (DCEP), is “almost ready,” is finally moving a step closer to its official launch nationwide.

China to Prioritize Testing its Central Bank Digital Currency in Wealthier Cities First

China is planning a more extensive expansion of the testing of its central bank digital currency (CBDC) after reportedly starting its first tests in the Greater Bay Area.

China’s CBDC Testing Expansions Exaggerated, Digital Currency Details Revealed

A source close to the matter said that China's CBDC pilot program "has not yet been expanded on a large scale," and the test is just "internal and closed.”

China Hand-Picks the Greater Bay Area Surrounding Hong Kong to be the First to Deploy its CBDC

China’s central bank digital currency (CBDC) has been successfully launched earlier this year and the country is currently continuing its path towards fully launching its digital currency electronic payment (DCEP).

China’s Central Bank’s DCEP is Trying to Make WeChat Pay and Alipay Redundant

Mu Changchun, the Director-General of the Institute of Digital Currency of China’s central bank, People’s Bank of China spoke at one of the panels at the Singapore Fintech Festival held at the Singapore Expo on Nov. 12 regarding the future of digital currencies.

China’s Central Bank Digital Currency DCEP to be Operational for Local Government Employees Starting in May

Local government employees in the city of Suzhou will be receiving China’s central bank digital currency, digital currency electronic payment (DCEP) in May, according to a local news outlet. China has been charging full speed with its digital currency development plans shortly after Facebook revealed its Libra stablecoin project.

China's CBDC Testing Advances along 19.25M Yuan Distribute to Residents

The Digital Yuan testing is extending to Shanghai as residents will be given free money worth 19.25 million yuan.

China’s DCEP Aims to Restructure the Payment Network While Maintaining a “Normal” Monetary Policy

A Chinese senior central bank official said China should maintain a “normal” monetary policy as the country has been recovering from COVID-19 smoothly.

China to Build ‘Digital Central Bank’ Infrastructure, Striving to Become the World’s Leader in Digital Currency Development

China’s Central Bank, People’s Bank of China (PBoC) is planning to look into building a digital central bank infrastructure to improve the standards of financial services in the country. On May 18, the Chinese Central Bank’s 2020 video conference on scientific and technological work was held in its capital, Beijing. The meeting focused on the technological achievements made in 2019, an in-depth analysis of the current situation and challenges, and the upcoming key plans for 2020.

Suzhou Next City in China to Test Digital Yuan DCEP in Red Envelope Event

China’s central bank is scheduled to test its digital yuan dubbed the Digital Currency Electronic Payment (DCEP) in a second red packet lottery event in Suzhou on December 12.

China's Central Bank Publishes Rules for Blockchain-Based Financial Applications

The People’s Bank of China (PBoC) has published a set of evaluation rules for blockchain-based finance applications. The published rules aim to provide regulatory oversight using three basic standards bordering on technical, performance, and security.

China and EU Trade Talks Included the Potential Cooperation of Central Bank Digital Currencies

The European Union and China recently had trade and economic discussions regarding topics including central bank digital currencies (CBDC) and supply chain.

Tencent, Huawei, and Baidu Executives to Join China’s New National Blockchain Committee to Set Industrial Standards

The Chinese central government has put together a national blockchain committee to work on setting industrial standards. The Ministry of Industry and Information Technology (MIIT) issued a notice on April 13 of the “Public Notice on the Formation of a National Blockchain and Distributed Ledger Technology Standardization Technical Committee.”

China’s Central Bank Rolling Out DCEP National Currency, While Saying ‘Libra Won’t Succeed'

China has been reportedly developing its central bank-issued digital currency for a while and is believed to be ready to launch by China’s central bank, People’s Bank of China (PBoC).

China’s Central Bank Partners with Commercial Banks and Telecom Giants to Test Digital Currency in Two Major Cities

New developments of China’s central bank geared towards testing its digital currency electronic payment (DCEP) in the cities of Shenzhen and Suzhou. The People’s Bank of China, the country’s central bank is on track to become the first central bank on the globe to issue a national digital currency.

China's Central Bank Digital Currency (CBDC)

China's Central Bank Digital Currency (CBDC) now supports smart contracts. Soochow Securities' mobile app allows e-CNY purchases. Android phones may now perform contactless digital yuan wallet payments.

Chinese State-Owned Banks Start Exploring Digital Yuan Use-Cases for Buying Investment Funds & Insurance Products

Two Chinese state-owned banks have begun working to fund management and insurance companies to explore the use cases of digital yuan CBDC for purchasing investment funds and insurance products online.

Ripple Co-Founder says US-China Tech Cold War Will Be Won and Lost on Crypto and Blockchain Battlefield

Ripple Co-Founder, Chris Larsen believes the Cold Tech War between China and the United States is going to be won and lost on the blockchain battlefield.

GOP Senators Urge US Olympic Committee to Bar Athletes from Using Digital Yuan, China Rebukes Criticism

Three U.S. Republican senators urged United States Olympic & Paralympic Committee (USOPC) to ban American athletes from acquiring or using digital yuan (e-CNY) in the Beijing Winter Olympics in 2022. China rebukes their criticism.

People's Bank of China Seeks to Prohibit the Creation of Digital Tokens

The People’s Bank of China (PBOC) is calling for public opinion or feedback in line with its plans to revise its extant banking laws

Chinese Version CBDC (Digital Yuan) Applied to Guangzhou Housing Provident Fund Loans

The Guangzhou Housing Provident Fund Management Center has successfully implemented the usage of the Chinese version of the Central Bank Digital Currency (CBDC), commonly known as the digital Yuan, for housing provident fund loans.

Coinbase Crypto Exchange to Support CBDCs in the Future as Long as They Meet Listing Standards

Brian Armstrong, Coinbase's CEO, has stated that the crypto exchange was open to the idea of supporting central bank digital currencies (CBDCs) on its network in the future.

European Central Bank President: Coronavirus Has Accelerated Digital Currency Adoption

COVID-19 has led to an acceleration in digital payments adoption and technological innovation, as seen by the spending pattern of European citizens.

Bulgaria to Introduce Crypto Payment Options

The Bulgarian government is currently in discussion with industry stakeholders and the Bulgarian National Bank with respect to its crypto payment initiative.

Banks Will Start Mulling the Possibility of Crypto Trading in 3 Years: Former Citi CEO

According to Vikram Pandit, most financial institutions are likely to integrate digital currency trading services within the next one to three years

Crypto Week 2025: How Washington Just Rewrote the Rules for Stablecoins, Exchanges, and the Digital Dollar

During "Crypto Week" in July 2025, the U.S. established clear rules for stablecoins, favoring private tokens over a government CBDC, enhancing regulatory clarity.

Digital Assets Should be Regulated as Part of Banking Industry: Ex-Regulator

Financial experts are advocating for digital currency innovation and activities to be subsumed into the banking industry, a move that will let regulators permit their overall growth.

Is The US Ready for CBDC? Most Americans Opposed to Digital Dollar Adoption, Survey Reveals

Most American citizens appear to be against a digital dollar adoption within the US, preferring paper money to CBDC, according to a study.

Bank of Jamaica Collaborates with Local Government to Expand CBDC Adoption

In a recent update, it was reported that the Bank of Jamaica is set to partner with the Government to boost the adoption of its central bank digital currency, JamDex, as a payment method.

HSBC CEO: No Plans for Launching Crypto Trading

HSBC revealed that the bank has no plan to offer virtual currency as investments to their clients by starting cryptocurrency trading.

Russia’s Tinkoff Faces Regulatory Challenges to Offer Crypto Investments

Tinkoff's CEO complained that Russia's biggest online bank is unable to offer cryptocurrencies for clients due to the tough stance from Russia's central bank.

Chinese CBDC's Backend Developments are Complete, Revealed During 2020 FinTech Forum

The world’s attention is on China who has recorded a great advancement in the development of its central bank digital currency (CBDC). The Chinese CBDC project, also known as digital currency electronic payment (DCEP) entered its testing phase back in April with a test run billed for four major cities.

Bank of China’s Former President Lists Four Key Conditions For Digital Yuan to Replace Cash